China’s markets regulator said it will fully suspend the lending of restricted shares starting Monday, in fresh efforts to put a floor beneath the slide in the country’s equities.

Restricted shares are often offered to company employees or investors with certain limits on their sale, but they can be lent to others for trading purposes, such as short-selling, which can add pressure on markets during a prolonged slump.

Restrictions announced on Sunday will “highlight fairness and reasonableness, reduce the efficiency of securities lending, and restrict the advantages of institutions in the use of information and tools,” the China Securities Regulatory Commission (CSRC) said.

Also on AF: Investor Fever Sees Chinese US Stocks Fund Halt Trading

The move will give “all types of investors more time to digest market information” and create “a fairer market order,” CSRC said in a statement published on its official WeChat account on Sunday.

The securities regulator added that the move would “resolutely” crack down on illegal activities that use securities lending to reduce holdings and cash out.

As an added measure, CSRC also said it will limit the efficiency of some securities lending in the securities refinancing market from March 18.

Both Chinese stock exchanges in Shanghai and Shenzhen also said they will suspend securities lending by strategic investors during lockup periods, effective from Monday.

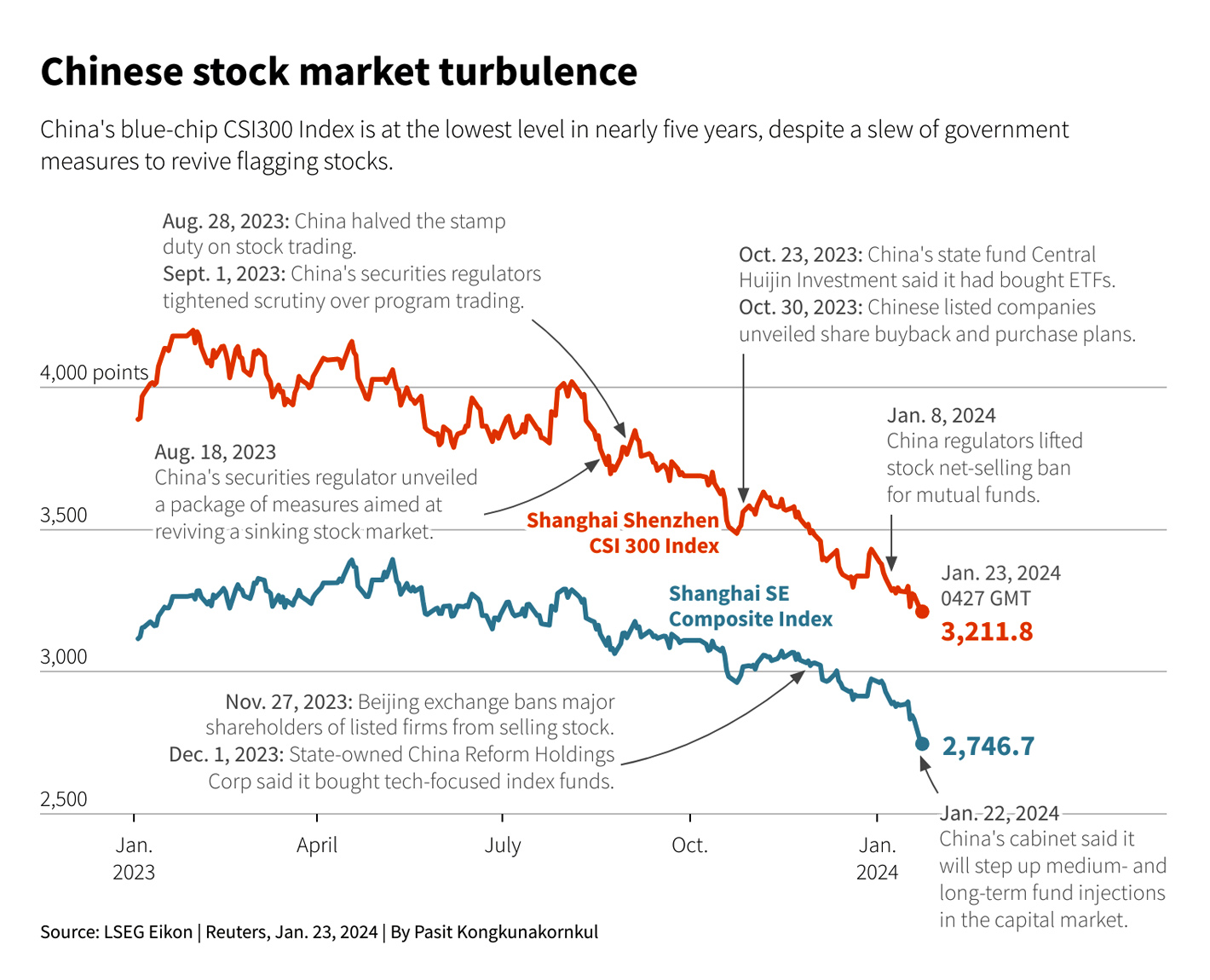

China has tightened its scrutiny of securities lending over the past few months to tamp down on short-selling amid a slump in the country’s stock market.

Last October, the CSRC restricted securities lending businesses and tightened scrutiny of improper regulatory arbitrage by imposing higher margin requirements.

The move was spurred by short-selling in shares of newly-listed companies, which fuelled anger among Chinese investors over market losses.

Beijing has also introduced a string of other supportive policies, including a deep cut to bank reserves.

The measure helped lift Chinese stocks off 5-year lows early last week but they retreated again on Friday, reflecting deep investor pessimism over the outlook for markets and the shaky economy.

Analysts and investors say Beijing needs to roll out more support measures to revive consumer and business confidence and get activity back on a more solid footing.

View this post on Instagram

China’s stock market tumbled in 2023 and has extended its slide in the new year. The blue-chip CSI300 Index has shed more than 20% of its value since January last year.

Small Chinese investors are scrambling even harder than foreigners to exit the crumbling stock markets and gain exposure to anything but the sputtering domestic economy.

That has fuelled a surge in premiums on global index funds and flows from the mainland into cryptocurrencies.

December data has signalled tougher days ahead for the Chinese economy with lacklustre consumption and the fastest fall in home prices for nine years. The country’s property market also remains in a deep crisis.

- Reuters, with additional editing by Vishakha Saxena

Also read:

China Looking at Further Moves to Prop up its Slumping Markets

Losses on $50bn Leveraged Products Behind China Stocks Plunge

China Equity Funds See Biggest Weekly Inflow in Years – BofA

Bid to Help China Property Groups Lifts Shares ‘But May Not Work’

China Told Only Major Intervention Can Turn Economy Around

Foreign Investors ‘Won’t Return Till China Starts Spending Again’

China Pushing Equity Funds to Bolster Slumping Stock Markets

Chinese Economy is in Trouble, US Nobel Laureate Says – NYT