Investor losses on billions of dollars worth of leveraged derivatives – popular in China as ‘snowball’ products – have been worsening the downturn in Chinese equities this week, market analysts say.

Snowball is a distinct Chinese market derivative in which investors receive a bond-like coupon as long as the underlying index in the product trades within a specified range.

The catch, however, is a pre-determined “knock-in” level on the product. When the underlying index falls below the “knock-in” level, brokers are forced to liquidate their hedges, which are usually long positions in stock index futures.

Also on AF: China Looking at Further Moves to Prop up its Slumping Markets

“Futures volumes have been elevated, around 50% higher than average yesterday, for example,” said Jon Withaar, who manages an Asia special situations hedge fund at Pictet Asset Management. That showed these products had been hedged via stock futures, he said.

Analysts at UBS estimate the outstanding notional amount in snowball products is around $50 billion.

The ongoing sell-off in China’s stock markets has meant that roughly 40% of knock-ins have likely been hit.

China’s snowball products are similar to the index-linked products sold in the 2008 financial crisis, with investors betting that US equities would not fall more than 25% or 30%, David Huang, senior investment strategist at AllianceBernstein, said at a press briefing last Friday.

“And it turned out, what you think wouldn’t happen, ended up happening.”

Vicious circle

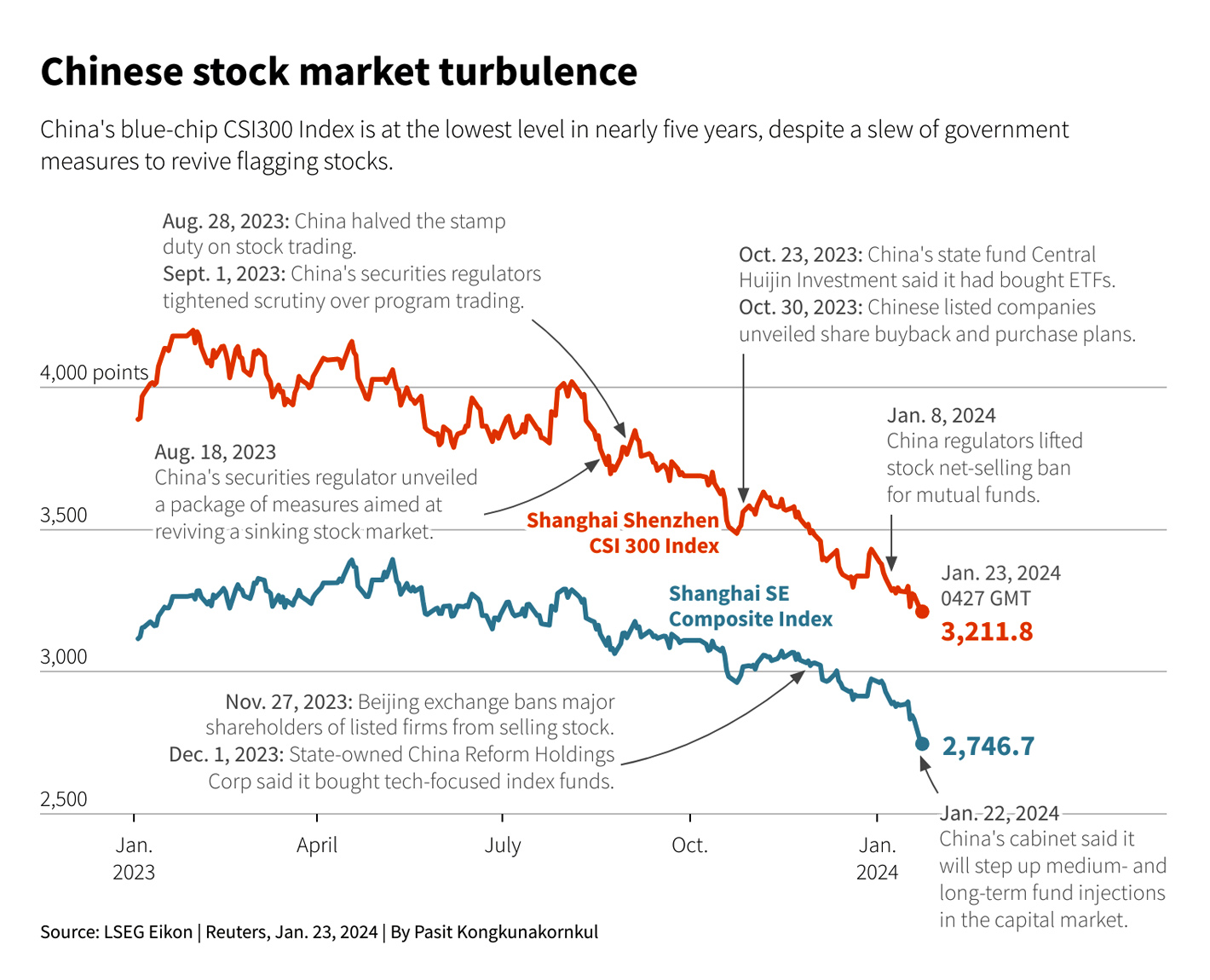

China’s stock markets plunged on Monday as equities in Hong Kong and on the mainland extending a long spell of weakness driven by an exit of foreign investors.

Share prices stabilised somewhat on Tuesday after authorities announced plans to support the market, but analysts were hesitant to cheer.

The small-cap CSI 1000 index has traded below the 5,000 level this week, after a 6% plunge on Monday to its lowest level in nearly four years.

Similarly, the mid and small cap CSI 500 index fell to its lowest level in more than four years on Tuesday.

Brokerage China International Capital Corp (CICC) estimated the average knock-in levels for many snowball products tied to the CSI500 and CSI1000 are at 4,865 and 4,997, close to where the indexes are.

Analysts at Bank of America said snowball products were one of the reasons for the stock market drop, and a drag on the already weak stock market.

The bank estimates a further 6% to 7% decline in the CSI500 or CSI1000 indexes will trigger another round of knock-ins.

Boon turned bane

Snowball derivatives gained popularity in 2021, as the pandemic and a weak economy forced Chinese brokerages and investors to get into innovative structured products betting on market volatility.

They remained popular among investors until recently, when knock-ins started happening more often as indexes fell.

Geopolitical tensions and a weak post-Covid recovery weighed heavily on Chinese markets – which remained the worst performers in Asia in 2023.

In effect, the CSI1000 index has shed an eye-watering 25% of its value over the past year.

One retail investor Mr Shi, who asked to be identified only by his last name, said he invested one million yuan ($139,466) in snowballs tied to CSI1000 index. He discovered his products had hit the knock-in level on Monday.

When he bought the two-year products in early 2023, he was expecting to earn a return of at least 8%. But now, unless the index rises above the 7,000-level within a year – implying a 40% rise from current levels – he will earn no coupon and also lose some of his principal.

View this post on Instagram

Snowball avalanche

Meanwhile, as knock-in levels are being hit, brokers are selling stock index futures to hedge their exposures.

Futures contracts on the CSI1000 due in Sept 2024 fell by the daily maximum limit of 10% on Monday to levels 8% below where the index was trading.

Futures contracts tied to the CSI1000 due in February saw turnover spike to 93 billion yuan on Monday. That compares to an average of daily turnover of 13 billion yuan in the past month.

Zhou Zhiyang, a fund manager at Jiahe Private Fund Management, said the divergence between futures prices and spot prices was drawing in arbitrageurs, seeking to profit by selling spot markets and buying futures contracts.

But AllianceBernstein’s Huang said that the divergence could also suggest that China’s A-shares “may indeed be on their last round of falls.”

The exit by some of the market’s most conservative investors could mean share prices are nearing a bottom, Huang said.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Tencent Leads China Shares up as Gaming Body Drops New Rules

China Banks Moves to Stabilize Yuan as Stock Markets Slide

Foreign Investors ‘Won’t Return Till China Starts Spending Again’

China Pushing Equity Funds to Bolster Slumping Stock Markets

China Slashes Stamp Duty on Stock Trades

Beijing Tells Law Firms to Scale Back China Risks in IPO Docs