(ATF) The Shanghai Stock Exchange has suspended the huge stock listing of Ant Group amid concern that investors have not been given proper notice about major regulatory changes announced on Monday.

The bourse decided to push back the $34-billion listing originally set to take place in Hong Kong and Shanghai this week, citing concerns that Ant would “fail to meet the issuance and listing conditions or information disclosure requirements”, it said in a statement on Tuesday evening.

China’s top regulators summoned Ant Group founder Jack Ma and two top executives to a meeting on Monday, during which they said the company’s lucrative online lending business will face tighter government scrutiny.

Central bank officials and banking regulators issued rules on Monday that will ban online lenders such as Ant Group from providing loans for speculative purchases such as stocks, bonds or real estate.

The People’s Bank of China and China Banking and Insurance Regulatory Commission (CBIRC) want to boost oversight of online lending in a bid to rein in rising debt levels given the dramatic economic impacts already from the coronavirus.

Ant Group has been facing growing pressure over potential risks in its online lending business. The firm’s Alipay platform has helped revolutionise commerce and personal finance in China, with consumers using the smartphone app to pay for everything from meals to groceries and travel tickets.

ASIA EIGHT: Today’s must-read snapshot from the Asian trading day

But Ant Group, which has more than 700 million monthly active users, has caused concern in China’s state-controlled finance sector by venturing into personal and consumer lending, wealth management and insurance.

Regulators and state media recently issued warnings about potential financial instability that could result from Ant Group’s rapid growth, suggesting official unease as the company prepared to list in Shanghai and Hong Kong on Thursday in the biggest IPO in history.

Jack Ma, Ant Group chairman Eric Jing, and CEO Simon Hu were called to meet representatives of the central bank, plus banking and securities regulators and the foreign exchange watchdog, according to a government statement.

It was an unusual meeting. The government said the three had “regulatory talks” but described the discussions with a Chinese term used when someone is summoned for a dressing-down, AFP reported.

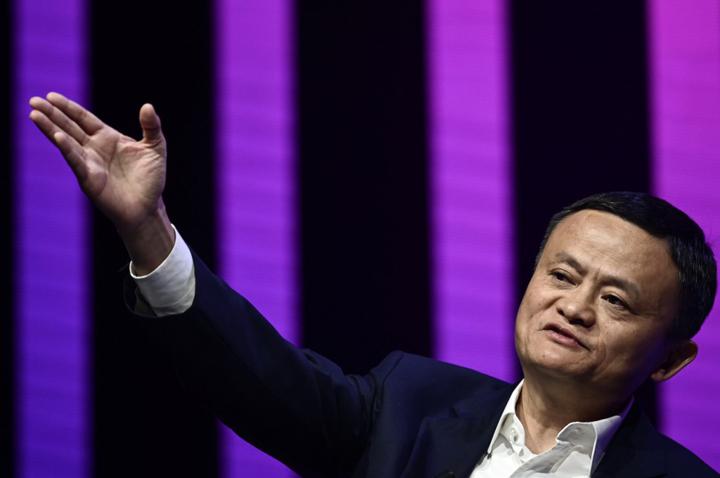

Ma, one of China’s richest and most powerful business figures as well as Ant Group’s controlling shareholder, also faced state media criticism for comments in late October in which he boasted of the size of the IPO and appeared to criticise regulators for stifling fintech innovation. (Ma seen here in an AFP photo from May 2019).

ALSO SEE: Global financial system must include all internet banking: Jack Ma

An Ant Group statement on the meeting with regulators said “views regarding the health and stability of the financial sector were exchanged”, but gave few details. “Ant Group is committed to implementing the meeting opinions in depth,” it said.

On the same day, the PBoC issued “Interim Measures for the Administration of Online Small Loans (Draft for Comment)” for public comments. Usually, the comment process is just a formality.

A commentary in state media said online small loans should not be used for investment in bonds, stocks, financial derivatives, asset management products; or for the purchase of houses and repayment of mortgage loans; and other purposes prohibited by laws and regulations of the State Council’s banking regulators and regulatory authority.

Lending limits, capital threshold raised

The draft rules from the PBoC and Banking regulatory commission seek to increase the bar for micro-lenders to be able to provide online loans directly to consumers or jointly with banks, while limiting the amount they can lend.

Regulators are concerned about regional lenders and banks that heavily use micro-lenders or third-party technology platforms – like Ant – to underwrite consumer loans, amid fears of rising defaults and deteriorating asset quality.

Chinese banks’ consumer loans sourced via tech firms reached 1.43 trillion yuan ($213.7 billion) as of end-June, according to the PBoC.

The draft, which is open for public feedback until December 2, set a new requirement for small online lenders to provide at least 30% of any loan they fund jointly with banks.

They also set a 5-billion-yuan registered capital threshold for micro-lenders that offer loans online across different regions. The current threshold varies between provinces but is well below 1 billion yuan.

Online micro-finance businesses often use big data, cloud computing, mobile internet and other user information from customer operations and online transactions obtained via legal channels. These can be used to evaluate the credit risk of the borrower, as well as determine the loan method and limit, and carry out small loan business online for loan applications, risk review, loan approval, loan issuance and loan recovery.

But under the new rules, micro-lenders which source borrower data from e-commerce platforms to assess people’s credit will be required to share the credit information with the central bank.

CBIRC: Close scrutiny warranted

Guo Wuping, head of the consumer protection division at CBIRC, said in a commentary on Monday that the rights of users of Ant-owned consumer loan companies Huabei and Jiebei deserve close scrutiny.

Guo said such fintech loan companies effectively perform the functions of banks and should adopt similar risk controls.

Licenses for eligible lenders will be renewed every three years, according to the draft rules, which said regulators will in principle not approve new micro-lenders that lend online across regions.

Lenders will have 12 months to comply with the new rules once it becomes official.

A ‘strong tightening signal’

Analysts expected banks to turn more cautious about providing joint loans with fintech lenders to consumers as a result.

But it remains to be seen how much impact the pressure may have on the Ant Group share issue, which has global investors salivating.

The regulators’ meeting with Ma and his colleagues was a “strong regulatory tightening signal”, according to Jefferies, which analysed the impact of eight of the new rules and said they “expect slower growth in online micro-loans and lower profitability for loan facilitation business”.

Online micro-lending was set to “largely to slow down” with online lenders and fintech platforms likely to suffer “lower profitability”, Jefferies said.

They were likely to face higher compliance costs because national online lenders will now be supervised by central regulators including the PBOC and CBIRC instead of local financial bureaux. That suggested “comprehensive supervision, eg, much more frequent reporting and monitoring, window guidance”.

with reporting by AFP and Reuters