China recently issued two policies for creating infrastructure-focused real estate investment trusts (REITs), kicking off a pilot programme to tap household savings and private capital to spur infrastructure development without overstretching already debt-laden local governments.

Industry professionals say the scheme faces several challenges and will likely take a few years to develop.

Last Tuesday, China’s top economic planner, the National Development and Reform Commission (NDRC), issued a circular the application of infrastructure REITs pilot projects to its provincial units, saying the programme is an effective policy tool for mitigating risks, deleveraging, stabilising investments and improving weaknesses, and an “important innovation” for China’s investment and financing mechanisms.

A few days after NDRC’s statement, China Securities Regulatory Commission (CSRC) released a final version of the guidelines on public offerings of infrastructure REITs, incorporating feedback on an earlier version.

These two policies complete the core policy framework for REITs and came about three months after the NDRC and CSRC announced that China would create a public market for REITs to support infrastructure projects.

Almost the 15th year into the research and experiment of REITs, China previously only allowed privately sold quasi-REITs in the real estate sector.

Under the new programme, the country will see its first publicly sold trusts, which are investment vehicles backed by income-producing properties and trade like stocks.

Although commercial property is excluded for fear of stoking asset bubbles, the REITs could help ramp up infrastructure investment to revive the Chinese economy, which has been hammered by the coronavirus pandemic.

Beijing commercial property is considered unattractive assets because of high prices and low operational incomes.

Earlier this week, Shanghai Stock Exchange said at a REITs conference with enterprises and investment institutions that its work to set up REITs supporting rules were almost complete, and the technical systems will be ready soon, according to an article published on the exchange’s WeChat channel.

Qualifications of REITs projects

Priority will be given to supporting six key regions: Beijing-Tianjin-Hebei, Xiong’an New Area, the Yangtze River Economic Belt, Guangdong-Hong Kong-Macau Greater Bay Area, the Yangtze River Delta and Hainan Free Trade Harbour, according to NDRC’s circular.

Industries that are either weak or fall under the New Infrastructure Plan will be given priority – these include warehousing and shipping, toll roads, railways, airports and ports, sewage and waste-treatment systems, utilities supply, data centres, telecommunications, as well as “smart energy” and “smart city” projects.

A REITs project must be operational for at least three years, and must be profitable or have a positive net operating cashflow in the last three years. Generally, it should be able to pay an annual dividend of at least 4% in the next three years, according to the NDRC document.

Commercial properties such as hotels, department stores, office buildings, apartment buildings, and residential complexes will not be included in the pilot.

Product configuration requirements

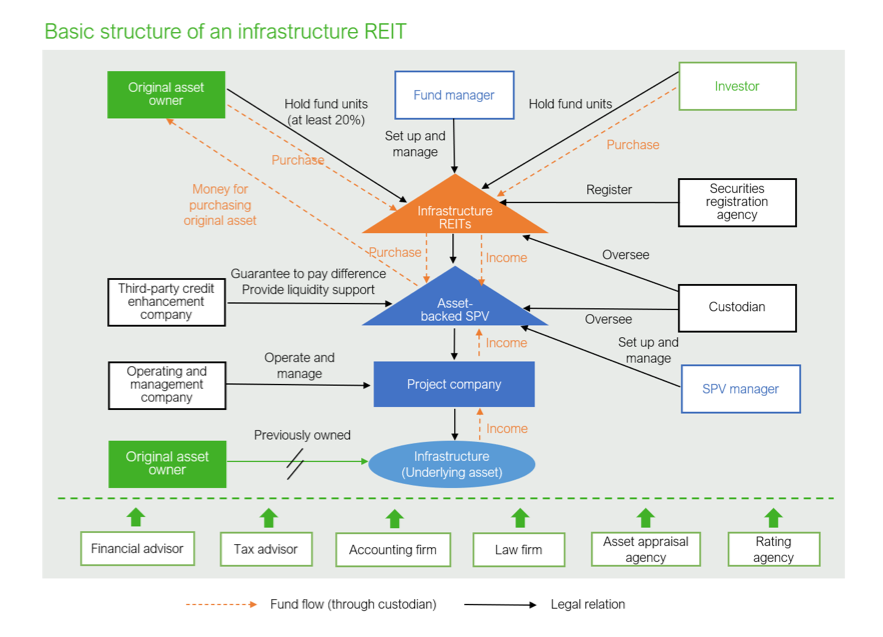

According to the guidelines issued by CSRC, at least 80% of a fund’s assets must be invested in asset-backed securities (ABS) and take full ownership of the infrastructure’s operating company.

The fund manager must actively manage the infrastructure project for stable income and distribute at least 90% of the fund’s annual distributable profits to the investors.

Compared with its previous version, the final guidelines lifted some requirements in product configuration, due diligence and strategic allotment, which will help to speed up the release of the first batch of products.

One REIT fund can now invest in more than one ABS while the previous version asked for a one-to-one match.

The new guideline also raises the cap of debt – or leverage – that REITs can carry to 28.6% from 20%. This helps the fund managers to use leverage to add more quality projects and improve returns to investors.

The beginning of a bumpy journey

However, industry professionals say China’s REITs rollout faces a few challenges and will only achieve long-term growth if the obstacles are resolved. Most of them do not expect large volume REITs transactions in the initial rollout.

At a recent seminar hosted by Tsinghua University Public-Private-Partnership Research Center and attended by Zhifeng Han, deputy head of the Investment Department of the NDRC, experts mentioned that four things are lacking in China’s REITs development – high-quality assets, long-term investors, experienced asset operators and fund managers, and supporting policies.

Tsinghua University PPP Research Center has contributed to the REITs policies and manages NDRC’s PPP expert pool.

Most infrastructure projects in China today are over-priced but produce low operating income or rental fees.

Projects with reasonable or lower prices and higher income would be suitable for REITs, for example toll roads and utilities that receive fees from the users, logistic centres and industrial parks, as well as information infrastructure assets such as data centres, said Shouqing Wang, Chief Expert of Tsinghua University PPP Research Center and a professor from the university’s Department of Construction Management.

Han from NDRC said at the seminar that many infrastructure projects in China have great investment potential if appropriate measures are taken.

He cited the subway Line 4 in Beijing as an example in which the construction and operation are separated – the Beijing government invested 70% in the tunnel and rail construction and Hong Kong MTR Corporation and two Beijing companies formed a joint venture to invest 30% in cars, signaling and telecom facilities and are responsible for its operation.

Tax burden

A key challenge to incentivise the original asset owners to participate in the programme is high taxes.

To form a REIT, first an asset owner needs to sell its entire ownership to the REIT and pay 100% of income tax. Then the CSRC guidelines require that the original asset owner must hold at least 20% of the REIT units for a minimum of five years.

This means the original asset owner makes an advanced tax payment on its 20% ownership.

In addition, if the asset is an industrial park, in many cases the asset owner also needs to pay very high land appreciation tax when it sells its ownership. This is in addition to the income tax.

Besides, there is a duplicate taxation issue during REIT operations when both the project operator and the investors need to pay income tax as they record income.

Industry professionals have reportedly proposed tax deferral or waiver plans for REITs to China’s finance and taxation policymakers. Hopefully tax neutrality policies for the REIT vehicle will be created soon.

Benefits to investors

By CSRC’s definition, China’s REITs are publicly-sold mutual funds investing in ABSs. Unlike the privately sold quasi-REITs, which have a debt nature, the REIT is an equity investment that does not guarantee a positive yield.

Available to both institutional and individual investors, REITs are believed to carry lower risks than stocks and higher yields than bonds. An investor can expect two components of returns in a REIT investment, namely cash dividends and the increase in asset values.

The CSRC has required that all REITs pay a minimum dividend of 4%, which is not very high compared with the average REIT dividend ratio in North America, Asia and Europe, but still attractive compared with China’s 10-year treasury bond yield (currently at 2.99%) and most companies’ stock dividends.

Yifeng Wang, Everbright Securities’ chief analyst on banking, said in a note that he expects China’s REITs to pay dividends of between 4% and 6% and a combined annual yield (dividend and increase in asset value) of between 6% and 14%.

Because of their high dividends and lower liquidity in the mid-to-long term, REITs may be particularly attractive to insurers, pension managers and wealth managers, Wang said.

• Iris Hong

This page was upgraded on January 19, 2022 for style purposes.

READ MORE:

News of deed tax rise spurs interest from homebuyers