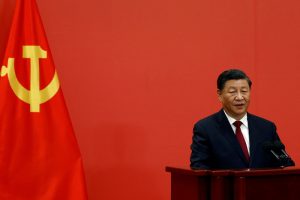

China’s financial elite are trimming lifestyles as an enforced “common prosperity” drive designed to flatten out inequalities hits their pay and benefits.

The policy, driven from the top by Chinese leader Xi Jinping, has resulted in pay cuts and delayed bonuses for staff of state-owned lenders such as China International Capital Corporation and Citic Securities, sources said.

Other lenders such as state-owned China Merchants have slashed travel and entertainment allowances since the beginning of the year, they said.

“Capping the salary of the financial industry is in line with the broad trend, and it is also part of the common prosperity drive,” Xia Chun, chief economist at wealth manager Yintech Investment Holdings in Hong Kong, said.

ALSO SEE: China, North Korea Among Suspects in US Courts Data Breach

Pay Cuts for Bankers

Despite China’s economic slowdown, the financial sector was one of the few lucrative industries for professionals after regulatory crackdowns on two other high-paying sectors – technology and property – led to job losses.

Pay cuts for investment bankers in China started last year in response to a business downturn as the economy slowed, but industry watchers said the trend has gained momentum this year under the “common prosperity” drive.

That could affect talent retention at a time Western investment banks are expanding in China.

The trend of slashing salaries was reinforced after China’s securities industry association urged the country’s brokerages in May to set up a sound remuneration system, warning that excessive, or short-term incentives could lead to compliance risks.

The trigger was Xi’s renewed drive for “common prosperity”, launched last year as an effort to reduce income inequality that threatens long-term economic growth and even the legitimacy of Communist Party rule.

Although official rhetoric on “common prosperity” may have ebbed slightly in recent months because of the slowing economy, sources said perks and pay at banks and financial companies remain under pressure.

- Reuters, with additional editing by George Russell

READ MORE:

China’s ‘Common Prosperity’ All About Control, Says Academic

China Makes a Retreat From ‘Common Prosperity’ Policy – WSJ

China’s ‘Common Prosperity’ to Boost Middle-Class, UBS Says