(ATF) China bonds extended a new year rally, led by industrials, on optimism a deal by Beijing to clear some of the debts of a key commodities producing African nation will benefit Chinese companies.

The listed bond of the Chengdu Rail Transit Group surged following news that a bullet train service linking the Sichuan capital with Tibet would be completed in June, promising more rail and economic investment in the region.

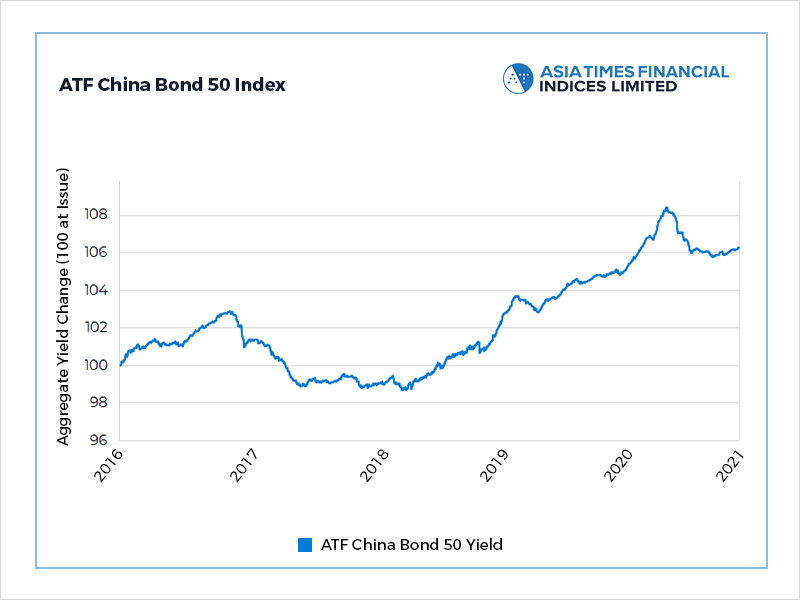

The benchmark ATF China Bond 50 Index climbed 0.02%, its ninth day of gains and taking its advance since Christmas to 0.34%. Of the sub-indexes, Corporates and Enterprises rose 0.02%, Financials added 0.03% and Local Governments advanced 0.01%.

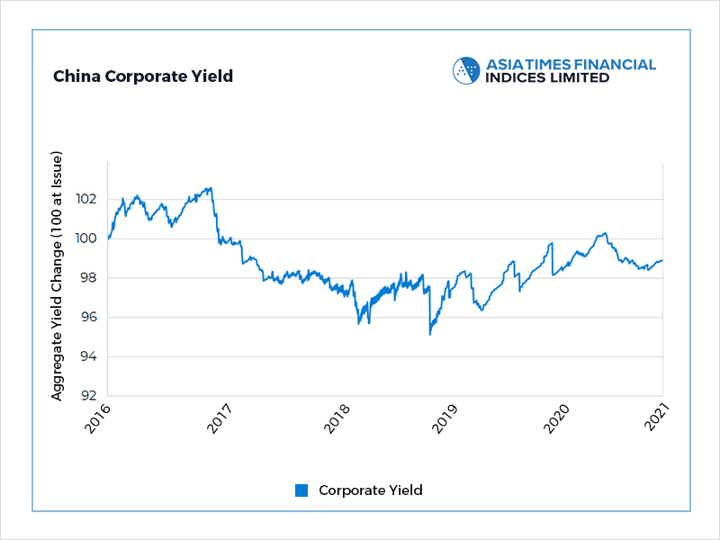

Industrial bonds, including those of Chongqing City Construction, China State Shipbuilding Corporation and China Aerospace Science and Industry Corporation climbed after Beijing said it would waive repayments on some of the $2.4 billion it has lent the Democratic Republic of the Congo in the past two decades.

Minerals-rich

The minerals-rich nation is key to China’s hopes to source coal, lithium and rare earths to fuel its economic growth and development of its technology sector.

Kinshasa recently stripped Australian miners of rights over projects in the country following Canberra’s deepening trade row with China.

Also on ATF

- NYSE China delisting fiasco shows risk to exchanges, index providers

- Asian markets ride the blue wave

- Thinking the unthinkable

Deepening economic ties between the countries is seen as a boon to the more than 10,000 mostly private Chinese companies operate that operate in the African nation.

Chengdu Rail Transit Group’s 4.4% bond soared, with its yield slumping 2.69% following an announcement from Being that the Lhasa-Nyingchi railway will be up and running in the summer.

Official media said the development would build on the Qinghai-Tibet Railway, which was opened in 2006 and that reports said had benefitted the region economically.

Foreign investors

The new year rally in Chinese bonds has been given added impetus by an almost 50% increase in inflows from foreign investors.

Foreign bondholders held Chinese interbank market bonds worth 3.25 trillion yuan ($503.35 billion) at the end of December, according to Reuters calculations using data from clearing houses Central China Depository & Clearing Co (CCDC) and Shanghai Clearing House.

That was up 1.07tn yuan, or 48.8%, from a year earlier, and the first time such holdings have exceed $500bn.

Foreign holdings of Chinese government bonds (CGB) were a record 1.88tn yuan at the end of December, up nearly 44% from a year earlier.

“Chinese CGB or policy bank bonds still have much higher yields than major developed-market bonds, so when the Chinese economy stabilised during the pandemic, foreign investors (were) looking for a safe place to put long-term money,” said Chaoping Zhu, global market strategist at JPMorgan Asset Management.

- Additional reporting by Reuters