Alipay and WeChat Pay could ‘fade like yesterday’s flowers’ as the Chinese government rolls out its CBDC payments infrastructure for free to merchants

(AF) The digital yuan, China’s fiat digital currency endorsed by the central bank, is set to dethrone Alipay and WeChat Pay and push commercial banks to transform their businesses, say analysts.

But while merchants may find the “zero fee” feature of the digital yuan particularly appealing, many Chinese consumers who have already ditched physical wallets have shrugged with indifference. It remains to be seen if Chinese central bank’s rollout of the digital yuan will be frictionless.

The central bank digital currency (CBDC), if adopted widely, will enable banks to obtain transaction data and consumer insight like never before, and compete with Ant Group’s Alipay and Tencent’s WeChat Pay, analysts from Fitch Ratings said.

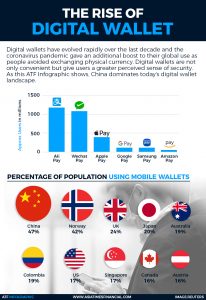

Alipay and WeChat Pay are the two mainstream digital payment systems in China with a combined 90% market share. Used via mobile phones, they have become so ubiquitous it is estimated that 2 trillion yuan in payments were made via the two systems in 2020, as going out without a wallet is now common practice in the country.

“Wider adoption of the central bank digital currency could lead to changes in data sharing and competition… In the longer term, this could lead to changes to the revenue structure of Alipay and Weixin Pay (or WeChat Pay), which dominate non-bank mobile-based payments,” said Fitch Ratings.

The digital yuan is a legal digital currency that has been issued by the People’s Bank of China (PBoC) in pilot schemes across the country. It is the digital equivalent of current banknotes and coins, and a controllable anonymous payment tool.

According to Fitch research, PBoC has designed a two-tier system for digital yuan under which designated commercial banks may open digital wallets and convert currencies to and from digital yuan for customers. A sub-tier of banks and private-payment service providers – such as Alipay and WeChat Pay – are likely to be authorised to provide services facilitating digital yuan circulation.

‘State’s will’

Meanwhile, Sun Yang, an analyst from Suning Institute of Finance, expects that third-party payment services like Alipay and WeChat Pay will “fade like yesterday’s flowers” because the digital yuan is not only “more advanced” but also comes with “the state’s will”.

“The digital yuan is inclusive and bank-agnostic – anybody can open a digital yuan account without verifying their identity or linking their bank account… It is endorsed by the central bank’s credit, and managed centrally. In terms of reliability and credibility, the digital yuan has far surpassed third-party payment service providers,” Sun said.

Merchants are charged no fees for accepting the digital yuan, based on merchants’ experience in the Shenzhen trial, she said.

“This is particularly appealing to the merchants. The thing is, many merchants get millions of yuan or tens of millions of yuan of payments in a year. Adding up the transaction fees and withdrawal fees, this cost is very high if they use third-party payment services,” said Sun.

Alipay and WeChat Pay both gained popularity quickly by charging no fees in their early days. However, they no longer offer free payment acceptance or withdrawals, which has caused some grumbling among its user base.

The banks will also benefit from the digital yuan, because consumers and merchants can make direct transactions using their e-CNY accounts at the banks without the need of going through a payment service provider.

“Banks will be able to obtain more abundant and detailed transaction data, which they can use to analyse consumers’ shopping behaviours and do their credit assessment,” Sun added.

Meanwhile, consumers literally don’t even need bank accounts.

“Because it is optional for a consumer to link a bank account to their e-CNY wallet, banks will need to provide more value-added services and innovative products to attract the consumers,” she said.

Banks today have limited access to transaction data. Besides the time and amount, a broad transaction category and the name of the payment service provider is by far all they know about a transaction.

Ant Group enjoyed substantial clout because of its access to consumer data from Alipay and Alibaba Group’s shopping platforms such as Taobao and Tmall.

Using a joint micro-loan model with banks, it was able to secure a large share of the revenue while contributing only 2% of the loans’ funding. Banks, often small and local ones, relied on Ant to promote their services to targeted consumers and assess their credit.

IPO pulled

Ant’s micro-lending subsidiaries generated net profit of 11.2 billion yuan ($1.7 bn) in the first half of 2020, which accounted for 51% of the group’s revenues, according to Ant’s prospectus.

But that’s all changing after Beijing in November pulled the plug on Ant’s massive IPO, which was set to raise $37bn and introduced new rules to increase Ant’s funding for loans to 30%. Ant is now transforming itself into a financial holding company that will be regulated like a bank instead of a technology firm.

Beijing is also determined to break Ant’s “monopoly” on data. China’s new Personal Information Protection Law, which has passed the second of three reviews, asks that internet companies set up “independent” agencies consisting of external members to process user data.

In Sun’s view, Ant Group and others have “fulfilled their mission” of connecting the financial ecosystem, culturing payment scenarios, and improving consumers’ payment experiences, and it is now time for them to “exit from the stage”.

Consumers today are very familiar with the “scan QR code to pay” function thanks to years of cultivation by Alipay, WeChat Pay and UnionPay, and hence it will be frictionless to promote the same function for digital yuan, she added.

Meanwhile, some other market observers believe the digital yuan will co-exist with Alipay and WeChat Pay.

“The People’s Bank of China certainly hopes the digital yuan can replace Alipay and WeChat Pay. However, I don’t think this will happen. Consumers have formed the habit of using them. It will be difficult to change their behaviour,” said a Beijing-based venture capitalist who was previously a senior executive at Tencent.

Lower fees

There is speculation that Alipay and WeChat Pay will lower their fees now that a government-backed competitor is set to arrive.

Consumers at a fintech show earlier this month said they did not find the digital yuan experience to be much different from those of the popular incumbents.

When asked what the difference was, a technical staff member at Huawei’s digital yuan demonstration booth said the eCNY can be transferred without a wireless connection. He demonstrated a digital yuan payment transfer using NFC-enabled Huawei phones.

Consumers probably won’t feel much difference, he said. “But from the government’s point of view, digital yuan transactions can be traced. For example, if the government provides a subsidy in digital yuan to you that is to be used for a particular purpose, you can’t use it for other purposes,” he added.

Such conditional fungibility was demonstrated in a digital yuan pilot last October in Shenzhen when the PBoC “airdropped” via lottery 10 million digital yuan to 50,000 residents in Luohu district in Shenzhen.

Each resident received 200 eCNY into a digital wallet on their phones. This money could be spent at a range of retail outlets in Luohu, but had to be used within a specified time.

“What we saw was an example of conditional fungibility – the capacity for an exchange – that can be designed and executed by the central monetary authority, for an issue of money that is seen as a contribution to the base M0 money supply. This is historically unprecedented,” said Warwick Powell, Adjunct Professor at the School of Design at the Queensland University of Technology’s Creative Industries Faculty.