US tech giant Apple said on Wednesday it plans to invest more than a billion euros ($1.2 billion) in Germany and will open the biggest research facility in Europe next year on computer chips and mobile software.

Apple said it would make Munich its “European Silicon Design Centre”. The plan is expected to create hundreds of new jobs at a facility for 5G and wireless technologies.

“I couldn’t be more excited for everything our Munich engineering teams will discover – from exploring the new frontiers of 5G technology, to a new generation of technologies,” Apple CEO Tim Cook said in a statement.

Apple has had a base in Munich since 1981 and now has hundreds of engineers developing microchips at its centres in southern Germany. The city, Cook said, “has been a home to Apple for four decades.”

The latest investment in the region would “exceed one billion euros in the next three years alone”, the company said.

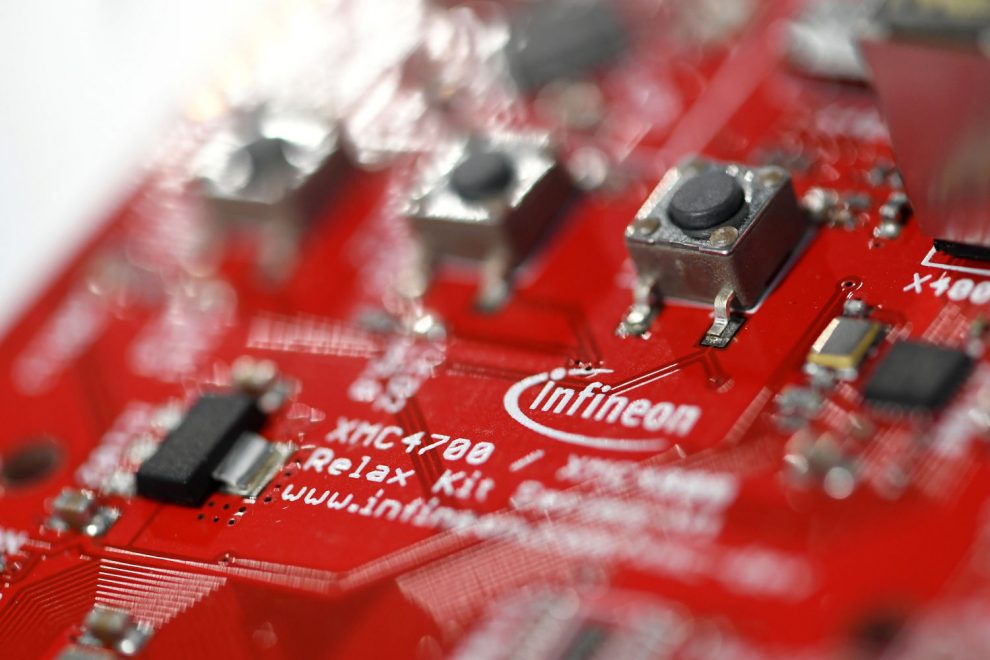

The new facility in Munich, slated to open in 2022, would host “Apple’s growing cellular unit, and Europe’s largest R&D site for mobile wireless semiconductors and software”.

EU Plan to Rival US and China

The announcement comes a day after the EU said it aims to capture 20% of the world’s semiconductor market by 2030 as Europe looks to become a tech power to rival the US and China.

A key component in everyday products such as cars and mobile phones, semiconductors are currently in short supply worldwide and Europe is dependent on Chinese and American imports in a market estimated at 440 billion euros – more than half a trillion dollars.

“The global semiconductor shortage appears to be largely the result of a strong revival in demand for goods including consumer electronics rather than pandemic-related supply disruptions,” Gabriella Dickens, a global economist at Capital Economics, said.

“It should generally have limited implications for gross domestic product, but it could dampen the pace of recovery in economies with large motor vehicle sectors” such as Europe, she said.

The shortages, also caused by changes in supply chains because of the coronavirus pandemic, have forced some major manufacturers to suspend production lines.

Security Risk

Carmakers do not have the bargaining power over other customers at semiconductor manufacturers as they account for only 10% of chip demand.

“This is becoming a national security risk for the US and Europe, which are the two geographical areas of the world most affected,” Peter Gamry, head of equity strategy at Saxo Bank, said.

The EU has been proactive in alerting markets to the shortage. “We were one of the first to pull the alarm last year,” EU internal market commissioner Thierry Breton told reporters, calling for the continent to double production this decade.

The EU plan also calls for a better-trained workforce, improved infrastructure and a transformation of public services.

Under a new roadmap, the European Commission also wants the EU to develop its first quantum computer before the end of the decade in order to be ready for a new era in fast computing.

The EU will also push member states to have 20 million information technology specialists by the end of the decade, compared with 7.8 million in 2019.

• George Russell, with reporting by Agence France-Presse.

This page was upgraded on February 15, 2022 to meet style standards.

ALSO SEE:

Subaru is latest carmaker squeezed by semiconductor shortage

Stuck in the EV chip traffic jam

90 Chinese firms working to boost semiconductor supply chain