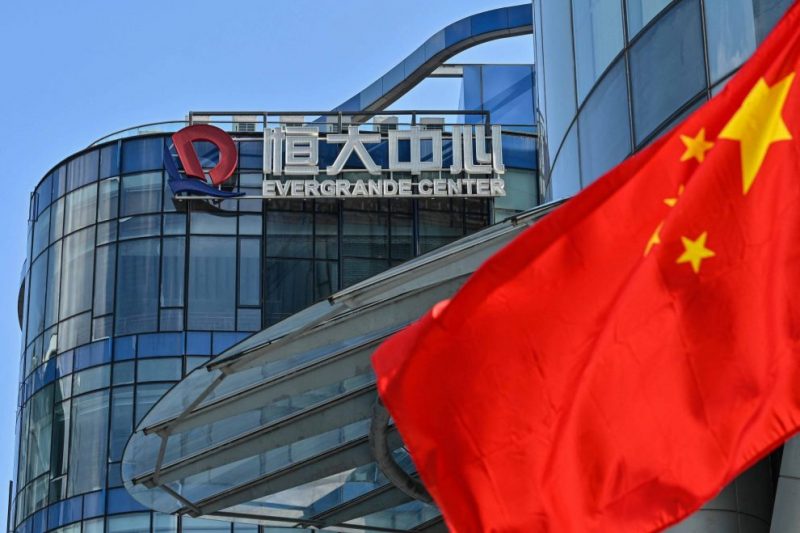

Shares of China Evergrande Group tumbled in opening trades in Asia after reports that it did not pay offshore coupons due on Tuesday.

And news later in the day, announced on the company’s Weibo account, that it had resumed work on more than 91% of its projects around the country, failed to lift the stock to any major degree.

Evergrande, whose $19 billion in international bonds are in cross-default after it missed a deadline to pay coupons earlier this month, had new coupon payments worth $255 million due on Tuesday (Dec 28) for its June 2023 and 2025 notes.

Media reports said the due date passed with no sign of payment by the embattled property developer. Both payments have a 30-day grace period.

Evergrande shares fell 7% in morning trading and were down 9% at HK$1.50 at the close of trading in Hong Kong.

The stock has lost 33% of its value in the past month and 89% over the year to date.

The decline on Thursday wiped out gains made earlier this week, when the market cheered over the initial progress the firm made in resuming construction work.

Company chairman Hui Ka Yan vowed in a meeting on Sunday to deliver 39,000 units of properties in December, compared with fewer than 10,000 in each of the previous three months.

“All employees of the group are fighting day and night and sprinting with all their strength to ensure that the goal of delivering 39,000 units this month is completed,” the company said, according to Securities News.

“(The non-payments) show Evergrande is still not doing okay even though it is delivering homes,” Thomas Kwok, head of equity business of Chief Securities in Hong Kong, said.

The market confidence in Evergrande and the China property sector is weak, as there could be more defaults with many bonds due in January, Kwok added.

Evergrande has over $300 billion in liabilities and is scrambling to raise cash by selling assets and shares to repay suppliers and creditors.

Buyers ‘Watching and Waiting’

Chinese homebuyers “have taken a wait-and-see mood attitude” amid weakening new home prices and developers’ liquidity stress, Fitch Ratings said last week.

“Official surveys indicate that urban home buyers’ sentiment remains at a high level relative to previous years, suggesting underlying demand will stay resilient in the medium term, underpinned by improving affordability and the relaxation of the Hukou, or housing registration, policy in major cities.

“Affordability, measured by urban disposable income per capita to new home average selling prices, has also improved since 2020, and is likely to keep rising as new home average selling price drops, providing support to mid-term demand.

“Homebuyers have piled into the property market when project prices (not sector average selling prices) dropped by 10%-15%, especially when developers also offered incentives such as free or heavily discounted decoration and car parks.”

But quarterly data showed that new home sales and gross floor area sold rarely dropped by more than 20%, while average selling prices had not fallen by more than 10% even during the global financial crisis in 2007-2008.

“Higher-tier cities will see more robust home demand as they ease Hukou policies. Young people also tend to migrate from lower-tier cities to higher-tier cities.”

Meanwhile, a senior official at China’s central bank said on Thursday that mergers and acquisitions in the property sector will help firms lower their debt.

Zou Lan, head of financial markets at the People’s Bank of China (PBOC), told reporters: “Mergers and acquisitions of projects between real estate companies are the most effective market-oriented means for real estate companies to resolve risks.”

- Reuters with additional editing by George Russell, Jim Pollard

READ MORE:

Evergrande Chief’s Services Unit Stake Drops On Forced Sale

China Evergrande Default Triggers Brawl Over Local Assets

Second Ratings Agency Declares Evergrande In Default