Ten weeks of cryptocurrency carnage followed by a sharp rebound has left investors’ heads in a spin.

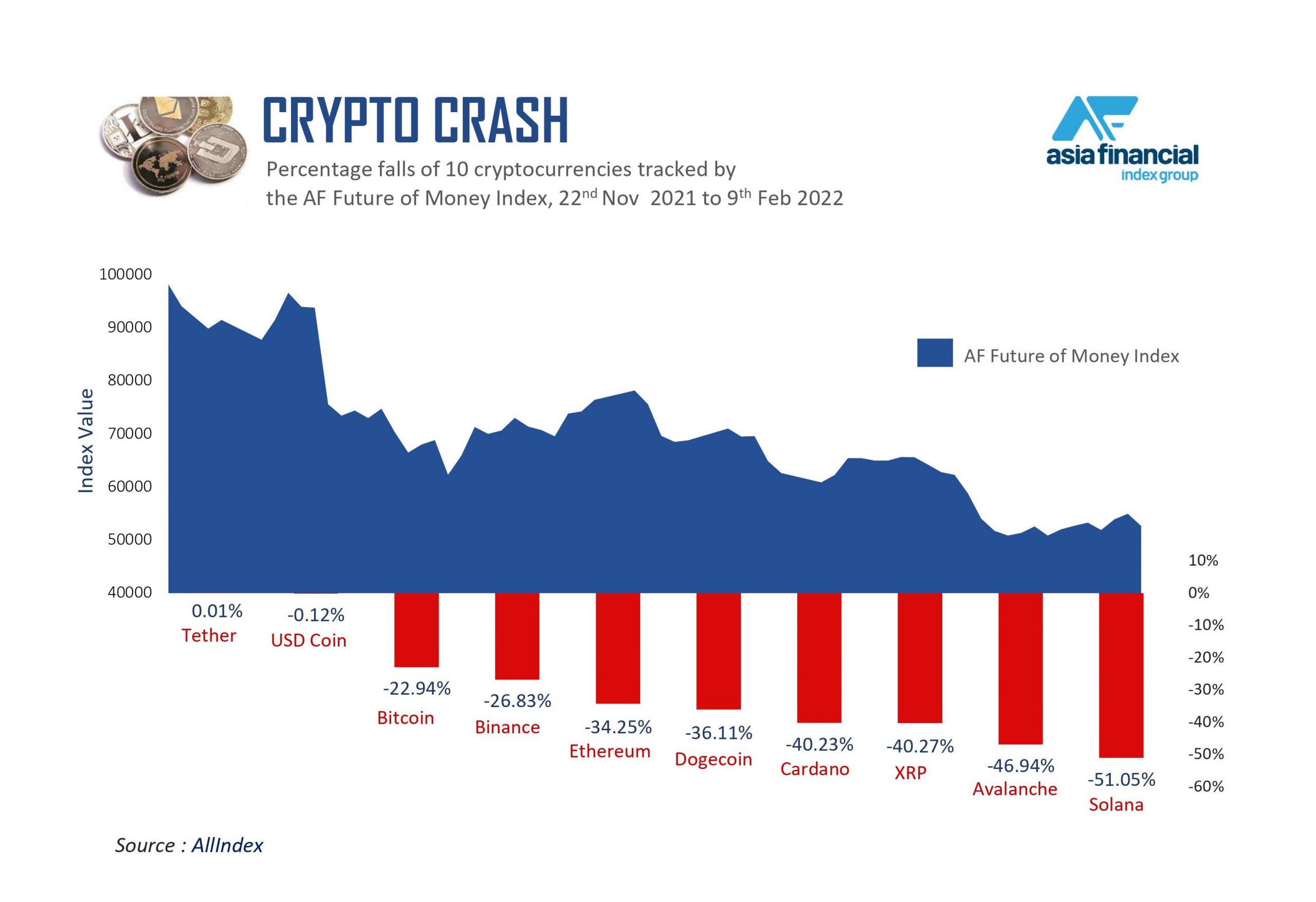

Asia Financial’s Future of Money index, a basket of 10 leading cryptocurrencies, has slumped 37.2% since November 22. The cryptocurrency sector overall saw its market cap shrink by 25% to about $1.98 trillion.

The sell-off was triggered by rising inflation and the US Federal Reserve’s faster-than-expected shift towards interest rate hikes, the threat that the Omicron variant would drag on economic growth, and unrest in Kazakhstan, the world’s second-biggest Bitcoin miner.

But since closing at a low for the year of 35,030.25 on January 22, Bitcoin’s surged more than 24% while the AF Future of Money index is up 4.8%. Bitcoin is down 2.56% for the day at $43,733.98 as of 08:00 GMT on February 9.

So with cryptocurrencies back on a rising trajectory for now, what lessons does its second-steepest plunge in five years provide investors?

Diversification, What Diversification?

Crypto asset bulls have long argued that cryptocurrencies such as Bitcoin and Ether provide portfolio diversification that helps hedge against turbulence in other asset classes. But the recent sell-off took cryptocurrencies down along with stocks after investors were spooked by the risk that rising prices would hasten the speed of interest rate increases.

The IMF says things changed after central banks pumped liquidity into the global economy to counter the pandemic, boosting investor risk appetite and pushing up stocks and crypto prices.

“Returns on Bitcoin did not move in a particular direction with the S&P 500, the benchmark stock index for the United States, in 2017–19,’’ the IMF said in a January 11 blog. “The correlation coefficient of their daily moves was just 0.01, but that measure jumped to 0.36 for 2020–21 as the assets moved more in lockstep, rising together or falling together.”

So the case for crypto as an asset to help significantly diversify portfolios is weakening. The IMF is so concerned about the correlation with stocks that it says it “raises the risk of contagion across financial markets.’’

Bitcoin vs Ether

Goldman Sachs reignited a debate last year when it said Ethereum has a “high chance” of eventually overtaking Bitcoin as a dominant store of value. Over 12 months, Ether’s surged almost 73.6% while Bitcoin is down by 5.9%. Bitcoin’s done fractionally better during the crypto crash though, and is up 4.5% over the past month against Ether’s 1.6% tumble.

Still, despite Bitcoin being the first mover and the dominant force for now with a market cap about double Ether’s, it’s clearly game on.

“If Bitcoin is digital value, Ethereum is a digital canvas or software platform that allows developers to create new crypto and traditional applications,’’ said JPMorgan analyst Kenneth Worthington in a January 10 note. “Its use cases are far more significant than what we see for Bitcoin. Cryptocurrencies made a leap beyond digital value with the development of Ethereum.”

Blockchain vs Cryptocurrencies

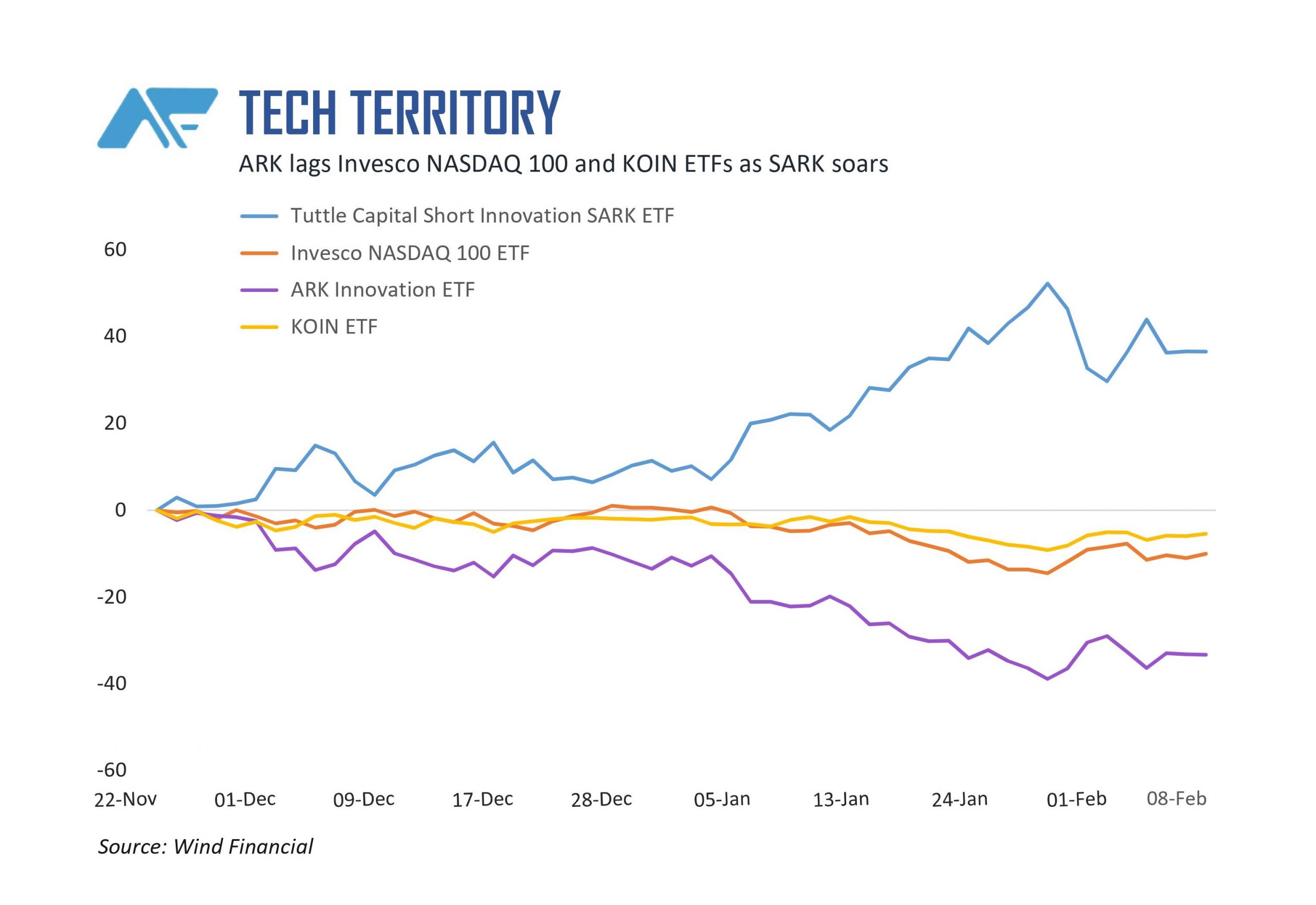

While Asia Financial’s Future of Money Index has plunged 37.2% since November 22, the AF Global Fintech Leaders Index, which tracks companies that lead in adopting blockchain technology, was down just 4.9%.

So blockchain is one way of gaining exposure to the crypto world without the rollercoaster ride of cryptocurrencies. Blockchain-linked investments also provide the opportunity to invest in a technology that arguably will be more transformational than digital currencies themselves.

Blockchain ETFs like Koin, which tracks the AF Global Fintech Leaders Index and is owned by AF’s parent Capital Link International, invest in world-leading companies positioned to capitalise on blockchain technology. They are established, well-regulated companies that shield investors from the wild swings of opaque, and poorly regulated digital currencies such as Bitcoin.

An added advantage is that because blockchain technology is deployed by a diverse range of companies – Koin invests in companies from Visa Card to Nestle SA to Microsoft Corp – such ETFs provide greater diversification than even many tech-focused funds. That’s enabling them to outperform tech sector giants such as Ark Innovation ETF, which has plunged 33.3% since November 22, and also rival broader-based innovation funds such as Invesco Nasdaq ETF, which tracks the Nasdaq 100 benchmark, and fell 10%. For those curious about other potential ways to play the tech crash, the chart (above) also shows Tuttle Capital Short Innovation ETF (SARK) rising almost 36.5% since Nov. 22. It shorts Cathie Wood’s ARK fund, giving investors the opportunity to profit from its declines.

The downside of blockchain-linked investments is that they spare investors not only stomach-churning drops but also their stratospheric rises. Anyone who bought the basket of cryptocurrencies that the AF Future of Money index tracks would now be sitting on gains of 1,403% since January 4 last year.

To Buy Or Not to Buy?

Goldman Sachs is sticking to its upbeat prediction that Bitcoin will hit $100,000 by 2027. Analyst Zach Pandl, co-head of foreign exchange strategy, sees it as a store of value like gold and computes that if Bitcoin’s share of the store of value market increases to 50% over the next five years, Bitcoin’s price will increase to slightly more than $100,000 for a compound annualised return of 17 to 18%.

“Bitcoin may have applications beyond simply a ‘store of value’ — and digital asset markets are much bigger than bitcoin — but we think that comparing its market capitalisation to gold can help put parameters on plausible outcomes for Bitcoin returns,” said Pandl in a research note.

Among crypto bears is University of Sussex Professor of Finance Carol Alexander in England. She predicts it will plunge to $10,000 by the end of this year in a meltdown similar to the crash that started in 2017. That implosion saw Bitcoin plummet from $19,650 in mid-December, 2017, to around $3,400 by February 2019 – to lose 83% of its value.

Like JPMorgan Chairman and CEO Jaime Dimon, Alexander says Bitcoin has no intrinsic value and considers it more of a “toy’’ than an investment.

With US inflation rising to its highest level in four decades, some investors continue to view cryptocurrencies as a hedge against rising consumer prices, while others say the recent crash shows it isn’t a useful hedge at all.

January’s crypto crash had sent the Crypto Greed and Fear Index to a six-month low of 10 out of 100, signaling “extreme fear.”’ It’s since regained its poise and on February 8 moved back into “neutral” territory.

- By Kevin Hamlin, Richa Gandhi, Frank Chen, and Indrajit Basu

This article was updated on February 8, 2022.

Read more:

Blockchain ETFs Buoyed by Crypto Boom, Liquidity, Inflation