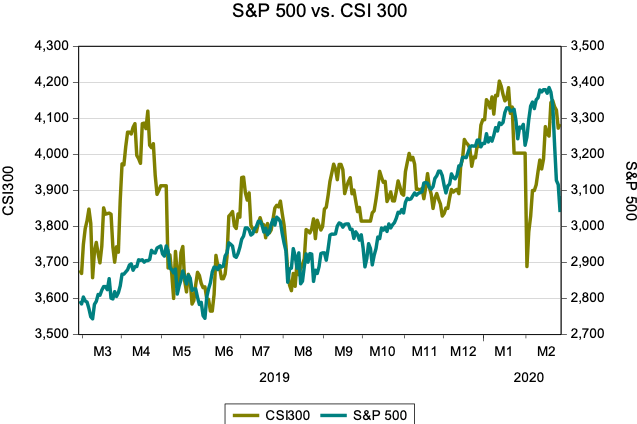

China’s stock market is the world’s best performer, thanks in part to massive fiscal stimulus in response to last year’s trade war and this year’s virus epidemic. That’s what governments are supposed to do in response to natural disasters, and the rest of the world should do the same thing.

With major US equity indices down more than 10% from last week’s record highs, equity markets in the West are sending an economic danger signal. Equity market sectors most exposed to the consequences of the epidemic are the worst performers. Energy and basic industries lead the declines, with 20% declines in airlines, hospitality, oil and gas, and basic materials. Defensive stocks such as consumer staples and pharmaceuticals, by contrast, lost only 3%-4%.

The German business daily Handelsblatt today reported that the German government is preparing a package of tax cuts and emergency assistance to small and medium enterprises to allay the economic damage from Covid-19. “In addition to conventional economic support measures such as tax cuts or accelerated depreciation, the federal government is giving special attention to helping individual companies that are particularly affected by the virus,” the newspaper wrote.

With US and many other government bond yields at record lows, government budgets have nearly unlimited capacity to expand in response to the short-term economic shock caused by quarantines, travel restrictions, and business closings. Emergency response has nothing to do with Keynesian fiscal stimulus. Natural disasters delay economic activity but do not change the economy’s long-term growth potential, unless they kill very large numbers of people. That manifestly is true of Covid-19, which has a low fatality rate. The economic impact of the virus stems from preventative measures, which temporarily suspend economic activity. Governments should step in and provide a fiscal bridge. This is no different than storm or flood damage.

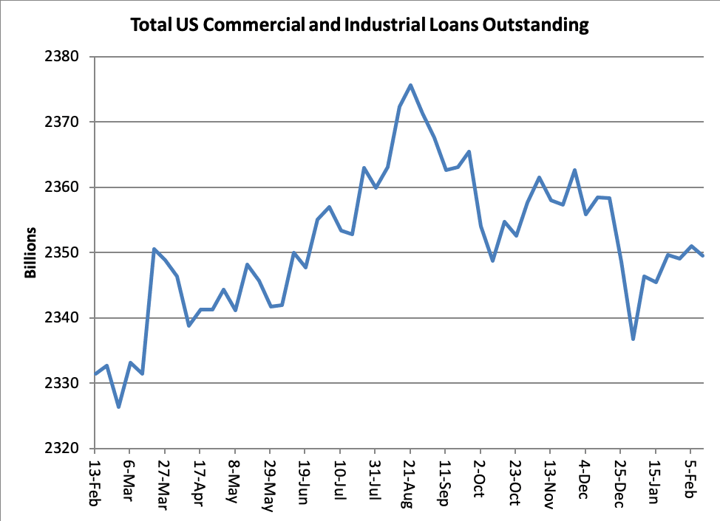

Monetary policy won’t work, because the real shock to the most-affected businesses hurts their capacity to borrow through normal commercial channels. The Federal Reserve should cut rates substantially, but the main impact of such measures would be psychological. The total volume of bank loans to business fell during the past five months as the economy slowed. A lower federal funds rate won’t increase borrowers’ ability to post collateral or bankers’ willingness to make loans.

To be effective, emergency measures must be big, dramatic, and immediate. Emergency tax reductions, including a temporary suspension of social insurance payments by individuals and businesses, are the ideal measure. Forty-four percent of Americans pay no income tax, but Social Security contributions comprise 12.4% of income, split between workers and employers. The US Congress should authorize emergency borrowing authority to make up the difference in the Social Security Fund.

The Export-Import Bank, the Small Business Administration and other government entities should authorize emergency zero-interest loans for businesses especially affected by the epidemic, including oil drillers, transportation companies, hospitality and retail.

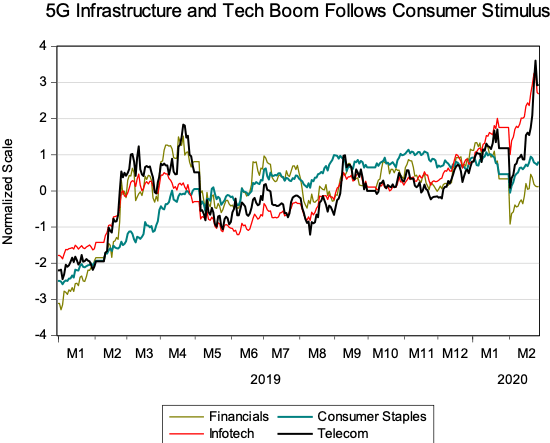

Emergency infrastructure spending won’t have much of a short-term impact, because the lead time is so long. That is not the case in China, where infrastructure spending has been a major driver of economic growth for the past 40 years, and the apparatus is in place to accelerate projects already underway. China responded to the manufacturing headwinds from the 2018-19 trade war by stimulating household spending, and then by increasing infrastructure spending, especially for the rollout of 5G broadband. The best performer during the first half of 2019 was the consumer staples sector, followed by a resurgent telecom sector during the last quarter of the year.

Politics may be an obstacle to rapid response on the part of governments, to be sure. The prospects for consensus on major initiatives during a US election year usually are small. In this case, though, it would be awkward for the Democrats to oppose a Trump Administration initiative to put money in the pockets of the poorest Americans and to aid small businesses, who employ the vast majority of Americans.

Beyond emergency spending measures, Western governments should seize the opportunity to invest in long-neglected infrastructure. That was a signature plank of President Trump’s economic plan, which got lost in the political fracas of the past two years. The US needs at least $1 trillion to repair roads, bridges and other basic infrastructure. It is also far behind China in the rollout of 5G mobile broadband.

The crisis gives the Trump Administration an opportunity to propose a federally-supported crash program to build out American 5G broadband through a public-private partnership. There are a dozen proposals to this effect now gathering dust, including one by retired Air Force General Robert Spalding developed in 2018 at the National Security Council.

The resilience of Chinese stocks may be the result of confidence in Beijing’s capacity to control an epidemic. China’s surveillance state, repugnant as it is to Western sensibilities, has certain advantages in an emergency. It is harder for Chinese to evade quarantine when the government can track every purchase of aspirin at a pharmacy, for example.

Nonetheless, the Chinese government’s massive response to the virus outbreak – after an initial episode of bureaucratic paralysis in late December – probably explains the stock market’s strength. As noted, China also has more capacity to expand infrastructure spending than Western countries. Infrastructure investment represents a much higher share of economic activity, so any increase has a correspondingly greater impact.

Which fiscal policy tools Western governments might choose really isn’t the issue. The important thing is for the Group of Seven governments to make a show of force and persuade their citizens that the full resources of the state will get them through a temporary period of distress.