Weekly inflows were the largest for three months as Covid’s impact on the global recovery began to be felt and the fear of inflation spread

Global bond funds saw the biggest weekly inflows in more than three months as investors rushed for safety amid concerns that the spreading Delta coronavirus variant could cause the economic recovery to stall.

According to Refinitiv Lipper data, global bond funds received inflows worth $19 billion in the week to July 7, the biggest since the week ended April 7.

US 10-year Treasury yields dipped to a four-and-a-half-month low this week as investors sensed cracks in the economic recovery and cooling risks of high inflation.

Also on AF: China SOEs Push Corporate Bond Defaults to a Record High

Meanwhile, global equity funds received a net inflow of $1.9 billion, the smallest in a month.

US equity funds faced an outflow of $5.2 billion, while European and Asian equity funds received inflows of $6 billion and $0.3 billion respectively.

The data showed funds that are focused on Chinese equities, faced outflows, on concerns about China’s crackdown on local tech companies.

Among equity sector funds, healthcare and consumer cyclical funds secured $550 million and $405 million, while financial sector funds saw their fourth consecutive week of outflows.

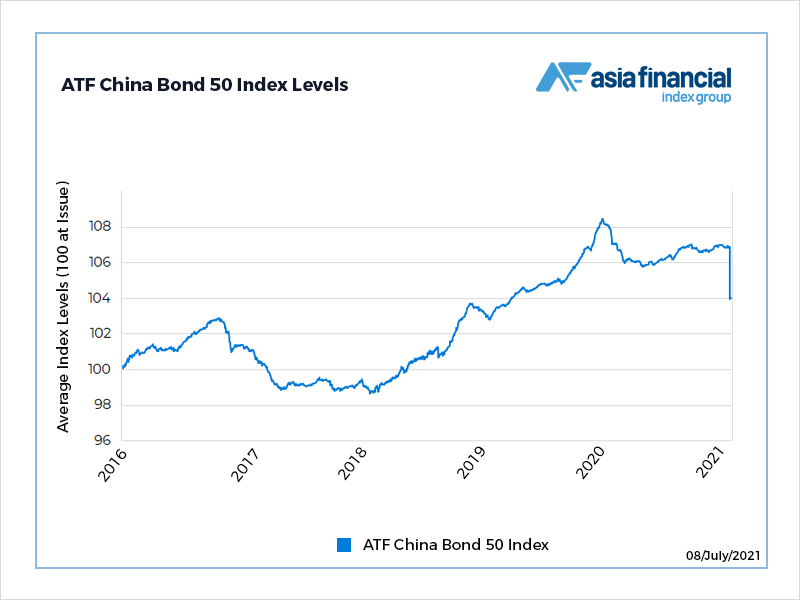

An investable cross-section of China’s onshore bond market containing both pure industry sectors and local government indices that includes corporates, enterprises, financials; local governments, AF’s Chinese Bond Market Index differs from regular bond indices because it has unique daily data access from the Chinese bond market and it uses trading oriented methodology with a focus on liquid bonds.

On the other hand, investors put $30 billion in global money market funds, the biggest in six weeks, underscoring the risk-off sentiment in markets in the week.

Among commodity funds, energy funds faced outflows for a sixth consecutive week, while precious metal funds had their biggest inflow in six weeks, thanks to a surge in gold prices.

An analysis of 23,668 emerging-market funds showed bond funds received a net $838 million, the largest inflow in four weeks, while equity funds saw outflows for a third straight week, worth a net $40 million.

- Reporting by Reuters

Read more:

China Huarong to hold first EGM since it sparked rout in credit markets

China Securities Regulator Seen Reviewing Firms Planning to List Abroad