(ATF) – If US equity futures and European markets don’t lie, we’ll see the fifth in six trading days of daily stock markets gains.

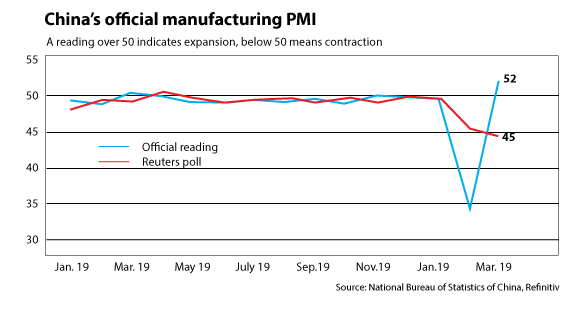

The unexpected rise in China’s March PMI to 52.0 after the record low of 35.7 in February helped markets in all asset classes even as the coronavirus continues to claim high fatalities in Europe and in the US.

The dollar index (DXY) climbed by 0.4% in Asian trading to 99.62 at 6pm HK time, a modest rise, but clearly no longer driven by significant dollar shortages.

The PBoC set the central parity of the Chinese currency at 7.0851, somewhat weaker than the day prior but well in line with the dollar gain. At 6pm HK, the CNY stood at 7.0976, hardly an intraday move to get currency traders excited.

As markets calm further and China’s capacity utilization and recovery move ahead apace, we expect Cny to continue to trade in the current comfort zone of 7.05 – 7.10. — good news for investors in China’s onshore bond market as hedging needs remain well contained.