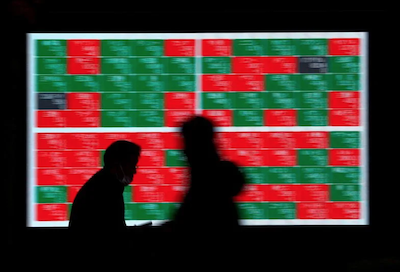

Asian stocks rallied on the week’s final day of trading, led by a tech surge in Hong Kong and a turnaround in the yen’s fortunes.

Shares across the region surged to their highest in 15 months, while the Japanese currency put more distance between itself and recent 34-year lows to cap a tumultuous few days that saw suspected intervention from Japanese authorities.

But with markets in Japan and mainland China closed on Friday, regional trading activity was subdued as traders looked ahead to the US non-farm payrolls data later in the day.

Also on AF: US Asks China to Declare AI Will Never Control Its Nuclear Arms

Hong Kong stocks advanced, as market sentiment continued to improve, buoyed by China’s stepped-up efforts to boost the economy.

The Hang Seng Index gained 1.48%, or 268.79 points, to close at 18,475.92, for a ninth consecutive day of gains and its longest winning streak since January 2018.

China’s politburo statement at the end of April “indicates a stronger commitment to a pro-growth and pro-reform policy agenda,” said Jason Lui, head of APAC Equity and derivative strategy, BNP Paribas, adding the firm is upgrading their view on the MSCI China index.

Meanwhile, UBS says global hedge funds that use an equities long-short strategy are growing increasingly bullish on China, evidenced by the heavy pick-up in their purchases of Hong Kong-listed shares.

Elsewhere across the region, in earlier trade, Sydney, Singapore, Wellington, Taipei, Bangkok and Jakarta were also well in the green, though Seoul, Manila and Mumbai dipped.

MSCI’s broadest index of Asia-Pacific shares outside Japan surged to 550.49, its highest since February 2023 and was last up 1% at 547.72.

European bourses were set for a higher open, with Eurostoxx 50 futures up 0.25%, German DAX futures 0.24% higher and FTSE futures up 0.15%. E-mini futures for the S&P 500 rose 0.29%, while Nasdaq futures are up 0.58%.

The spotlight for much of this week has been on the yen, which strengthened 0.43% to 152.99 per dollar on Friday, having started the week by touching a 34-year low of 160.245 on Monday.

In between, traders suspect the authorities stepped in on at least two days this week and data from the BoJ suggests Japanese officials may have spent roughly $60 billion to defend the beleaguered yen, leaving trading desks across the globe on high alert foe further moves by Tokyo.

Apple Quarterly Results

A series of Japanese public holidays as well as Monday’s holiday in the UK – the world’s biggest FX trading centre – could present a possible window for further intervention by Tokyo. Japanese markets are also closed on Monday.

The yen has weakened for over a decade, largely due to low Japanese interest rates drawing funds out of the country towards higher yielding assets in other large economies including the United States. Despite the sizeable bounce in the yen this week, it is still down 8% against the dollar this year.

The dollar index, which measures the US currency against six peers, was last at 105.24. The index is set to clock a 0.8% decline for the week, its worst weekly performance since early March.

The Federal Reserve this week left rates unchanged and signalled that its next policy move will be to lower its rates, though chair Jerome Powell noted that recent strong inflation readings suggest the first of these cuts could be a long time coming.

In after-market hours Apple reported quarterly results and forecast that beat modest expectations and unveiled a record share buyback programme, sending its stock up almost 7% in extended trade.

US economic data on Thursday also showed the labour market remains tight, ahead of key government payrolls data due later on Friday. Economists polled by Reuters forecast 243,000 jobs, with estimates ranging from 150,000 to 280,000.

In commodities, US crude rose 0.24% to $79.14 per barrel and Brent was at $83.86, up 0.23% on the day.

Spot gold eased 0.1% to $2,300.75 an ounce and were set for second straight weekly decline.

Key figures

Tokyo – Nikkei 225 <> CLOSED

Hong Kong – Hang Seng Index > UP 1.48% at 18,475.92 (close)

Shanghai – Composite <> CLOSED

London – FTSE 100 > UP 0.35% at 8,200.55 (0923 BST)

New York – Dow > UP 0.85% at 38,225.66 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Bank of Japan ‘Spent $59 Billion Lifting Yen’ 3.5% This Week

China, Japan, India Economies Held Back by ‘Xenophobia’: Biden

Japan Will Prop Up Yen Until Freefall Risk Fades: Ex-BoJ Chief

Hang Seng Jumps on Tech Bets, Yen Rally Weighs on Nikkei