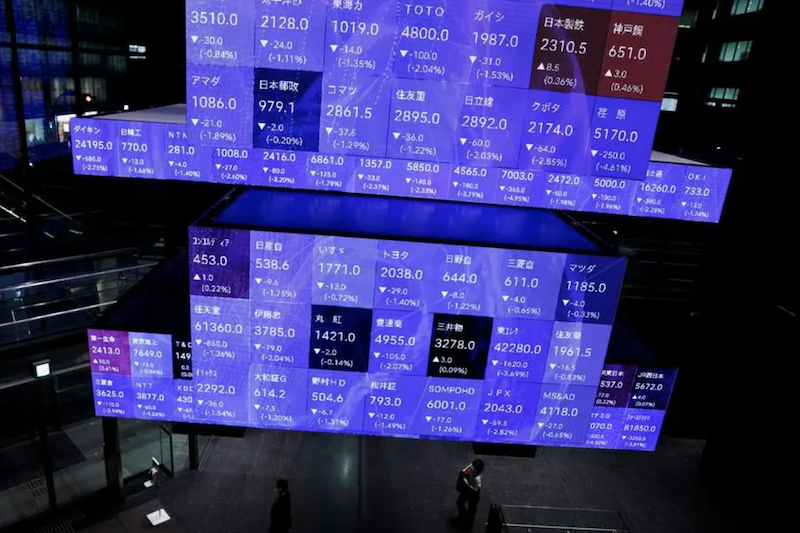

Asia’s major stock indexes rebounded on Friday with investor mood lifted by a Wall Street rally overnight to record their best day in weeks.

But stocks across the region were still on course for their worst quarterly performance in a year, as worries over persistently high interest rates continued to drag on sentiment.

The outlier was Tokyo where Japan’s Nikkei share average ended a volatile week with a slight decline, swinging between gains and losses during the session to send the stock benchmark to its worst quarter since mid-2022.

Also on AF: OpenAI, SoftBank, Apple Designer Ive in ‘AI iPhone’ Talks – FT

The Nikkei edged down 0.05% to 31,857.62, bringing its loss for the week to 1.68%. The broader Topix, with its lower concentration of tech shares, fell 0.94% for the day, and 2.23% for the week.

Investors were also cautious amid uncertainty over a potential US shutdown and the ongoing auto workers strike, along with key economic data next week, including the Bank of Japan’s tankan survey and the US monthly payrolls report.

The Nikkei has lost more than 4% this quarter, its first quarterly decline since last September and its biggest since the previous June.

The benchmark index hit its highest since early 1990 at 3,3772.89 in mid-June, and has slid about 5% since the most recent peak in the middle of this month.

Hong Kong shares bounced back, though, from the lowest level in 2023 hit in the previous session, as Wall Street gained overnight due to a pullback in US Treasury yields from multi-year highs.

The Hang Seng Index gained 2.51%, or 436.63 points, to 17,809.66, while the Hang Seng China Enterprises Index jumped 2.63%. The Hang Seng Index dipped nearly 3% for the month.

Evergrande Crisis Deepens

China’ s economic problems, though, continue to pressure the market. Embattled property giant China Evergrande Group said its founder is being investigated over suspected “illegal crimes”, leaving creditors increasingly concerned about the group’s prospects.

Evergrande Group and its units suspended share trading in Hong Kong on Thursday.

On the bright side, the US and China are discussing a possible trip to Washington by Xi’s top economic-policy aide, Chinese Vice Premier He Lifeng, the Wall Street Journal reported on Thursday, which could pave the way for Chinese President Xi Jinping to visit the US.

Mainland markets are closed for a week-long National Day holiday and will reopen on October 9.

Elsewhere across the region, in earlier trade, Sydney, Singapore, Wellington, Mumbai and Jakarta were also up. However, Manila and Bangkok dipped. MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1%, and were set for their biggest one-day percentage rise in four weeks.

Futures indicated that the relief rally might continue in Europe, with the Eurostoxx 50 futures up 0.07%, German DAX futures up 0.19% and FTSE futures up 0.12%.

Japan’s Yen Struggles

Investors are watching out for the US personal consumption expenditures price index due later on Friday, but before that euro zone inflation data will take the centre stage.

The recent rise in Treasury yields to 16-year highs has cast a shadow over the stock market, with the Federal Reserve’s hawkish tilt last week also weighing on risk sentiment.

In foreign exchange markets, the dollar index eased 0.15% to 106 but hovered near the 10-month high of 106.84 it touched earlier this week. The index is up 2.4% this month and set for second straight month of gains.

The Japanese yen was at 149.35 per dollar, perilously close to the 150 level which is viewed as potentially spurring intervention from Japanese authorities.

Oil prices regained ground after a brief pause in a rally as traders weighed expectations of supply increases by Russia and Saudi Arabia versus forecasts of positive demand from China during its Golden Week holiday. US crude fell 0.02% to $91.69 per barrel and Brent was at $95.05, down 0.35% on the day.

Gold prices were braced for their biggest monthly fall since February, hovering around six-month lows. Spot gold was little changed at $1,864.75 an ounce.

Key figures

Tokyo – Nikkei 225 < DOWN 0.05% at 31,857.62 (close)

Hong Kong – Hang Seng Index > UP 2.51% at 17,809.66 (close)

Shanghai – Composite <> CLOSED

London – FTSE 100 > UP 0.66% at 7,652.38 (0933 BST)

New York – Dow > UP 0.35% at 33,666.34 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Vows Anti-Corruption Crackdown on Financial Sector

China EV Startup Nio Seen in Tech-For-Cash Talks With Mercedes

Rates Fears Weigh on Nikkei, Property Slump Hits Hang Seng