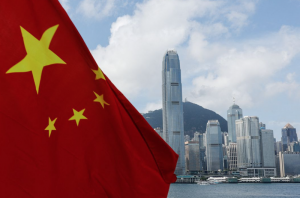

Capital outflows forced Hong Kong on Wednesday to defend its currency peg to the dollar amid an economic contraction caused by severe Covid-19 restrictions.

The Hong Kong Monetary Authority (HKMA) bought almost HK$1.6 billion ($202 million) of the territory’s currency after it fell to its lower limit of HK$7.85 during New York trading hours.

The Hong Kong dollar is pegged to a tight band of between 7.75 and 7.85 versus the greenback. It has been softening as US interest rates rise, while a surfeit of cash in the local banking system keeps Hong Kong rates pinned down.

One-month US dollar Libor, a benchmark lending rate, is around 0.8% – its highest since April 2020 – while the Hong Kong equivalent, one-month Hibor, is under 0.2% and barely above its pandemic lows.

HKMA chief executive Eddie Yue said last week that as it intervenes amid Hong Kong’s capital outflows, local rates should rise, removing the incentive for market players to conduct “carry trades”, and hence keep the Hong Kong dollar trading within its band.

“All these are normal operations in accordance with the design of the Linked Exchange Rate System,” he said.

This arrangement was created in 1983 and has survived many crises over the years, including an attack from famed short-seller George Soros during the 1997-98 Asian financial crisis.

The HKMA last intervened in October 2020. That year it sold HK$383.5 billion worth to rein in the strengthening currency, according to HKMA data, while it last intervened at the weak end of the band in March 2019.

- Reuters, with additional editing by George Russell

READ MORE:

US-Listed Property Platform KE Makes Hong Kong Debut

John Lee Confirmed as Next Hong Kong Leader – SCMP

Hong Kong to Cut Growth Forecast, Finance Official Warns