(ATF) HSBC plans to plough $6 billion into its operations across Asia and focus on targeting wealth management in the region where it makes most of its profit.

Europe’s biggest bank reported a 30% plunge in profit for 2020 – $6.1 billion after tax, a result that stemmed mainly from the impact of the coronavirus. It said it suffered higher-than-expected credit losses and other bad debts.

HSBC wants to speed up its shift to Asia despite tensions between China and the West. It sees the region as becoming increasingly affluent.

“We plan to focus on and invest in the areas in which we are strongest,” CEO Noel Quinn said in a statement.

The bank made noted markets in Southeast Asia such as Singapore, as well as China and Hong Kong.

The global economic slowdown caused by the Covid-19 pandemic hit large banks and financial giants hard. But HSBC was caught in the midst of soaring geopolitical tension because it is a major business link between China and the West.

With HSBC making 90% of its profit in Asia, and China and Hong Kong being major drivers of that business, it was more vulnerable than most to the breakdown in ties between China, the Trump Administration and other western powers. That tension was most notable after Beijing imposed its national security law in Hong Kong last July after months of protest by pro-democracy activists.

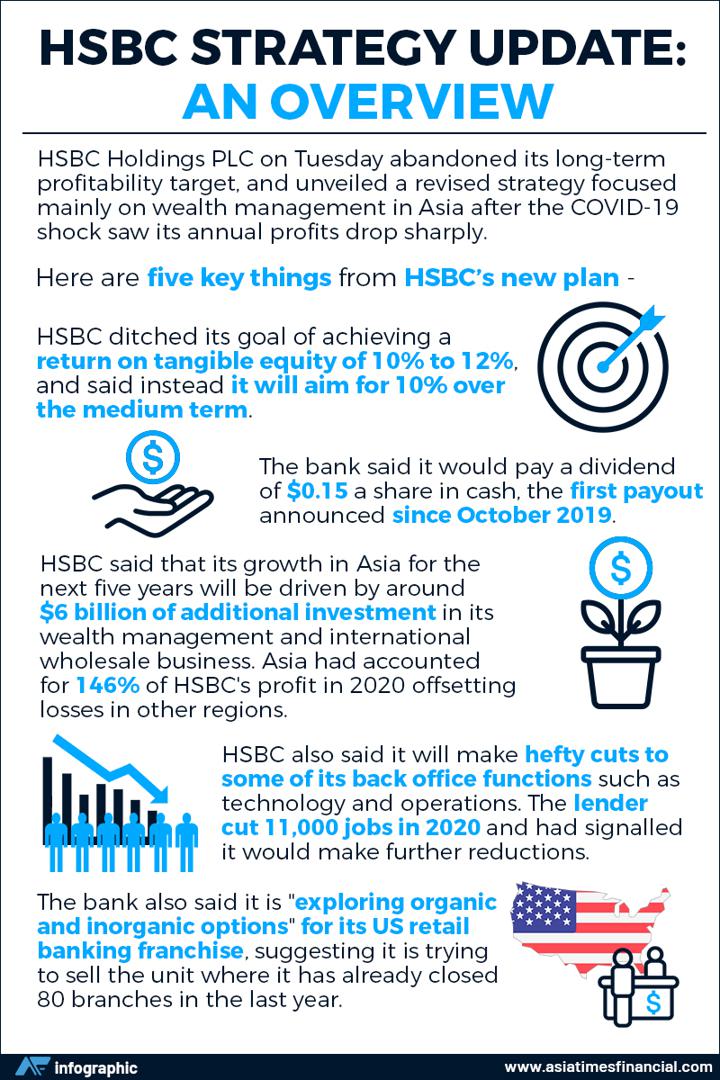

The bank has abandoned its long-term profit target – of a 10-12% return on equity – and says it will aim for 10% over the medium term. That is partly a result of quantitative easing and the low interest rates that created around the world.

“The big structural shift that’s gone on since we set out the plan last February has really been the shift in interest rates down toward zero in most markets that we do business in,” Ewen Stevenson, HSBC’s group chief financial officer, told Reuters.

“If interest rates were 100 basis points higher today across the board it would improve our returns by 3 percentage points.”

The bank said it would pay a dividend of $0.15 a share in cash, the first payout announced since October 2019, after the Bank of England blocked all big lenders from paying dividends or buying back shares in 2020 to conserve capital.

DIVIDEND CHANGE, JOB CUTS

However, it said it would stop the previous practice of paying a quarterly dividend, and target a payout ratio of between 40% and 55% of reported earnings per ordinary share from 2022 onwards, well below the level in recent years.

HSBC also said it will make hefty cuts to some of its back office functions such as technology and operations, without specifying the number of jobs affected. The lender cut 11,000 jobs in 2020 and had signalled it would make further reductions.

Investors were resigned to HSBC’s more modest ambitions and growth target.

“Everyone realises how big an economic opportunity China and India are but HSBC is starting to realise no-one has the opportunity to serve that wealth creation like they do,” said Dan Lane, a senior analyst at UK digital broker Freetrade.

“The prospect doesn’t come cheap but it looks like the company is finally ready to pump cash into getting even more East Asian customers on board.”

Profit from the bank’s wealth management and personal banking division in Asia was $5 billion in 2020, but its cash cow Hong Kong accounted for almost all of this.

Elsewhere in the world, HSBC said it is in talks with a potential buyer for its troubled France retail banking unit, which it has been trying to dispose for over a year, but no deal has been confirmed.

It said it expected to make a loss on the sale given the business’ underlying performance.

The bank also said it is “exploring organic and inorganic options” for its US retail banking franchise, suggesting it is trying to sell the unit where it has already closed 80 branches in the last year.

Reuters, and others, have reported the bank is trying withdraw from US retail banking.

HSBC’s Mexico operations made a loss of $187 million in 2020, as many of its branches remained closed due to the pandemic, but chief executive Noel Quinn said he is confident about the prospects for a business the bank has in the past considered selling.

“We’re confident that (HSBC’s Mexico business) will be successful again post-Covid, and it is a business at scale,” Quinn said.

With reporting by Reuters, AFP