India’s government is in no rush to stop rising inflation due to concerns that hiking interest rates will hurt economic growth.

India’s inflation is now around 7%, its highest in eight years and 3% above the central bank’s 4% medium-term target.

“We are in no hurry to get inflation to 4%. Growth and inflation have to be balanced,” a source with direct knowledge of the matter said.

“New Delhi would be comfortable with inflation coming below 6% in the next three to six months,” the source added. “Our inflation is under control especially after a series of measures from the government and the RBI (Reserve Bank of India).”

Also on AF: India Likely Selling Refined Russian Oil to West, Study Says

US Fed Hike Expected

Many other big central banks also worried about inflation have been raising rates aggressively, with the US Fed widely expected to raise rates by at least 75 basis points on Wednesday.

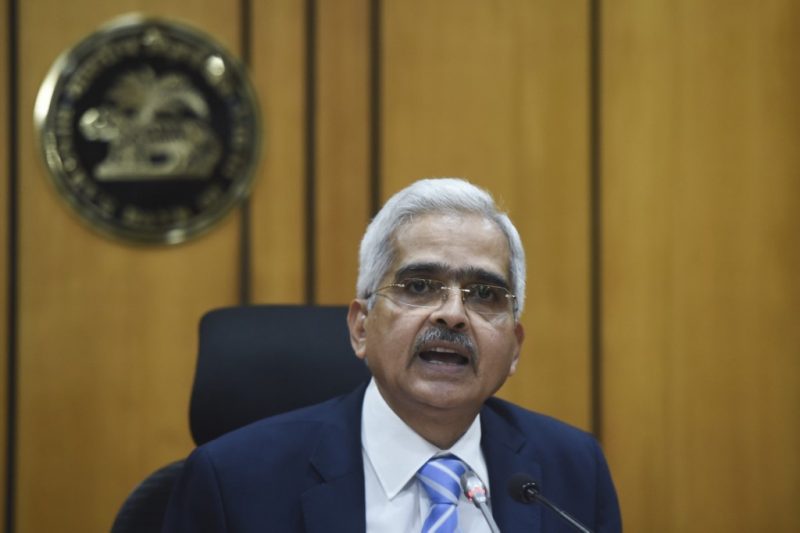

The RBI’s inflation-targeting Monetary Policy Committee (MPC), established in 2016, is mandated to keep inflation within a band extending 2 percentage points either side of its 4% target.

Inflation data for September, due on October 12, is nearly certain to keep India’s consumer price growth above 6% for a third quarter in a row, legally triggering the central bank to share its counter-inflationary plans.

‘Shocker’ in April

For four years the RBI’s monetary policy maintained an accommodative stance with a growth bias, but it changed course in May, just before the release of April’s “shocker” retail inflation reading of 7.8%, which was the highest in eight years, driven by a surge in food prices.

The government has taken a number of other measures to counter inflation, imposing curbs on rice exports last week after previously restricting exports of wheat and sugar, to cool local prices, while reducing taxes on gasoline and diesel in May.

With economic growth flagging, however, authorities have become worried about steps that would undermine domestic demand.

India’s April-June economic growth of 13.5% was lower than the RBI’s forecast of 16.2% for the period, threatening the overall growth projection of 7.5% for the full year.

- Reuters, with additional editing from Alfie Habershon

Read more:

India Calls for Online Gaming Crackdown Over Gambling Fears

Indian Yoga Guru’s Local Companies Set for Listings