As the US dollar tumbles from multi-decade highs, some investors are betting emerging market currencies will be big winners from a sustained reversal in the greenback.

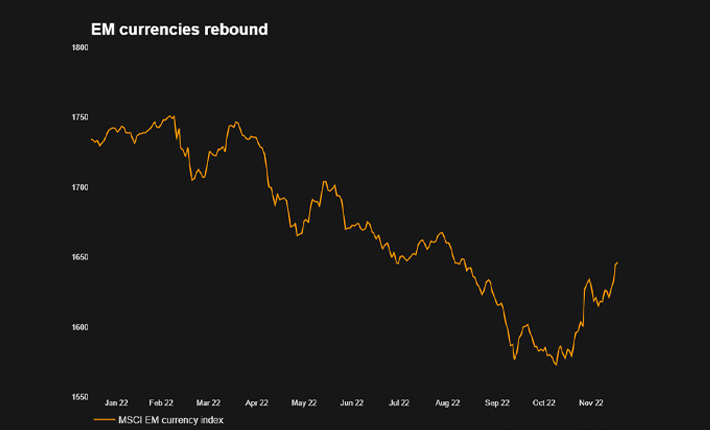

The MSCI International Emerging Market Currency Index is up nearly 5% from its lows and notched its best monthly gain in about seven years in November. The gains followed expectations that the US Federal Reserve will slow the pace of its interest rate hikes.

Investors are also hopeful of a shift in China’s Covid policy. The world’s second-largest economy and a key consumer of the commodities produced by many emerging market countries is set to announce a further easing of its Covid curbs as early as Wednesday.

Also on AF: China 2023 Earnings Forecasts Lifted by Reopening Boost Hopes

The Chinese yuan is up about 5% against the dollar since late October and posted its best weekly performance against the US currency in at least two decades on Friday.

“I think the cat is out of the bag. They can’t go back to their pure restrictive zero COVID policy,” said Jack McIntyre, a portfolio manager at Brandywine Global.

McIntyre has been increasing exposure to some Asian currencies, including the Thai baht and the Malaysian ringgit. Thailand’s currency rose 8% in November, while the ringgit has appreciated 6%.

Signs of a dollar bear run

Emerging market currencies have outperformed their developed market counterparts this year, with MSCI’s index of emerging market currencies down 5% year-to-date. The dollar’s G10 peers have lost nearly twice as much.

Analysts say signs of a broader turn in dollar sentiment are visible in the buck’s 8% decline against a basket of developed market currencies from its September highs.

In futures markets in November, speculative traders swung to a net short position on the US dollar for the first time in 16 months.

“The planets are lining up for a dollar bear market,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US.

Upadhyaya is focusing on the currencies of high-yielding emerging market countries that have balanced current accounts and smaller budget deficits, including the Indian rupee.

Meanwhile, some investors think it may be too early to bet on a sustained dollar reversal. Signs of stubborn inflation in next week’s US consumer price data could reignite bets on Fed hawkishness and boost the dollar.

Tightening by central banks around the world also risks sparking a global recession, a scenario some believe could hurt emerging market currencies and help the dollar.

- Reuters, with additional editing by Vishakha Saxena

Read more:

Yuan-Rouble Dealings Skyrocket as Russia Embraces the Redback

India’s HDFC Raises $1.85 Billion in Largest-Ever Bank Bond Issue