Latest News: Bonds

Investors should favour stocks in the MSCI China and MSCI Hong Kong indices over global benchmarks, BCA Research analysts said

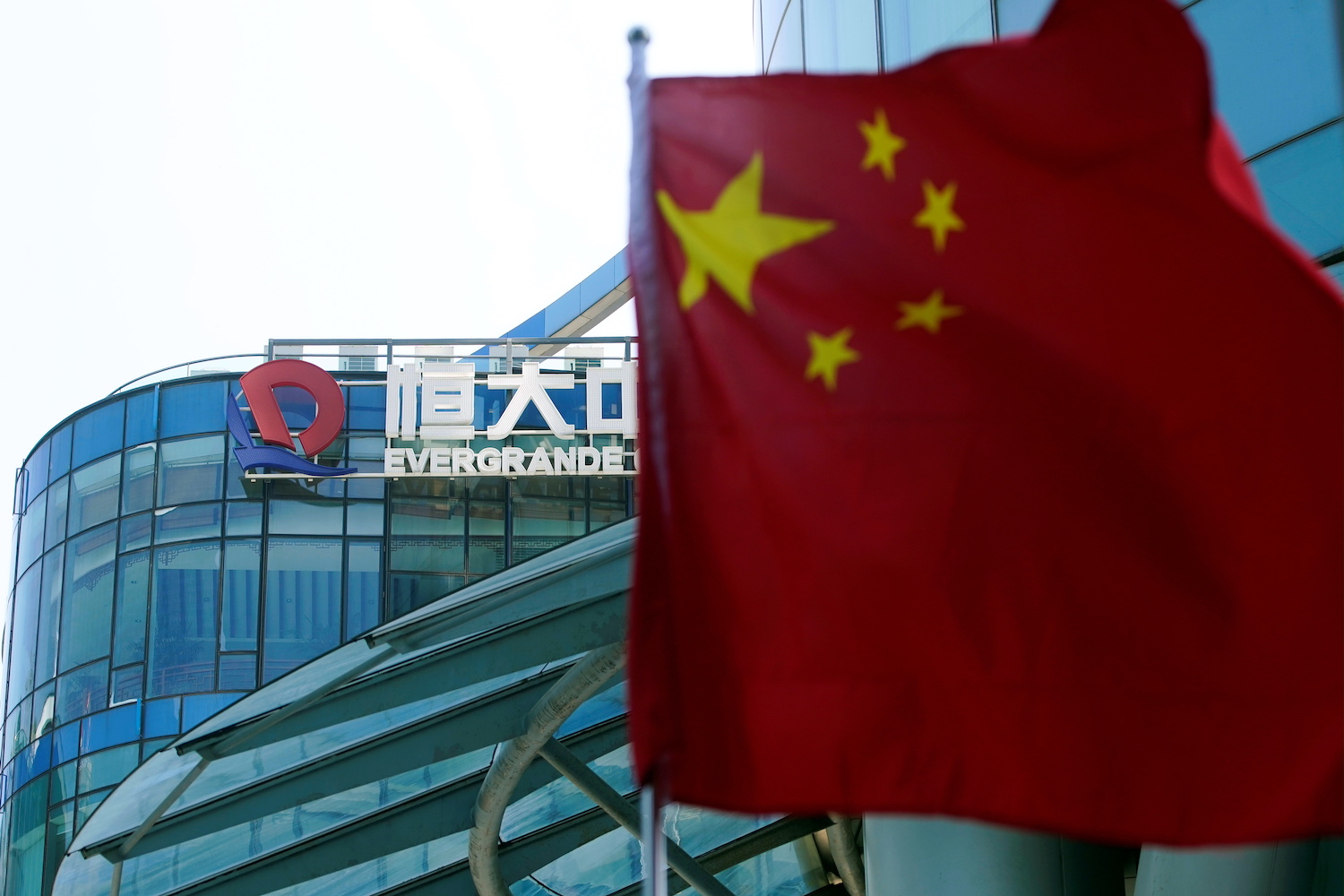

Ad hoc group says it has seen no substantive response from developer with offshore creditors to formulate viable restructuring plan

'Profound' green policies have been adopted around the world for net-zero transitions, while recent reforms to China’s financial markets have begun to shift global markets towards Asia

Benchmark 10-year yield falls as much as 5 basis points to a low of 2.71% in early trade on Wednesday, its lowest since June 2020

Developers' shares rose on Tuesday after news of Shanghai Pudong Development Bank's plan to raise $790 million via three-year bonds through China's interbank market for project buy-ups

Conglomerate says it bought back $5 million worth of its July 2022 notes and $5 million of its April 2026 notes from the open market

Market analysts said the size of the rate cut and the timing were a big surprise, and they believe further monetary stimulus could follow.

China Evergrande reached a deal with bondholders to delay redemption and coupon payments for a 4.5 billion yuan ($707.52 million) bond

Bond markets in Asia are likely to stay resilient even as the US Federal Reserve begins to unwind stimulus and hike interest rates this year, economists said

The issue consists of one tranche, and price guidance to investors has been set at Treasuries plus 210 basis points, the term sheet said

Outstanding overseas institutional holdings of interbank bonds rose to a total of 4 trillion yuan ($628 billion) at the end of last year

A slide in bond prices has pushed the 10-year Treasury yield to 1.769%, its highest since early 2020

AF China Bond

- Popular