Foreign investors raised their holdings of Chinese government bonds (CGBs) in November at the fastest pace in 10 months.

Official depository data revealed on Thursday showed the move was supported by passive flows after a major index began including the instruments.

Total foreign holdings of CGBs stood at 2.39 trillion yuan ($376.58 billion) at the end of November, data from China Central Depository and Clearing Co showed. That was a record high and up 3.8% from a month earlier – the quickest monthly percentage increase since January.

November marked the first full month of the phased inclusion of CGBs in FTSE Russell’s World Government Bond Index (WGBI). Inclusion is expected to eventually drive $130 billion of index-related foreign inflows into the bonds over a 36-month period.

Also on AF: China ‘Volcker Moment’ Still On, Worst Yet to Come: Nomura

Offshore investors’ holdings of quasi-sovereign bonds issued by China’s policy banks, typically among the most liquid in China’s interbank bond market but which are not included in WGBI, slipped 0.15% to 1.07 trillion yuan. It was the first such dip in holdings since April 2020.

While analysts say they expect passive flows to continue, investor sentiment has been hit in recent months by a debt and liquidity crisis rocking China’s $5 trillion property sector that has raised concern about wider financial contagion.

Rating agency Fitch on Thursday declared Evergrande and smaller rival Kaisa Group in default after they missed bond payments this week. Kaisa has also begun work on an offshore debt restructuring.

After touching record highs in early November, Chinese corporates’ high-yield dollar bond spreads have narrowed recently as investors look to a managed debt restructuring of embattled developer China Evergrande Group.

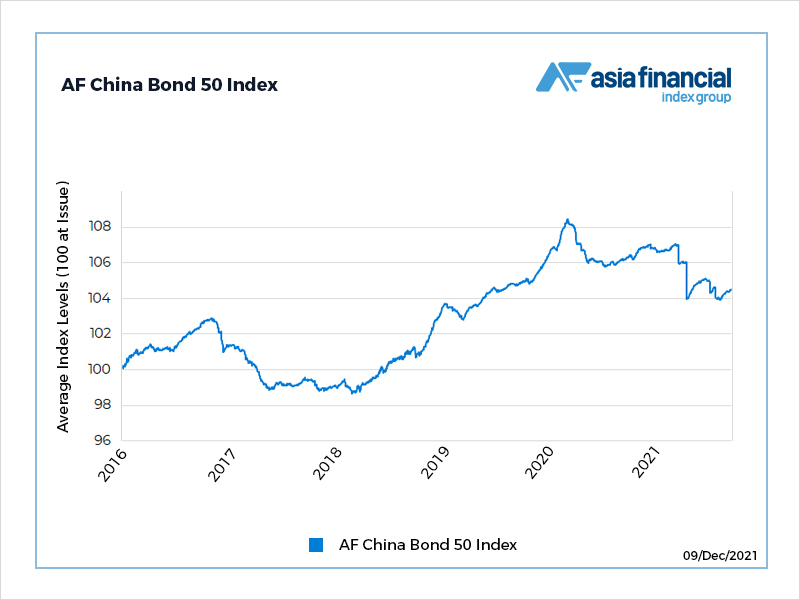

That trend is also shown in the AF China Bond 50 Index, above, which has edged up recently after earlier falls triggered by anxiety over property market turbulence.

- Reuters with additional editing by Sean O’Meara

Read more:

Eastspring Survey Shows Bullish Appetite for China Bonds