Latest News: Forex

Banking sources say the net payments system is designed for large corporations and works directly with 11 Chinese provinces

Beijing says the ramping of US tariffs is becoming a joke; meanwhile it is canvassing trading partners on how to deal with its trade crisis

Trump announces a 3-month pause on tariffs he imposed on dozens of countries last week. All now face a 10% base tariff, bar China, where exporters face a 125% tariff

The yuan sank to its weakest level in more than 17 years on Wednesday with US-China trade tipped to be halved by new US tariffs, while US Treasuries were also subject to intense selling

Analysts said both sides seem "unwilling to back down" and they fear "the worst may be yet to come." In that event, China may move to boost domestic consumption, and start war games

State media outlet says "countermeasures" will likely include tariffs and non-tariff measures, with US agricultural and food products "most likely be listed"

World stocks were on track for their worst week since mid-December, slumping more than 2% as threats of sweeping US tariffs unnerved investors

"The likelihood of achieving the BOJ's outlook has been rising," the central bank said, as many firms say they will continue to raise wages steadily in this year's annual wage negotiations

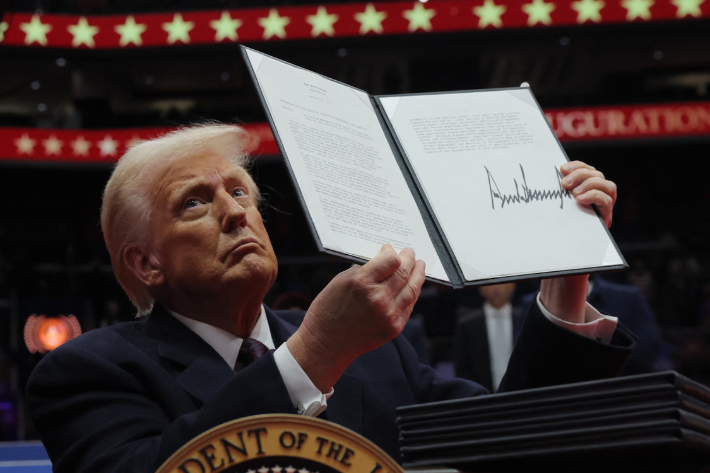

Before we head into Donald Trump’s first full day in office on Tuesday, here’s a look at what his first day back as president meant for technology, climate and markets

Currency traders and stock markets have been rocked by Trump's return to the White House, which has brought joy and disappointment. Investors are still trying to envision how things will play out

The likely disruption to Russian supply drove oil prices to their highest in months on Monday. Much will depend on whether Trump lifts the embargo and if China acknowledges it

Nearly $160 billion poured into money market funds in the week to January 8, according to LSEG Lipper data

AF China Bond

- Popular