Asia’s stock markets saw a muted end to the week with many investors staying on the sidelines ahead of the release of key US inflation data.

Many major indexes were also closed for the Easter holiday weekend bringing some calm to what has been a turbulent week for currencies and equities across the region.

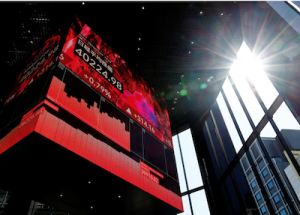

The Japanese yen was flat for the first time in many sessions and the Nikkei share average ended higher, driven by chip-related heavyweights, posting a record fiscal-year gain in terms of points amid heavy foreign buying.

Also on AF: FTX Crypto Fraudster Bankman-Fried Jailed For 25 Years

The yen fell to a 34-year low against the dollar this week, prompting local authorities to hold an emergency meeting, a sign Tokyo is moving closer to intervening in the market.The Japanese yen was last flat at 151.40 per dollar.

The Nikkei index hit successive record highs this month, after breaking levels on February 22 last seen in 1989 during the country’s bubble economy.

The rally was supported by foreign buying on a weaker yen and expectation that the Bank of Japan will stick with loose monetary policy.

On Friday, the Nikkei ended up 0.50% at 40,369.44, recouping some of the previous session’s losses.The broader Topix was ahead 0.65%, or 17.81 points, to 2,768.62.

China stocks rose as well as optimism over state-backed buying offset lingering worries about the property sector. The Hong Kong market was closed for a public holiday.

Sentiment was boosted by a mutual fund disclosure showing state investor Central Huijin has been buying stakes in bluechip funds to bolster the market.

But property shares fell after a string of Chinese property developers, including Vanke, reported weaker financial results for 2023.

The blue-chip CSI300 index was up 0.47%, with its financial sector sub-index higher by 0.03%, the consumer staples sector up 0.28% and the real estate index down 1.99%.

Oil Prices Elevated

The Shanghai Composite Index rose 1.01%, or 30.50 points, to 3,041.17, while the Shenzhen Composite Index on China’s second exchange gained 0.87%, or 15.00 points, to 1,747.61.

Around the region, MSCI’s Asia ex-Japan stock index was firmer by 0.23%. Markets were also shut in India, Indonesia, the Philippines, Singapore, and the United States.

Wall Street’s main stock indexes finished the previous session with minimal changes as markets broadly were largely rangebound ahead of Friday’s much-anticipated US personal consumption expenditures (PCE) price index data, a closely watched inflation measure.

Few markets will be open to assess and respond to the fresh data, however, given the long Easter weekend in many countries.

Oil prices stayed elevated this week, which analysts fear could slow disinflation in Asia and become a sore point for central banks.

Crude oil prices have averaged $85.4 a barrel this month, up from $77.70 a barrel at the end of 2023, spurred by the OPEC+ decision to extend production cuts.

The Philippines, South Korea and Thailand are set to announce inflation data next week, which could decide the stances of their central banks.

Market focus will also be on the Reserve Bank of India’s policy decision and China’s PMI data.

Key figures

Tokyo – Nikkei 225 > UP 0.50% at 40,369.44 (close)

Hong Kong – Hang Seng Index <> CLOSED

Shanghai – Composite > UP 1.01% at 3,041.17 (close)

London – FTSE 100 <> CLOSED

New York – Dow > UP 0.12% at 39,807.37 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Investors Suspect Beijing Behind Controlled Yuan Decline

China Keen For Tech Innovation to Drive Economic Growth

Shimao Bondholders Group to Vote Against Debt Revamp Plan

Yen Fears Drag on Nikkei, Hang Seng Lifted by Policy Bets