Asian stocks rebounded on Tuesday with investor mood lifted by strong earnings reports despite increasing tensions in the Middle East.

Traders preferred to focus on the resilience of the US economy and sideline worries about the deteriorating situation in Gaza following the weekend’s horror attacks.

Japan’s Nikkei share average took its cues from Wall Street as optimism about upcoming earnings overtook concerns about Israel-Palestine.

Also on AF: Asia Central Banks’ $30bn Forex Fight to Fend Off Dollar

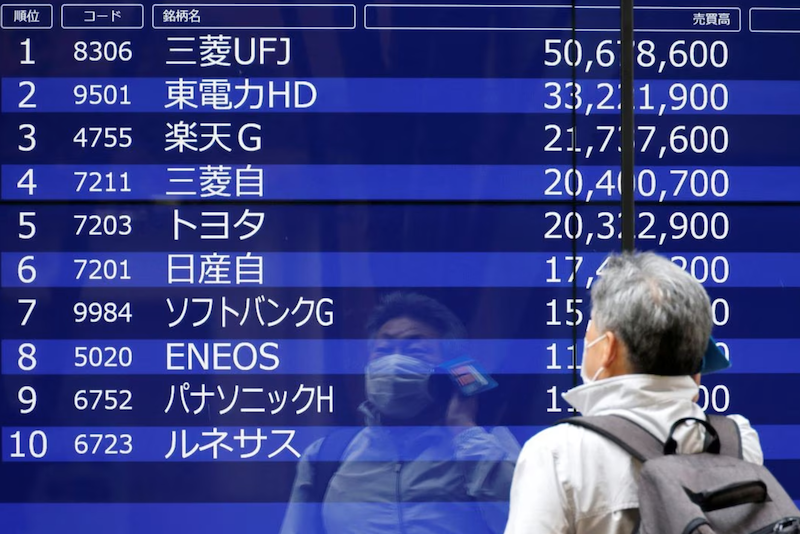

The Nikkei gained was up 1.20%, or 381.26 points, to close at 32,040.29, recouping more than half of Monday’s 2% tumble. Of the benchmark’s 225 components, 172 rose versus 49 that fell, while two were flat. The broader Topix advanced 0.82%.

Japanese tech stocks, which had been sold off aggressively at the start of the week, rebounded strongly. Japanese chip industry giant Tokyo Electron was a standout winner, jumping 2.4%.

Chinese stocks climbed, after dozens of Chinese companies announced plans to buy back shares to boost investor confidence, while the rebound in global shares helped sentiment too.

The blue-chip CSI 300 Index was up 0.35% and the Shanghai Composite Index added 0.32%, or 9.68 points, to 3,083.50. The Shenzhen Composite Index on China’s second exchange edged down 0.01%, or 0.12 points, to 1,884.20.

China’s third-quarter gross domestic product (GDP) data, due on Wednesday, is expected to show growth slowing as demand at home and abroad faltered, according to a Reuters poll.

China’s property sector, meanwhile, edged toward deeper trouble with Tuesday marking the end of a 30-day grace period on a late payment from developer Country Garden.

If investors don’t receive the coupon payment, all of Country Garden’s offshore debts will be deemed in default.

Fed Tone Shift

Stocks in real estate and healthcare lost more than 1% both though tech giants listed in Hong Kong added 0.7%. The Hang Seng Index gained 0.75%, or 132.98 points, to 17,773.34.

Elsewhere across the region, in earlier trade, most of Asia took up the baton with Sydney, Seoul, Mumbai, Singapore, Taipei and Manila all positive. MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.58%.

Overnight the S&P 500 had climbed 1%, while oil prices and the US dollar had fallen.

A host of “favourable” signs from the strength of the US consumer, economic growth, and interest rates supporting bank profits, gave reasons for hope, said Kerry Craig, a global market strategist at JPMorgan Asset Management.

And a recent shift in tone from Federal Reserve officials, hinting that interest rate hikes might be over, has also cheered investors and bond markets lately.

Quarterly results from Goldman Sachs and Bank of America are due on Tuesday, with Morgan Stanley, pharmaceutical giant Johnson & Johnson, Tesla and Netflix due later in the week.

Benchmark 10-year Treasury yields are about 15 basis points off 16-year highs, though they crept higher in Asia trade to 4.7542%.

Biden in Israel

US President Joe Biden will visit Israel on Wednesday as the country prepares to escalate an offensive against Hamas militants that has set off a humanitarian crisis in Gaza and raised fears of a broader conflict with Iran.

Iran’s Foreign Minister said Israel would not be allowed to act in Gaza without consequences, warning of “preemptive action” by the “resistance front” in the coming hours.

In other developements, Russian President Vladimir Putin on Tuesday arrived in Beijing to meet with Chinese President Xi Jinping even as the war in Ukraine raged on.

The widely watched trip is aimed at showcasing the trust and “no-limits” partnership between the two countries, as Beijing is moving to strengthen ties with counties for its infrastructure-focused Belt and Road initiative.

In currency markets the Australian dollar ticked up a little to $0.6352 as minutes from the most recent central bank meeting struck a surprisingly hawkish tone, while the US dollar steadied elsewhere.

Gold edged away from Friday’s three-week high and was last at $1,914.3 an ounce. Brent crude futures had dropped more than $1 a barrel on Monday on hopes for an agreement that the US will ease sanctions on Venezuelan oil.

Brent futures retrieved earlier losses of 0.25% to stand back at $89.66 a barrel on Tuesday.

Key figures

Tokyo – Nikkei 225 > UP 1.20% at 32,040.29 (close)

Hong Kong – Hang Seng Index > UP 0.75% at 17,773.34 (close)

Shanghai – Composite > UP 0.32% at 3,083.50 (close)

London – FTSE 100 > UP 0.35% at 7,657.66 (0937 BST)

New York – Dow > UP 0.93% at 33,984.54 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Country Garden’s $17bn Offshore Debt on Verge of Default

China Imposing Foreign Travel Limits on Bankers, State Workers

Ex-Bank of China Chairman Arrested Over Bribery, Illegal Loans

Nikkei Slides, Hang Seng Dips as Middle East Worries Weigh