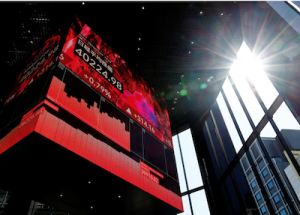

Asian stocks were in retreat on Tuesday after already fading hopes of US rates cuts anytime soon were dashed further, while tensions in the Middle East also weighed heavily on investors’ minds.

Shares across the region sank and the dollar climbed to more than five-month highs as stronger-than-expected US retail sales for March further reinforced expectations that the Federal Reserve is unlikely to be in a rush to cut interest rates this year.

And the threat of all-out conflict between Israel and Iran also kept risk sentiment in check, lifting prices of gold and oil, though there was one piece of positive news after data showed China’s economy grew 5.3% in the first quarter year-on-year, easily beating analysts’ expectations.

Also on AF: China Providing 90% of Chips Used in Russia, Despite Sanctions

Japan’s Nikkei share average fell nearly 2% to close at an eight-week low as technology stocks tracked the overnight declines on Wall Street.

The Nikkei fell 1.94% to 38,471.20, its lowest close since February 21, and the index lost as much as 2.3% during the session. The broader Topix lost 2.04% to 2,697.11.

China stocks fell too, with small-cap companies leading the decline, as March economic indicators showed the recovery is losing momentum, despite stronger-than-expected GDP data.

A raft of March figures released alongside the GDP data, including property investment, retail sales and industrial output, showed that demand at home remains weak.

China’s blue-chip CSI 300 Index fell 1.07%, set to log the biggest daily drop in more than half a month, while the Shanghai Composite Index lost 1.65%, or 50.31 points, to end at 3,007.07. The Shenzhen Composite Index on China’s second exchange slumped 3.77%, or 64.24 points, to 1,638.44.

Shares in property developers lost 2.4% and tourism slumped 3.8%, while new energy and media firms lost 2.1% each.

Tech giants listed in Hong Kong plunged 2.7% and the benchmark Hang Seng Index dropped 2.12%, or 351.49 points, to close at 16,248.97.

Elsewhere across the region, in earlier trade, Seoul, Taipei and Manila were all down more than 2%, while Sydney, Singapore and Jakarta also sank and there were also losses in Wellington and Mumbai.

MSCI’s broadest index of Asia-Pacific shares outside Japan plunged more than 2% to a two-month low of 518.03.

Yen Near 34-Year Low

The sombre mood was set to continue in Europe, with Eurostoxx 50 futures down 1.30%, German DAX futures down 1.15% and FTSE futures down 1.28%.

US stocks closed sharply lower on Monday as a jump in Treasury yields weighed on sentiment amid concerns about rising tensions between Iran and Israel. E-mini futures for the S&P 500 fell 0.14%.

US retail sales rose 0.7% last month, the Commerce Department’s Census Bureau said on Monday, while economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, would rise 0.3%.

The stronger-than-expected data comes after a report last week underscored inflation remains stickier than markets had expected, leading to a drastic scaling back of rate cuts this year.

Traders now anticipate 45 basis points of cuts this year, down from more than 160 bps in expected easing at the start of the year. Markets are now pricing in September, instead of June, to be the starting point for rate cuts, according to the CME FedWatch Tool.

The yield on 10-year Treasury notes was at 4.612% in Asian hours having surged to a five-month high of 4.663% on Monday.

The elevated yields boosted the dollar and kept the yen near 34-year lows it has been rooted at in the past few days.

The dollar index, which measures the US currency versus six rivals, touched a five-and-half-month high of 106.39 earlier in the session and was last at 106.29. The yen weakened to 154.42, leading to fresh worries over intervention and comments from officials. Currencies in emerging markets also slumped.

In commodities, US crude rose 0.64% to $85.96 per barrel and Brent was at $90.65, up 0.61% on the day on rising tensions in the Middle East.

Spot gold added 0.2% to $2,387.05 an ounce.

Key figures

Tokyo – Nikkei 225 < DOWN 1.94% at 38,471.20 (close)

Hong Kong – Hang Seng Index < DOWN 2.12% at 16,248.97 (close)

Shanghai – Composite < DOWN 1.65% at 3,007.07 (close)

London – FTSE 100 < DOWN 1.59% at 7,839.10 (0934 BST)

New York – Dow < DOWN 0.65% at 37,735.11 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Proposes New Trading, Listing Rules to Revive Market

China Orders Telecoms to End Use of US Chips by 2027 – WSJ

Nikkei, Hang Seng Dip on Israel-Iran Fears, China Stocks Gain

Floods, Droughts, Earthquake, Big Freeze Cost China $3.3bn