Asia’s major stock indexes rallied on Thursday, hitting two-month highs, buoyed by interest rates news out of the US and China.

Shares across the region were boosted as the dollar notched new peaks against the yen and the yuan as the Federal Reserve paused its rate hikes while flagging more, drawing attention to the contrast with more dovish policy outlooks in Asia.

That cast Asia’s biggest economies in stark relief, with China cutting another key policy rate amid fresh signs its economy is stumbling.

Also on AF: India Set to Overhaul China as Biggest Driver of Oil Demand

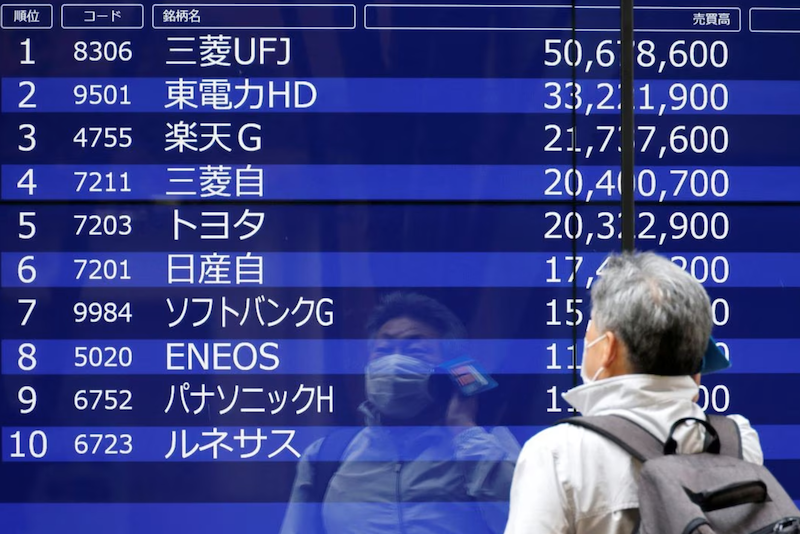

Bucking the trend was Japan where the Nikkei share average gave back its gains to inch lower as investors locked in their profits after the index’s sharp gains in a four-session winning run.

The Nikkei index ended 0.05% lower at 33,485.49. It, however, traded higher for most of the day, including rising as much as 0.8% to a fresh 33-year high, before reversing course to snap the four-day rally in which it had gained 6%.

The broader Topic inched 0.2% lower to 2,293.97 on the day.

The yen slipped to its weakest level so far this year, as the US dollar rallied after the Federal Reserve signalled rate hikes later in the year.

In China, industrial output and retail sales figures fell short of market forecasts and property investment and home sales tumbled at a sharper pace, in the latest sign the country’s post-pandemic economic recovery is losing steam.

China cut a key benchmark, its medium-term loan rates, by 10 bps – two days after trimming short-term rates – and the yuan hit a six-month low in anticipation that more support is on the way, before steadying.

“Expectations are building that additional stimulus will come from Beijing and this could be the much needed catalyst for the Chinese market to overcome a disappointing first half,” said Tai Hui, Asia-Pacific chief strategist at JP Morgan Asset Management.

ECB Poised to Take Rates to Two-Decade High

The hope of more stimulus saw Hong Kong’s Hang Seng Index gain 2.17%, or 420.50 points, to 19,828.92.

The Shanghai Composite Index rose 0.74%, or 23.99 points, to 3,252.98, while the Shenzhen Composite Index on China’s second exchange was ahead 1.18%, or 24.15 points, to 2,062.95.

Elsewhere across the region, in earlier trade, Sydney, Singapore and Taipei all rose though there were losses in Seoul, Manila and Jakarta.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6% to a new two-month high.

The European Central Bank, meanwhile, is expected to deliver its eighth straight rate hike later in the day which will take borrowing costs to two-decade highs.

S&P 500 futures were flat. European futures and FTSE futures each fell about 0.2%.

Two-year Treasury yields, which closed two bps higher at the end of the New York session rose another 3.5 bps in Tokyo trade to 4.7416%. Ten-year yields rose 3.1 bps to 3.8291%.

Oil steadied with benchmark Brent crude futures up 0.5% to $73.55 a barrel.

Gold, which pays no income, was pressured by expectations for US interest rates to linger at high levels, and fell to a two-week low of $1,934 an ounce.

Bitcoin dropped 3% overnight and nursed losses just below $25,000.

Key figures

Tokyo – Nikkei 225 < DOWN 0.05% at 33,485.49 (close)

Hong Kong – Hang Seng Index > UP 2.17% at 19,828.92 (close)

Shanghai – Composite > UP 0.74% at 3,252.98 (close)

London – FTSE 100 < DOWN 0.11% at 7,594.51 (0934)

New York – Dow < DOWN 0.68% at 33,979.33 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

PBOC Cuts Lending Rate as China’s Economy Slows in May

China E-Commerce Giants Face Tariff Hit if US Bill Passed

China New Loans Weaker-Than-Expected, Stimulus Forecast