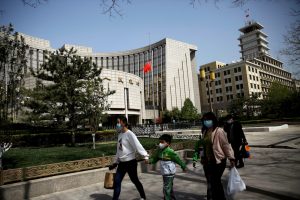

China’s central bank made the biggest weekly cash injection in more than two years this week to maintain stable liquidity conditions towards the end of the month.

The People’s Bank of China (PBOC) injected 300 billion yuan ($47.4 billion) worth of seven-day reverse repos into the banking system on Friday, compared with 10 billion yuan of such loans expiring on the same day.

For the week, the PBOC injected 760 billion yuan on a net basis – the biggest weekly cash offering since January 2020.

China’s yuan hovered at a near four-year high against the dollar on Thursday, underpinned by rising demand for less risky assets as Russian forces began attacking Ukraine.

Safe haven demand surged to benefit the dollar, while the Chinese currency also attracted higher attention from overseas investors.

In contrast to most emerging market currencies, which depreciated against a soaring dollar, traders and analysts said the yuan appeared to be more resilient.

That, they said, was due to rising foreign capital inflows into Chinese assets and heavier corporate conversion of their export receipts into the yuan.

“There has been continued heavy demand (for the yuan), and markets are discussing if the yuan has become the latest safe haven currency,” a trader at a Chinese bank said.

- Reuters, with additional editing by George Russell

READ MORE:

Yuan Holds No. 4 Spot in World Payments Rankings – Xinhua

Yuan Up But Depreciation Pressure Rising, Worry on Asian Currencies

China-US Monetary Policy Split Helps Yuan: Ex-Regulator