Asia’s major share indexes slipped into the red on Monday with investors unnerved by the threat of global interest rates remaining high for longer than was hoped and by China’s continuing economic struggles.

Central banks have reinforced the message that rates are unlikely to drop any time soon, while traders were also braced for the latest inflation data from the US and Europe this week.

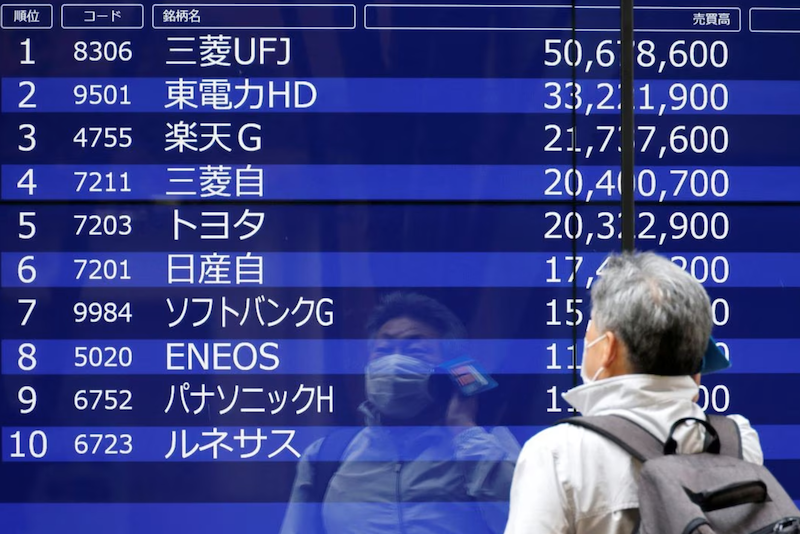

The outlier was Japan’s Nikkei share average which rebounded sharply as investors bought back beaten-down stocks following the index’s worst week of 2023.

Also on AF: Chinese Tourists Get Special Welcome as Visa-Free Visits Begin

The Nikkei share average gained 0.85%, or 276.21 points, to close at 32,678.62, while the broader Topix was ahead 0.39%, or 9.23 points, to 2,385.50.

Last week, the Nikkei declined every day in a holiday-shortened week punctuated by major central bank meetings, including the US Federal Reserve on Wednesday and Bank of Japan on Friday. The Nikkei’s 3.37% tumble was its worst weekly performance this year.

Healthcare was the top performing sector in the latest session, jumping 2.69%, while tech shares also rebounded, tracking gains for US peers from Friday.

But Chinese shares fell, as cautious foreign investors offloaded domestic stocks ahead of a week-long holiday, while a weak regional market also weighed on sentiment.

Before that break, investors will be keeping an eye on consumption data due out, as well as industrial profit figures and manufacturing and services PMIs which will be released later in the week.

In mainland markets, shares in real estate developers and securities brokers lost more than 2% to lead the decline, while tourism slipped 1.2%.

The Shanghai Composite Index dropped 0.54%, or 16.82 points, to 3,115.61, while the Shenzhen Composite Index on China’s second exchange fell 0.47%, or 8.97 points, to 1,904.57.

Bond Investors Smarting

In Hong Kong, tech giants dropped 1.9%, and mainland developers declined 3.3%.

Shares of China Evergrande plunged 25.5% after the embattled developer said it was unable to issue new debt due to an ongoing investigation into one of its subsidiaries, dealing a fresh blow to its restructuring plans.

The Hang Seng Index lost 1.82%, or 328.16 points, to 17,729.29, while the Hang Seng China Enterprises Index dropped 2.11%.

Elsewhere across the region, in earlier trade, Sydney, Seoul, Wellington, Singapore and Jakarta were also lower. Mumbai, Taipei and Manila ticked higher.

MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.5%, edging back to a 10-month low plumbed just last week.

Europe was set for a subdued open, with Eurostoxx 50 futures off 0.3%. S&P 500 futures, however, rose 0.3% while Nasdaq futures gained 0.4%, after Hollywood’s writers union reached a preliminary labour agreement with major studios.

Bond investors were still smarting from the US Federal Reserve’s more hawkish rate projections, which caught markets by surprise.

Coupled with the recent resilience in the US economy, markets now see about a split chance that the Fed would resume hiking in December, while drastically scaling back rate cut expectations to just 65 basis points next year.

Ten-year Treasury yields inched up 3 basis points to 4.4662% on Monday, after retreating from a 16-year high of 4.508% on Friday. Two-year yields were little changed at 5.1162%, having fallen from a 17-year top of 5.2020% hit last week.

Yen Hits 10-Month Low

Much will depend on US data. In a sign of slowing growth, US business activity was basically at a standstill in September, with the vast services sector essentially idling at the slowest pace since February.

The Fed’s favoured inflation gauge, the core Personal Consumption Expenditures Price Index, is expected to show a 3.9% annual increase in August, easing from 4.2%. Other US data in the week includes final Q2 GDP.

Euro zone preliminary inflation figures for September are due on Friday and are expected to ease to 4.5% annually from 5.2% in August. Markets are expecting that the European Central Bank is done hiking.

In the broader currency market, the dollar was on the front foot, extending its gains from last week. The yen last traded at 148.37 per dollar, after touching a fresh 10-month low of 148.49 earlier in the day.

Oil prices resumed their climb, not far from their 10-month highs. Brent crude futures rose 0.6% to $93.79 per barrel. US West Texas Intermediate crude futures were also up 0.5% at $90.44.

Key figures

Tokyo – Nikkei 225 > UP 0.85% at 32,678.62 (close)

Hong Kong – Hang Seng Index < DOWN 1.82% at 17,729.29 (close)

Shanghai – Composite < DOWN 0.54% at 3,115.61 (close)

London – FTSE 100 < DOWN 0.53% at 7,643.04 (0934 BST)

New York – Dow < DOWN 0.31% at 33,963.84 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China’s 1.4bn People Couldn’t Fill Empty Homes: Ex-Official

EU Denies China Decoupling Plan But Admits ‘De-Risk’ Aim

Hang Seng Boosted by Stimulus Pledges, Nikkei Dips on BoJ Vow