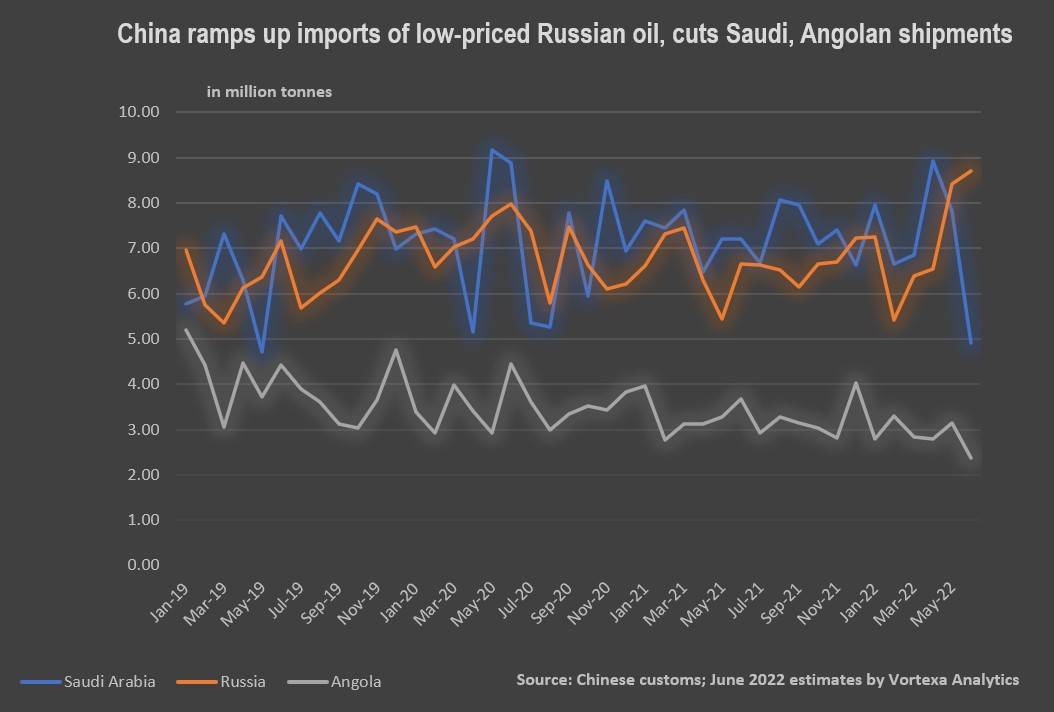

Record imports of cheap Russian crude oil continued to flow into China in June, according to industry monitors, who said supplies from Africa and the Middle East were being squeezed out partly because Covid lockdowns had reduced the demand for fuel.

Imports of Russian oil were likely to total about 2 million barrels per day (bpd), from both shipments and pipeline supplies, making Moscow China’s top supplier ahead of Saudi Arabia, analysts said.

Russian oil meets about 15% of China’s demand and helps its refiners keep costs down at a time when their margins are crimped by slowing demand from strict Covid-19 controls and Beijing’s restrictions on fuel exports amid supply concerns.

Imports in June were similar to the record volume in May, tanker trackers Vortexa, Kpler and Refinitiv said.

Meanwhile, overall Saudi oil imports in June are forecast to slump to a near two-year low of 1.3 million bpd, Refinitiv estimated.

ALSO SEE: China, India Positive on G7 Plan to Cap Russian Oil Price

Pipeline Deals

Seaborne Russian shipments were estimated at between 1.04 and 1.15 million bpd last month, steady versus May’s near-record high at around 1.1 million bpd, according to the analytics firms.

Separately, China is set to receive approximately 880,000 bpd of Russian oil via the two East Siberia-Pacific Ocean Pipelines (ESPO) and the Kazakhstan-China pipeline under government deals, with all the three projects pumping at maximum rates, said two traders with knowledge of the matter.

Alongside India, the world’s third-largest crude importer, the Asian economic powerhouses have since May ramped up Russian oil imports after western companies backed off dealing with Moscow for fear of falling foul of sanctions over Russia’s invasion of Ukraine or drawing negative publicity.

Combined, the two countries bought an additional 1 million bpd of Russian oil in May versus April, according to Chinese customs and Indian trade sources. That is equivalent to a fifth of Russia’s total exports, providing Moscow a buffer from western sanctions while bolstering refining profits at home.

Sinopec Top Lifter

In China, state refiner Sinopec Corp remains the top buyer of ESPO blend crude, Russia’s flagship export grade from Far Eastern port Kozmino, lifting 12 shipments or a third of Russia’s seaborne ESPO sales in June, Vortexa’s analyst Emma Li said.

In May, Sinopec scooped 15 shipments, tripling the state major’s volume before the war, according to Li and two traders.

“In terms of profitability, Unipec far excels and leads among Chinese players by sitting at the top of the food chain – dealing with top Russian suppliers at the steepest possible discounts,” said a trader, referring to Sinopec’s trading arm.

Sinopec’s purchases, totalling some 20 million barrels over May and June, were sent to its refineries. Some of the cargoes had been bought at a record discount of $20 a barrel below benchmark Dubai crude on an FOB Kozmino basis, traders said.

That’s a boon for Sinopec refineries as Chinese fuel demand began to recover from late May after months of Covid-induced lockdowns, traders said. Sinopec declined to comment.

Chinese customs is expected to release June crude oil import data next week, which analysts said could post an 8% slide from a year earlier, reflecting the impact of Covid curbs on business activity and consumption in dozens of China’s cities. Customs will release import origin data on July 20.

Cuts in Saudi, Angolan oil

Chinese refiners are also expected to keep steady inflows of Urals, traditionally destined for European refineries, at around 250,000 bpd for June, according to Vortexa and Kpler.

Lured by record discounts as steep as $40 below Brent crude FOB Baltic ports, Indian refiners and China’s teapot plants have stepped up buying Urals.

China has been able to cut back on supplies from Saudi Arabia and Iraq – likely to fall 40% and 30% month-on-month, respectively – as well as Angola, which could drop a quarter from May, according to assessments by Vortexa and Refinitiv.

However, some traders estimated Chinese appetite for Russian oil could be curbed in the coming months by rising freight costs and as India draws more shipments in a growing rivalry with China. Saudi contract volumes could also return to pre-pandemic levels later in the year.

- Reuters with additional editing by Jim Pollard

ALSO ON AF:

China’s Help a Key Reason Sanctions on Russia Are Working

Russian Oil Sold to Fuel-Starved Sri Lanka – Nikkei Asia

Russian Oil Lands on US Shores via Indian Refiners – WSJ