(ATF) China bond investors sat on the sidelines Thursday as growing inflation expectations continued to dim the appeal of fixed-income assets worldwide.

Bonds of local governments plummeted the most in almost two months. The decline followed reports that officials in Sri Lanka and Pakistan had attacked the terms of their loans from China in an extension of the “debt-trap diplomacy” row that has plagued Beijing’s belt and road initiative (BRI).

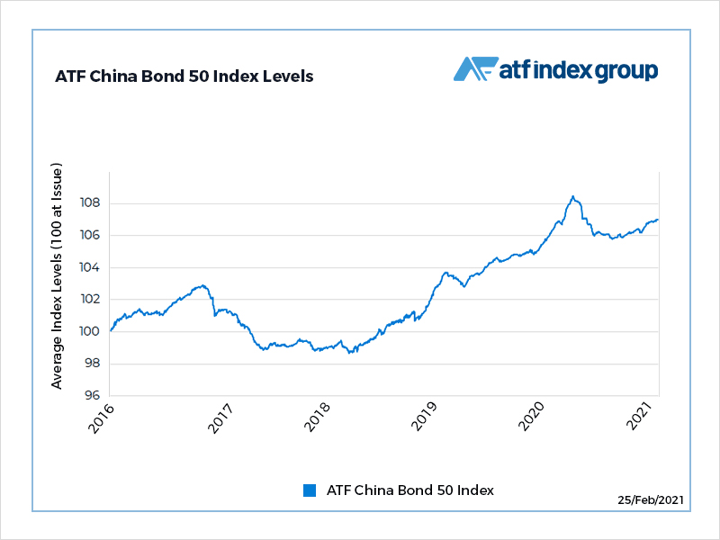

The benchmark ATF China Bond 50 Index was little changed at 107.02. It’s limped for the past week amid a global sovereign bond selloff that’s seen US Treasuries reach their highest levels in a year. That’s come as analysts have forecast a rise in inflation as surge of pent-up economic activity is unleashed once pandemic lockdowns are lifted.

Also on ATF

- Biden sends warning to China on chips and rare earths

- Hong Kong-US WTO dispute sparks friction amid hurt civic pride

- Australia enacts landmark law to make tech firms pay for news

Bonds usually fall at times of rising inflation because the rising cost of living erodes the value of the fixed payments on the debt. At the same time, increasing yields stoke the appeal of riskier assets such as equities.

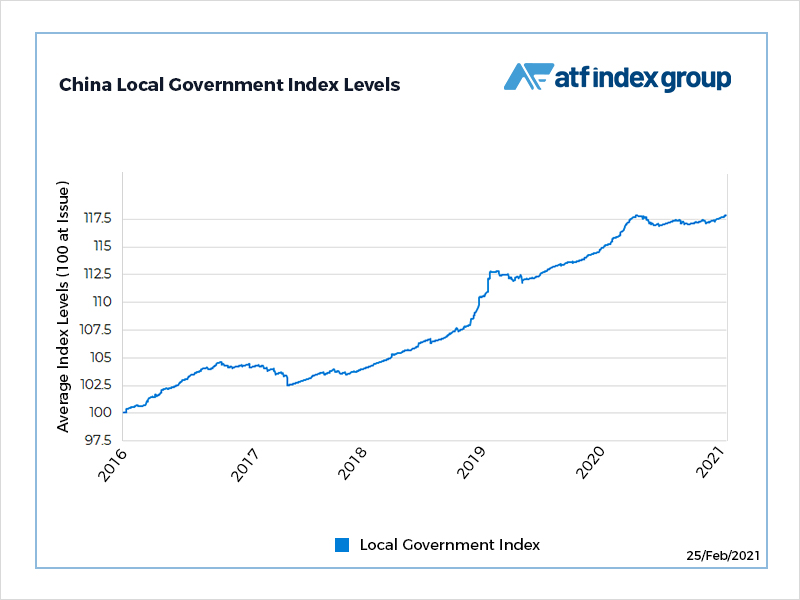

The Local Government sub-index slid 0.09%, the most since January 1. Local government issuers are among the biggest financiers of RBI projects, which have come under increasing scrutiny after a number of debtors complained of unmanageable terms.

Sri Lanka’s foreign minister reportedly described as a “mistake” the island nation’s consideration of extending China’s 99-year lease on the Hambantota port to 198 years. The deal, struck to provide port facilities at the southern town, has been criticised as a way of allowing the Chinese navy to set up an Indian Ocean base.

In other reports, Pakistani officials have asked China to slow RBI project on the South Asian country, which is already struggling to honour $22 billion of Beijing-extended debt.