The Indian rupee held its gains against the dollar as the central bank raised its key lending rate by 50 basis points on Friday.

The Reserve Bank of India raised the key repo rate to 5.90% in an effort to fight rising inflation, which was above its target zone for the eighth consecutive month in August.

The rupee traded at 81.54 per dollar at 0820 GMT, having closed at an almost record low of 81.86 on Thursday.

This was the fourth straight increase, as policymakers extended their battle to tame stubbornly high inflation and analysts said further tightening is on the cards.

The RBI has now raised rates by a total 190 basis points since its first unscheduled mid-meeting hike in May but inflation continues to remain high – as in many other countries.

Also on AF: China’s PBOC Backs Mortgage Rate Cuts to Lift Property Sector

Financial Markets Nervous: Das

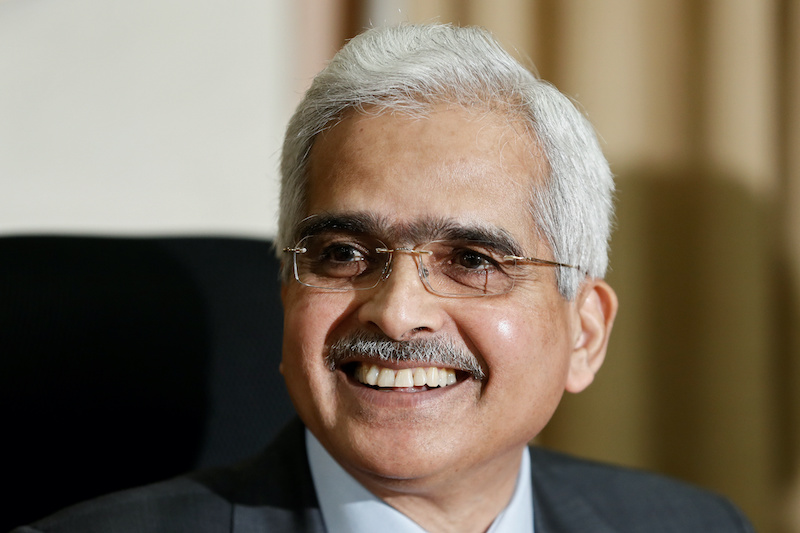

“The inflation trajectory remains clouded with uncertainties arising from continuing geopolitical tensions and nervous global financial market sentiments,” Governor Shaktikanta Das said in his address accompanying the MPC’s decision.

“In this backdrop, MPC was of the view that persistence of high inflation, necessitates further calibrated withdrawal of monetary accommodation to restrain broadening of price pressures, anchor inflation expectations and contain the second round effects,” he said.

The MPC also was of the view the current policy rate, adjusted for inflation, was still below 2019 levels.

Sticky, above-target inflation and currency depreciation triggered by chances of further frontloaded rate hikes by developed market central banks had made the hike expected, Aurodeep Nandi, an India economist and vice president at Nomura, said.

RBI’s reluctance to change stance from “withdrawal of accommodation” indicates that more monetary policy tightening is in the offing, Nandi said.

‘Emerging Markets Being Strong-Armed’

The US Federal Reserve’s relentless and aggressive interest rate hikes over recent months to curb inflation have battered the rupee, and most other emerging and developed market currencies.

Policymakers around the world are grappling with a sweeping shift away from their respective currencies and into the safe-haven dollar, raising worries of capital outflows and further damage to their economies.

Analysts agreed that further rate hikes were needed as the US Fed’s aggressive stance to combat inflation would likely keep battering emerging and developed market currencies.

“At this point, we still think that the RBI would not go too restrictive and [the] terminal rate could hover near the estimated real rates, implying not more than 100 bps hikes ahead, including today’s decision,” said Madhavi Arora, lead economist at Emkay Global Financial Services.

“Clearly, the fast-evolving world order and consistent repricing of Fed’s out-sized hikes are strong-arming the emerging markets,” Arora said.

“Given the global adverse conditions we remain wary of the pressure on the rupee and hence the need for continued rate hikes,” Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, said.

Growth Projection Trimmed

The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 5.65% and 6.15%, respectively.

The MPC lowered its GDP growth projection for financial year 2023 to 7% from 7.2% earlier, while its retail inflation forecast was held steady at 6.7%.

India’s annual retail inflation rate accelerated to 7% in August, driven by a surge in food prices, and has stayed above the RBI’s mandated 2-6% target band for eight consecutive months.

The benchmark 10-year bond yield eased marginally after the RBI’s decision to 7.3636% at 0615 GMT while the partially convertible rupee weakened briefly before bouncing to 81.57 per dollar versus 81.86 on Thursday.

At the open on Friday, the rupee had received a boost from data out late Thursday that showed that India‘s current account deficit widened less than expected in April-June, while balance of payments showed an unexpected surplus.

The NSE Nifty 50 index recovered ground and was trading up 0.90% at 16,969.85, and the S&P BSE Sensex rose 0.93% to 56,930.07.

- Reuters, with additional editing from Alfie Habershon and Jim Pollard

Read more:

Indian Rupee Could Hit 82.50 to Dollar, IDFC First Bank Warns

India Shares, Rupee up After RBI’s 50bps Rate Hike