(ATF) The axe has finally fallen.

China’s largest chipmaker Semiconductor Manufacturing International Corp (SMIC) confirmed on Sunday that its US suppliers have been subjected to additional export restrictions by the US Bureau of Industry and Security (USBIS) after concluding there is an unacceptable risk that equipment supplied to it could be used for military purposes.

But while SMIC acknowledges that the new rules may have a material adverse effect on its production and operations, analysts say that the foundry would continue functioning normally for a while.

In the long run, though, if the US restrictions persist they could jeopardise China’s dream of attaining self-sufficiency in semiconductor manufacturing.

Industry insiders say, anticipating escalating trade tensions between China and the US, SMIC has been proactively stocking up equipment, consumables, and raw materials from its upstream supply chain vendors over past year or two. Given that the US hasn’t yet prohibited engineers from entering SMIC premises, the chip-maker’s foundry can continue functioning “as usual” on current inventory for at least six months.

Also, SMIC’s chemical raw materials are mostly sourced from Japanese suppliers, who are not affected by the export restrictions.

READ MORE: China chip giant SMIC shares dive on US export controls

“However, if SMIC’s US-based suppliers continue to be restricted from shipping, not only will the foundry’s future expansion plans be hindered in the short run. It will, in all likelihood, also result in great difficulty for China to reach complete semiconductor independence for certain categories of advanced processes (such as those below the 7 nanometer (nm) lithography node),” Joanne Chiao, analyst at Taiwan-based TrendForce told ATF.

The 7nm lithography process is considered the most advanced for chip design and fabrication. It is important because it allows for miniaturisation of the transistors, or electrical gates, that perform the computational calculations that are the backbone of devices such as smartphones. The size of transistors are a useful metric for judging the power a computer’s CPU.

Limited capabilities

According to TrendForce, the Chinese semiconductor industry is capable of independently providing lithography and inspection equipment for processes down to the 90nm node gauge.

But Chinese foundries including SMIC still depend on US equipment suppliers for processes below that, specifically for 12-inch fab equipment. TrendForce also said semiconductor equipment suppliers in China are highly unlikely to be able to provide equipment covering all aspects of the manufacturing process for at least another 10 years.

This means that China will have to rely on overseas suppliers heavily for processes below 90nm, even as China’s development of semiconductor equipment is gradually adjusting and replacing parts in the relatively more mature global supply chain.

The impending snapping of SMIC’s supply chain before it can even develop its own mature 7nm production line, hence, could be disastrous for China’s chip-making dreams.

However, TrendForce’s preliminary analysis indicates that the export restrictions will likely have less impact on suppliers of silicon wafers and other raw chemical materials for semiconductors, since these are procured are mostly from Japanese and European suppliers.

READ MORE: Sliver of hope for Huawei as SMIC develops its own chip tech

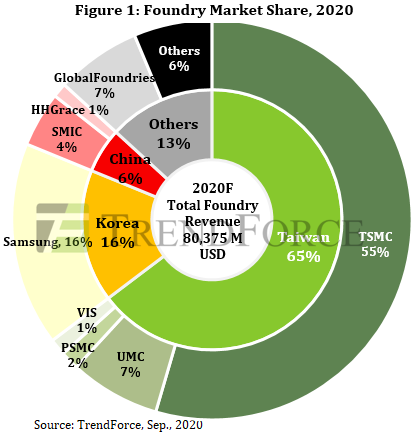

TrendForce estimates that Taiwanese foundries dominate the chip market with a 65% market share, followed by Korea on 16%. Although SMIC ranks first in China, it commands just about 4% of the global market.

Its domestic dominance is another reason why “the latest sanctions, which pose significant risks of cutting off SMIC’s upstream supply chain of semiconductor equipment and raw materials, will likely cause considerable damage to the foundry’s R&D of advanced process technologies and China’s efforts at semiconductor independence,” added Chiao.

Pull-out risks from others

SMIC may also see its non-Chinese customers withdraw orders if the nation’s sole advanced chip maker finds itself unable to purchase new equipment to expand production capacity in the future.

“The proposed sanctions, particularly, may force SMIC to slow its capacity expansion plans for mature processes (28nm and above) and R&D for advanced processes (14nm and below), which could drive its non-Chinese clients, in an attempt to mitigate risks, to others such as GlobalFoundries, Taiwan-based foundries like TSMC, UMC, Vanguard and PSMC, as well as Korea-based Samsung,” TrendForce said.

The researcher also estimates that the impact of the sanctions against SMIC will be much greater compared with the adverse effects of the recent sanctions against Chinese memory-chip maker Jinhua Integrated Circuit Company (JHICC) or even telecom equipment company Huawei.

“Although Chinese semiconductor equipment manufacturers have been refining their product offerings through frequent collaborations with domestic foundries in recent years, these manufacturers, unlike their foundry counterparts, still lag behind their dominant global competitors by a massive amount in terms of R&D progress. Therefore, in the absence of key semiconductor equipment from mainstream global suppliers, SMIC will suffer major roadblocks in the continued development of its advanced process technologies, portending the broader impact of US sanctions on the overall Chinese semiconductor industry”, TrendForce said.

Bracing up

Nevertheless, analysts are optimistic that the setback in China’s chip-making will also lead to a stepping up of Beijing’s efforts for a self-reliant supply chain. “Beijing will continue to enact supportive policies for semiconductor players,” said Morningstar analyst Phelix Lee,

In August, for instance, the Chinese government revised tax exemption rules for domestic players that employ 28nm process or more advanced nodes.

“Possible policies may include providing more grants for semiconductor research in tertiary institutions, funding corporate research, subsidising engineering academic programmes, offering non-saleable land at nominal cost, waiving value-added tax for semiconductor equipment and materials, facilitating debt arrangements, and reforming state-owned entities by introducing private capital,” Lee said.