(ATF) Returns on the bonds of Chinese state-owned-enterprises (SOEs) climbed Monday after regulators said troubled China Huarong Asset Management was trading normally.

The announcement from the China Banking and Insurance Regulatory Commission eased investor concern that the company’s plight could spark a selloff across China’s corporate bonds.

While that salved the nerves of investors, returns across China’s credit markets dropped after four companies made coupon payments, which tend to send bond prices lower.

Also on ATF

- Huarong panic may prompt China sovereign wealth fund move

- Growth outlook underpins markets

- Bitcoin plunges on China mining fears and concern about regulation

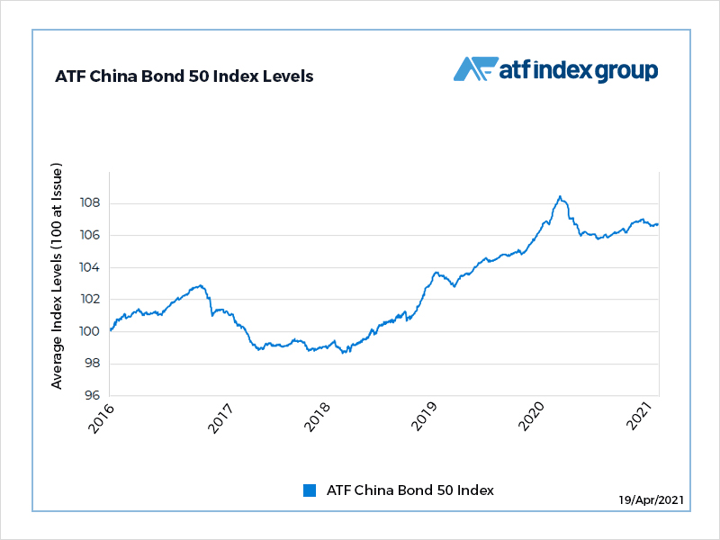

The benchmark ATF China Bond 50 Index of AAA rated China credits fell 0.06% to 106.68. The gauge has lost 0.26 since March 1, when a prolonged period of coupon payments began. Investors tend to move out of bonds when coupon payments are made because they reduce the pool of interest the securities will pay over the rest of their lifetime.

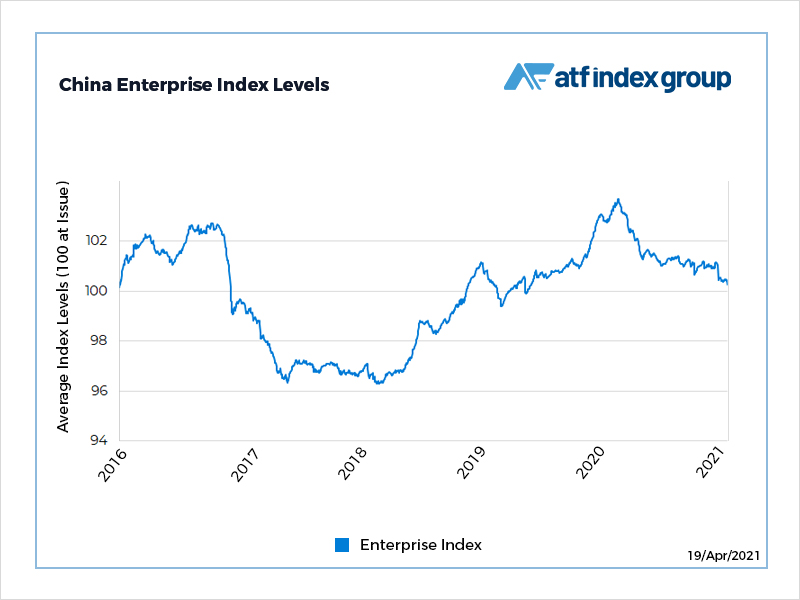

The Enterprise sub-gauge of SOEs climbed 0.02%, outweighing declines brought about by a payment on State Grid Corporation of China’s 5.26% due in March 2027.

Huarong has battled with financial problems and the execution of its former chief executive for fraud. Its bonds have been downgraded and the company has been put on life support.

Huarong is a quasi-domestic systematic important financial institution (D-SIFI) with total assets of 1.7 trillion yuan and has strong connections with other FIs given its core business of distressed asset management, leverage, and main funding source of bank borrowing and bond issuance.

The Financials sub-index fell 0.04% after Jinshang Bank made a payment on its 3% bond due in March 2023 and China Aerospace Science and Industry Corporation followed suit on its 4.79% security due next March.

The Corporates gauge fell 0.08%, the most in a month, after Chengtou Holdings made a payment on its 4.53% bond maturing in March 2024.