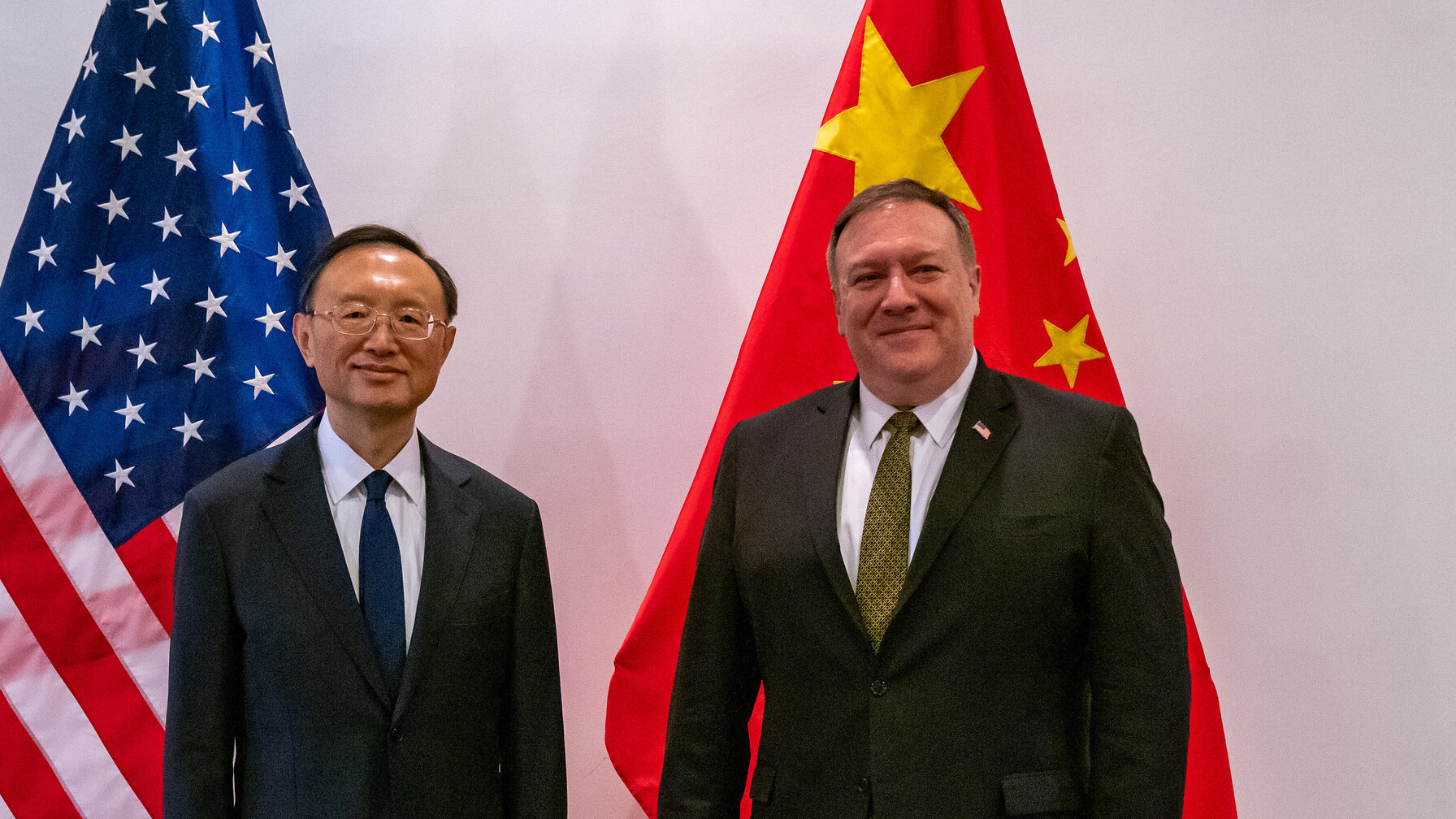

(ATF) “During my meeting with CCP Politburo Member Yang Jiechi, he recommitted to completing and honouring all of the obligations of Phase 1 of the trade deal between our two countries,” read a tweet on Thursday by US Secretary of State Pompeo after his encounter with Yang in Hawaii.

On Friday, Chinese sources privately confirmed the Pompeo tweet and said China would speed up purchases of US farm goods, on which it had fallen behind during the coronavirus lockdown.

This was more than good enough for Asian and EU stock markets and US futures to rise and to lift the yuan (CNY) to 7.0723 by 6pm HK time, sharply above the parity level of 7.0913 set by the PBoC this morning. The offshore yuan (CNH) pushed even higher, to 7.0687.

The Hong Kong dollar continued its strong performance at the upper limit of the trading band with the US dollar and stood at 7.7502.

After Netease and JD.com, it’s now New York-listed Yum China that’s going to go for a secondary listing in Hong Kong, expecting to raise US$2 billion. The wall of money flooding into Hong Kong is not only pushing up the HKD, but it also has pushed shares in the Stock Exchange of Hong Kong to a 52-week high.

Will the recent yuan strength, and the outperformance of the HKD and Chinese stocks last?

Recovering

The Chinese economy is recovering at a reasonable pace, which should support equities and the Chinese currencies (CNY, HKD).

The latest bout with the coronavirus in the Beijing region appears to have been successfully contained.

The most important risks in the coming months are political. Introduction of a national security law in Hong Kong could rekindle political unrest. A Donald Trump tweet Thursday night that the US “certainly does maintain a policy option, under various conditions, of a complete decoupling from China. Thank you!”, sounded ominous.

But the fact that even at moments of the sharpest US-China political tensions over the past several months, the US-China trade deal has not ruptured, provides comfort that tangible mutual benefit can prevail over ideological strife.

Meanwhile, it’s US dollar weakness that will remain a substantial factor in relative yuan strength. At 97.4100 on the DXY (dollar index), the greenback is at its weakest since early March and will continue in this vein unless a renewed coronavirus wave seriously disrupts global recovery and kicks up safe haven demand.