Latest News: New Energy Vehicles

Lee's security adviser said the countries discussed nuclear-powered submarines on the "premise" the vessels would be built in South Korea

BYD has been building factories for local assembly in countries such as Hungary and Brazil and it plans a third plant for Europe, with Spain the top candidate.

Officials in three countries are investigating electric buses, after news that suppliers have remote access for software updates and control system diagnostics, amid fear they could be 'exploited' while vehicles are in transit.

Dutch chipmaker suspends supplies of wafers to its Guangdong assembly plant amid concern its technology could be stolen by its Chinese owner. The row has inflamed fears on the supply of chips to carmakers worldwide

World's top carmaker plans to lift its share of India's passenger car market to 10% by 2030 and will launch over a dozen new models to help achieve that, sources say

"Spectacular" growth of solar power helped renewable sources generate more energy than coal and fossil fuels in the first half of this year, a new report says

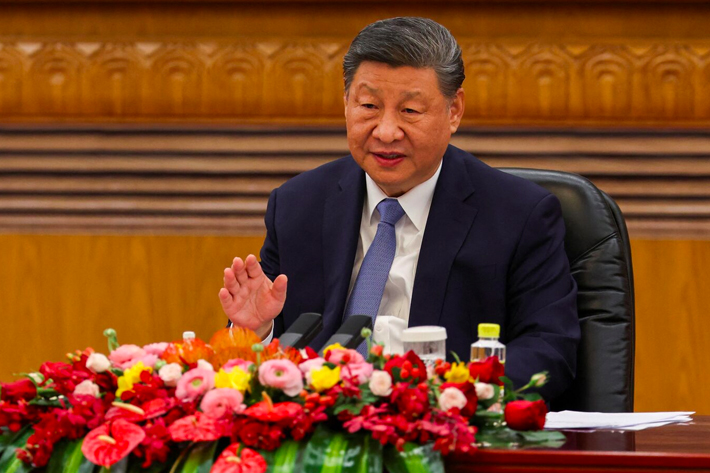

Anger is mounting in the European Union over China's "weaponisation" of its trade policies and industrial overcapacity; a flurry of anti-dumping probes looks let to be launched

Companies across Asia and other regions making medical drugs, trucks and furniture were assessing the impact of new tariffs announced by President Trump on Thursday

China's first ever emissions reduction pledge failed to impress observers at a summit hosted by the UN Secretary-General, despite the outrageous rejection of climate science by US President Donald Trump a day before

Australian mining companies have been assessing setting up plants in the US amid the Trump Administration's push to bolster its processing facilities for rare earths and other critical minerals

Lee said they cannot afford to invest $350 billion without a safety mechanism to cut risk, such as only supporting commercially feasible projects

Carmakers and dealers are struggling to make money in the world’s biggest auto market and oversupply, along with fierce competition, has left scores of firms on the brink of collapse

AF China Bond

- Popular