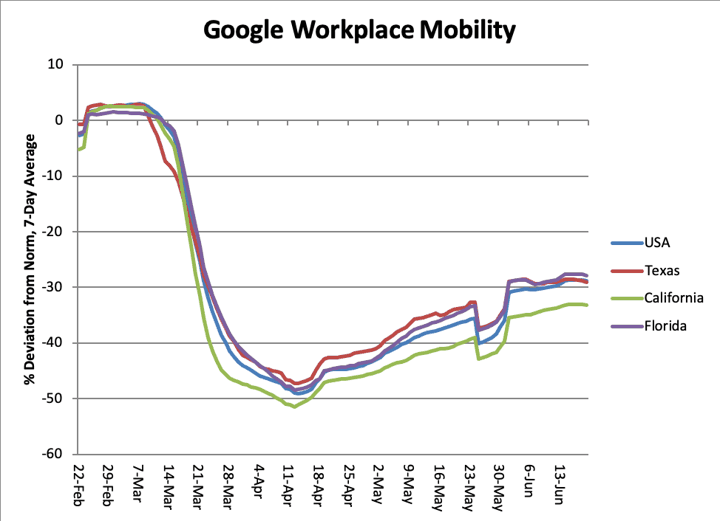

Location data for Android smartphones published daily by Google show that the US economy stopped growing in June after a modest improvement in May. The number of US workers who showed up at their place of employment remained unchanged during June, at about 30% below normal.

This does not take into account employed individuals working remotely from home, but it nonetheless shows a stalled recovery.

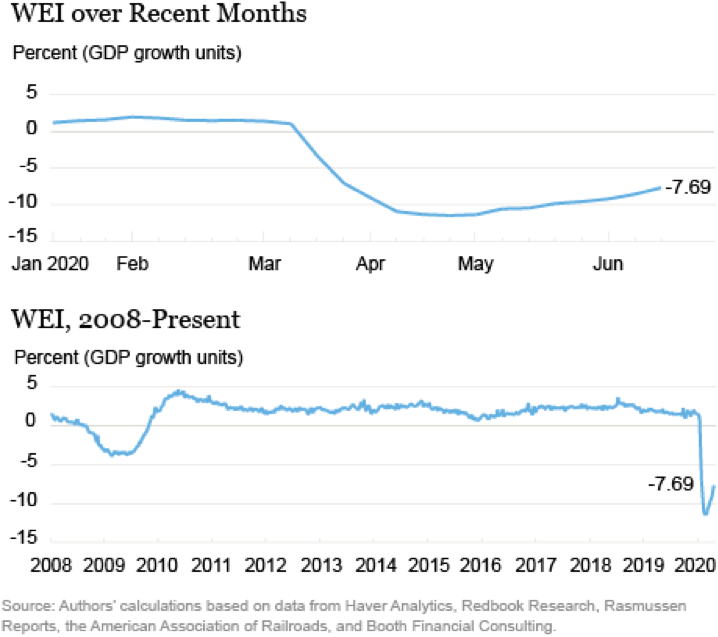

The New York Federal Reserve publishes a weekly index of economic activity using the Johnson Redbook weekly data for same-store sales, daily Treasury Department data for withholding tax receipts from wages, railway car loadings, and other high-frequency data. The most recent reading as of June 13 (a week behind the Google data) tells a similar story.

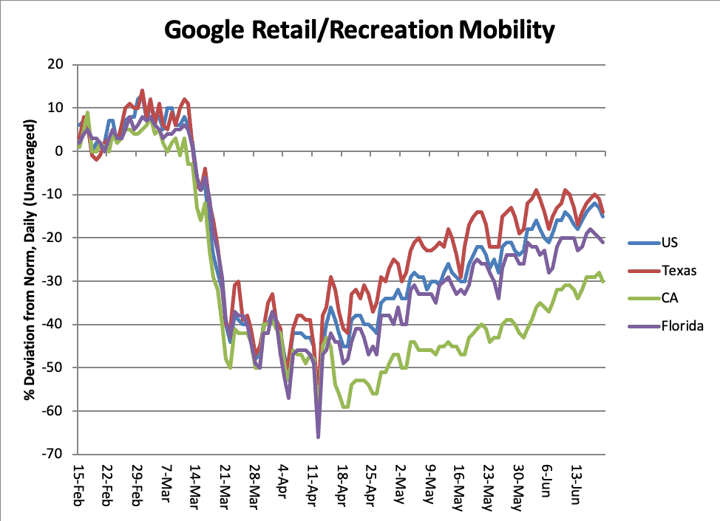

Of particular interest is Google’s data for mobility in retail and recreation sites. This has been rising steady since April:

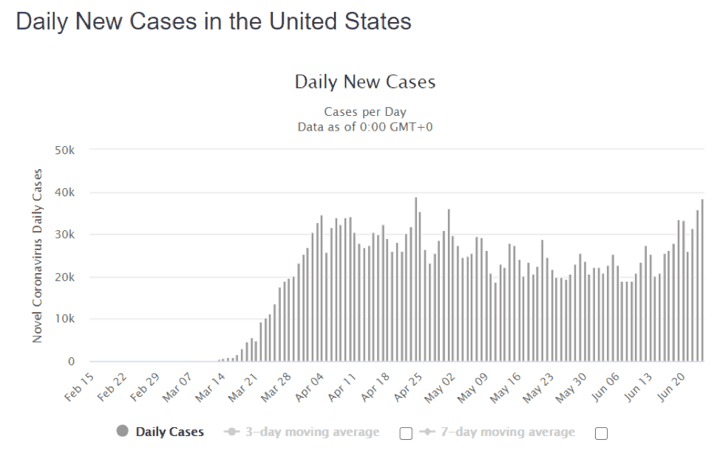

Nationally, the presence of Americans at retail stores, restaurants and similar venues is only 10% below the norm, compared to an April trough of 50% below the norm. This is a vivid and accurate gauge of the extent to which Americans returned to public spaces. It’s not surprising that the incidence of Covid-19 infection surpassed the April highs on June 24. Several states have said that they may stop planned re-opening or return to lockdowns. On June 23 Texas Governor Greg Abbott urged Texans to stay home.

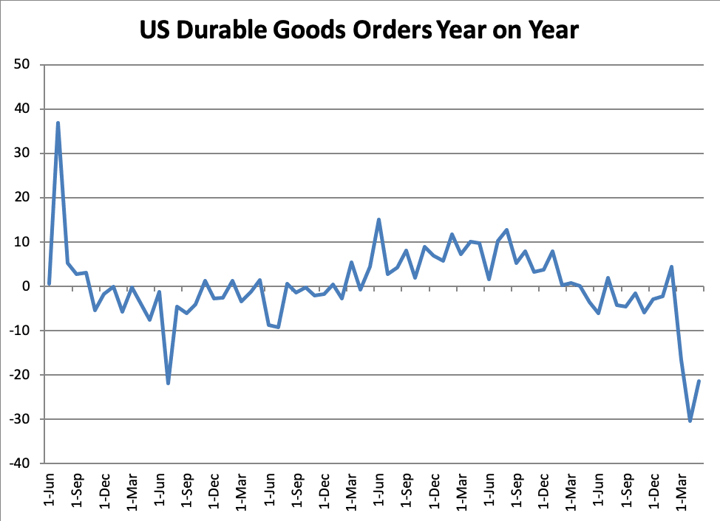

This portends a weakening US economy over the summer. Some Wall Street analysts have called attention to big jumps in month-on-month data for retail sales, durable goods orders and other measures of economic activity. That is misleading; when economic activity falls to an extremely low level, even a small improvement will look like a big percentage move in monthly terms. Durable goods orders, for example, fell to 30% below the year-earlier level in May and rose in June to 22% below the year-earlier level.

Rather than a “V-shaped” (rapid) or “U-shaped” (slow) recovery, the US economy is more likely to describe a “W,” with advances and declines depending on the evolution of the pandemic.

The new cases are concentrated in California, Texas, Florida and Arizona, which together comprise a third of US gross domestic product.