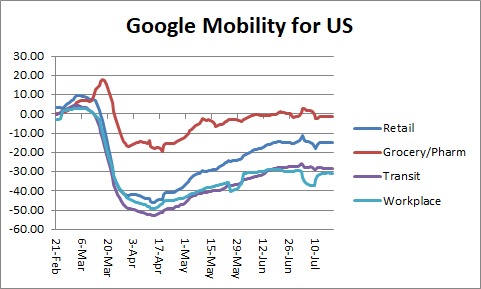

(ATF) Take a look at the Google Mobility chart for the US below.

After some decent recovery through the end of June, workplace and retail-related mobility have taken another hit and economic recovery has stalled.

Initial US jobless claims published Thursday painted a bleaker picture: Weekly claims – for the week ended July 18 – rose for the first time since late March, up by 109,000 to 1.42 million.

To put these numbers in perspective, before the Covid-19 crisis, the largest one-week tally was 695,000 in 1982.

Given that the Covid-19 pandemic continues out of control in several of the most populous US states, the unemployment claims point to an inevitable renewed economic growth dip just ahead.

The US dollar is not taking kindly to all this. It’s faltering against the euro and traded at 1.16 against the European common currency at 6pm HK time, weakest since September 2018.

Overall, on the dollar index (DXY) of a basket of currencies, it stood at 94.6620, for a one-month loss of over 2%.

(Won’t seem large to you if you’re an equities guy, but it’s a ton for a currency trader).

Dollar weakness

Where are we going with this dollar weakness – and concomitant gold strength of $1,892 per ounce?

A further relatively orderly decline in the dollar value as the US economy loses ground again is my base case scenario. I’ll be watching the yield on US five-year Treasuries, which declined to an all-time 0.2548% low on Friday – but not precipitously so.

But for the greenback, it all now depends on the financial impact of the expected US double-dip decline. Most US banks are in pretty good shape. However, a major company’s insolvency in the non-financial sector could put severe strain on the USD.

And the yuan?

The PBoC set central parity at 6.9938 this morning. By the end of the China trading day, it stood at 7.0150, down in sympathy with Chinese equities.

No question the escalation of anti-China rhetoric and action over the past week by a desperate Trump administration trying to find an issue to improve the president’s election chances has had a chilling effect.

China, by closing the US consulate in Chengdu has reacted as is normal with such diplomatic tit-for-tat for the shutdown of the Chinese consulate in Houston – southeastern metropolis for southeastern metropolis.

But the real story that defines currency relations at this stage is the basic disparity between the US and the Chinese economy.

ALSO SEE: Markets roiled by geopolitics

Fund created to stabilise state enterprises

Banks, investors may chase a falling supply of new bonds in 2H