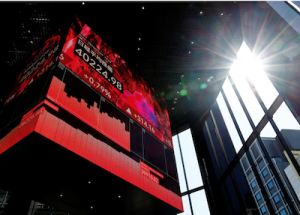

Asia’s major stock indexes were on the back foot on Wednesday as rising US yields and worries over tech supply chains after an earthquake hit Taiwan unnerved investors.

On Wall Street, a recent run of solid US economic data – including an unexpected expansion in the manufacturing sector and the slow easing in the labour market – stoked doubts about the amount of Fed easing likely this year and next.

That put equities under pressure and Japan’s Nikkei share average dropped again, also weighed down by a fall in heavyweight Fast Retailing, owner of the Uniqlo store chain.

Also on AF: China’s Solar Sector Seen Facing Years of Oversupply, Low Prices

The Nikkei lost 0.97% to 39,451.85 as of the close, and earlier dipped to its lowest since March 18 at 39,217.04. The broader Topix was down 0.29%, or 7.94 points, to 2,706.51.

Fast Retailing, which is the most heavily-weighted stock in the index by a wide margin, lost 3.34% to be the biggest drag, contributing 154 basis points of the Nikkei’s total 387-point decline.

The stock tumbled from a record high reached earlier in the week after the company announced late on Tuesday its first year-on-year sales decline at domestic Uniqlo outlets for three months.

Big tech names like chip-testing equipment maker Advantest dropped 2.14%, while Nintendo lost more than 4%. Artificial intelligence-focused startup investor SoftBank Group slid 1.24%.

Tech shares underperform when borrowing costs rise, and US long-term Treasury yields jumped to their highest since November at more than 4.4% overnight.

China stocks fell on Wednesday, tracking global peers lower, although data showed China’s services activity recently accelerated.

Services activity growth accelerated in March as new business rose at the quickest pace in three months, a private-sector survey showed on Wednesday, following the better-than-expected manufacturing surveys, adding to signs that parts of China’s economy are gaining momentum in the first quarter.

The powerful earthquake, which Taiwan bore the brunt of, also raised concerns about possible disruptions to the vital chip-making industry, denting sentiment.

China’s blue-chip CSI300 index was down 0.36%, while the Shanghai Composite Index edged down 0.18%, or 5.66 points, to 3,069.30. The Shenzhen Composite Index on China’s second exchange dropped 0.66%, or 11.73 points, to 1,767.96.

Chinese H-shares – shares of Chinese mainland companies that are listed in Hong Kong or overseas – fell 0.78% to 5,913.99, while the territory’s benchmark Hang Seng Index was down 1.22%, or 206.42 points, at 16,725.10.

Treasury Yields Surge

Elsewhere across the region, in earlier trade, Sydney and Seoul were off while Singapore, Mumbai, Wellington, Manila and Jakarta were also in the red.

Taipei fell after a 7.4-magnitude earthquake just off Taiwan’s east coast, which added to the regional uncertainty, though there was some relief that the threat of a tsunami had dissipated.

Europe was set for a subdued open, with Eurostoxx 50 futures little changed and FTSE futures easing 0.3%. Wall Street stock futures were off 0.2% as investors pondered the risk of fewer rate cuts ahead of an appearance from Federal Reserve Chair Jerome Powell and US services and jobs figures due later in the day.

The three major Wall Street indexes fell about 0.7%-1% with Tesla shares losing about 5% after quarterly deliveries fell for the first time in nearly four years.

Long-term Treasury yields climbed to multi-month highs overnight before paring some of the movements. The benchmark 10-year yield was steady at 4.3572% on Wednesday, after hitting a four-month high of 4.405% overnight.

Investors now await euro zone inflation data, which could surprise on the downside after German inflation eased more than expected.

In currency markets, the dollar failed to get a lift from higher yields but still loomed large against its major peers. The yen was jittery at 151.57 per dollar, just a whisker away from the 152 level that prompted authorities to intervene in late 2022.

Oil held near five-month highs on worries about tighter supplies ahead of an OPEC+ meeting where the group is unlikely to change output policy. Brent rose 0.1% to $89.00 a barrel, while US crude was little changed at $85.15 per barrel.

Gold prices extended their record rally on Wednesday. Spot gold rose 0.1% to $2,282.58 per ounce, after hitting an all-time high of $2,288.09 earlier in the session.

Key figures

Tokyo – Nikkei 225 < DOWN 0.97% at 39,451.85 (close)

Hong Kong – Hang Seng Index < DOWN 1.22% at 16,725.10 (close)

Shanghai – Composite < DOWN 0.18% at 3,069.30 (close)

London – FTSE 100 < DOWN 0.56% at 7,890.53 (0933 GMT)

New York – Dow < DOWN 1.00% at 39,170.24 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Foreign Orders Lift China’s Manufacturing Again in March: Caixin

Japan Approves $3.9bn of Cash Backing For Chipmaker Rapidus

Hang Seng Enjoys Tech Boost, Nikkei Flat Amid Profit-Taking

China Stocks Lead Asia Rally, Nikkei Drops Under Yen Pressure