Markets have been disrupted this year by the growing clout of retail investors. Some see themselves as genuine traders, others as modern-day Davids fighting Wall Street’s Goliaths. More yet regard themselves as anarchic warriors of the 99%. Eetika Kapoor explain the nuts and bolts of what is undoubtedly a mini revolution in global finance.

What is a meme stock and should you care?

Global finance has been buzzing with one particular phrase recently – ‘Meme stocks’. This is not a recent phenomenon but when a company called GameStop, which was priced at just $20 a share in 2019, suddenly spikes to $483 per share, people want to tune in.

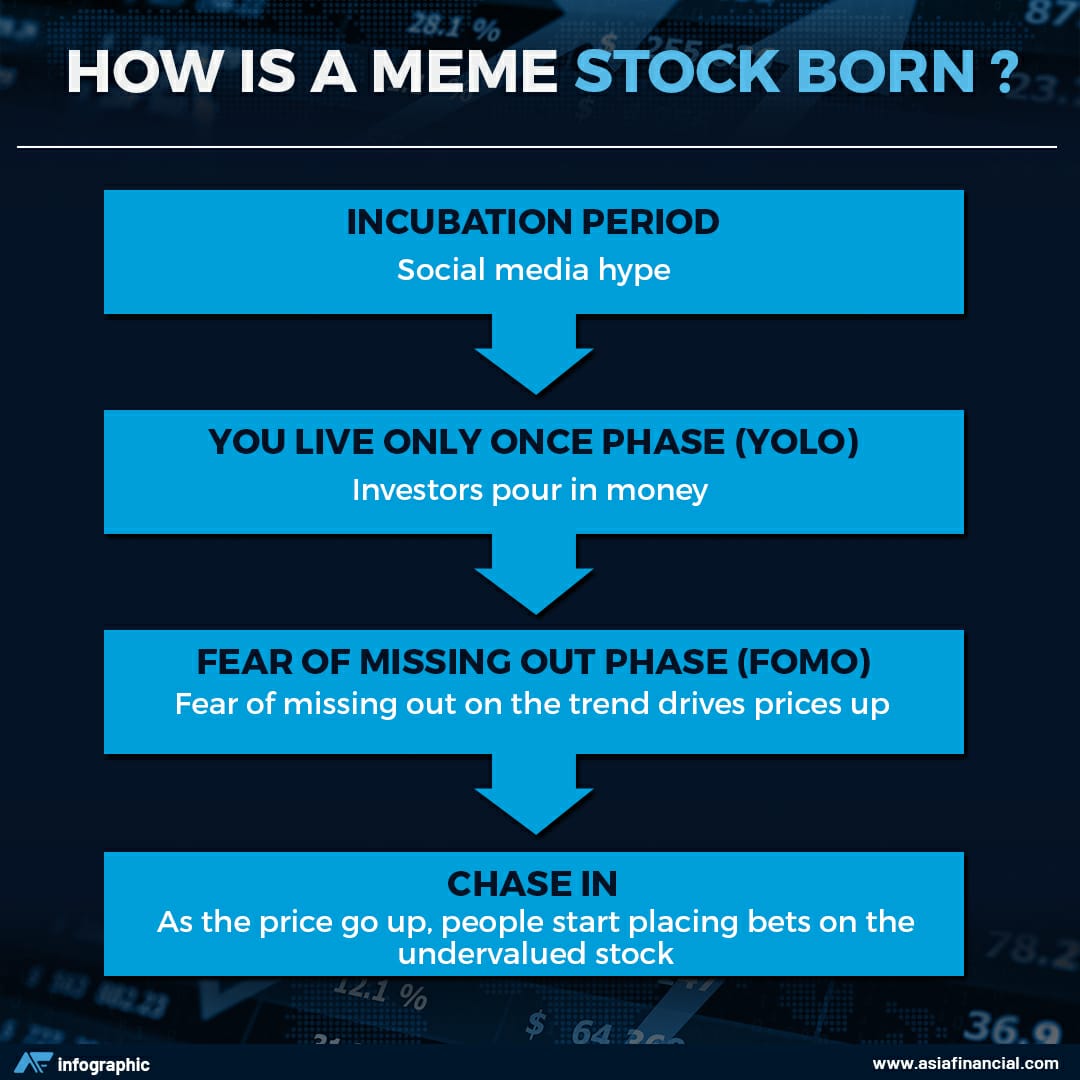

‘Meme stocks’ are stocks that go viral and their share prices shoot up not because the company is performing well but due to the hype of social media, mostly on platforms like Reddit. Meme stocks include, but are not limited to, the likes of AMC entertainment, Koss, Nokia, BlackBerry, etc.

This has given birth to what are now being called ‘retail investors’ – individuals sitting in the comfort of their homes with the ability to move markets.

WallStreetBets: Birth of FOMO trader

Founded in 2012 by Jaime Rogozinski, WallStreet Bets (WSB) is a Reddit page that shot to fame in 2020. WSB has been known for its aggressive trading discussions and community of opinionated retail investors. The follower count went up from 80,000 in 2019 to the current 11.3 million.

What happened in 2020? Hedge fund raiders from WallStreet shorted or tanked shares of a retail gaming company called GameStop.

Shorting stock, also known as short selling, involves the sale of stock that the seller does not own, or shares that the seller has taken on loan from a broker. When you short a stock, you expose yourself to a large financial risk. You assume that you can buy it back at a lower price from the market.

Is shorting legal? No. But does Wall Street dabble in it? Yes. The investors were confident that GameStop didn’t hold much value.

This is where Redditors from WallstreetBets came in. Some were driven by unadulterated hatred for Wall Street and some were nostalgic about the old gaming company. They began buying worthless GameStop shares and drove the price of the shares from less than $20 to as high as $483 at its peak on Jan 28, 2021 leading to what is known as ‘short squeeze’.

A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to prevent even greater losses

We are well aware of how influencers operate. WallstreetBets can be termed as financial influencers. Do you buy every trend that an influencer suggests? No. But do you add it to a wishlist? Most probably.

Rise of Retail Investors & Meme Stocks

The landscape of investment has changed. Even though traders and investors look up to the Warren Buffet style of investment, the world nowadays is fuelled with quick runs and fixes. This has given way to ‘retail investors’.

A retail investor is an individual investor who invests in stock markets by purchasing shares of a company or invests in mutual funds, exchange-traded funds, etc, that can be facilitated by a broker.

Working from home, post-Covid stimulus cheques, huge amounts of capital in the market and the endless stimulation offered by social media makes it hard to resist the temptation of day trading, stock acquisitions and equity investments.

Rising online transitions, easy-to-use apps for trading, zero commission on shares and the readily available opinions of business personalities like Munger, Elon Musk and Bill Gates have ended up creating the phenomenon of meme stocks. Statistica predicts total transaction value in the digital payments segment to reach US$6,685,102m in 2021.

Do any guidelines mandate meme stocks?

As of now, there have been warnings sent by the US Securities and Exchange Commission to Reddit and WallStreetBets. They have asked the platform to pull out a ‘prospectus’ declaring that a particular stock has risen, eg 500%, without any apparent reason as a warning to the investors so that they can exercise caution (like hell they will!).

What they don’t understand is that investors pouring money into these meme stocks are comfortable losing their money. In fact, they boast about it on the Reddit forum WallStreetBets. The page has already denied any claims of it being a financial advisor. So do it at your own risk.

The big question: Should you invest in meme stocks?

The very essence of a meme stock is a parody in itself. It is driven by the FOMO mentality (fear of missing out). Dogecoin, a cryptocurrency, rose to 11,000% and was almost equivalent to one American dollar.

Should you as an investor take the risk? Ask yourself, are you comfortable with the idea that your money may not exist the next day? Meme stocks exist not because these companies hold value but due to some retail investors wanting to ‘play the field’.

Before investing in meme stocks, here are two cents from investors, on condition of anonymity:

– Do your research: Investments are no instant noodles. Don’t be swayed by promises of quick returns. Know the basics before jumping into any investments. All that glitters is not gold.

– Be updated with market news: Read. Read. Read. Whether your meme stock is in the news for the wrong reasons or right, you should be aware of it. That is when you can decide if you want to move the money.

– Compatible livelihood: Are you a writer living off peanuts and have no fixed income? It’s better if you stay away from the hullabaloo of meme stocks. Come back when you have enough to splurge.

– Keep a log: This goes for any investment portfolio. Keep a close record of the stocks you are investing in. If you don’t understand the nitty gritty of it, hire a certified financial planner or advisor to do it for you.

– This might just be a bubble: Investors believe that this meme stock mayhem could be short lived and might just be a bubble. One day this could burst and people who invested in it will be hit financially, much like the real estate bubble of 2008.

Until then, if you want to ride the wave, at least have the best surfing board.

Editing by Sean O’Meara

ALSO SEE:

- Yellen hails resilience of financial markets in GameStop turmoil

- Yellen’s GameStop summit will have Asian implications

- Asia could be next as Reddit squeeze on hedge fund shorts goes global

- Reddit rally starts to fizzle as GameStop and silver slip

- Asia braces for Reddit volatility as Citadel faces GameStop fallout

- Top Glove joins Reddit surge as GameStop rebounds

- Robinhood sparks controversy with trading limits, Korean fund opts out