Russia’s invasion of Ukraine has caused a 2.8% drop in world trade between February and March, data released on Wednesday show.

Container freight traffic has already slumped by half at Russia’s three largest ports – St Petersburg, Vladivostok, and Novorossiysk, according to the Kiel Institute of the World Economy.

Ukraine is practically cut off from international maritime trade. No large container ship has called at the country’s most important port, Odesa, on the Black Sea, since the outbreak of war.

“The sanctions imposed by the west are clearly having an effect, and the Russian population is facing an increasingly scarce supply of goods from abroad,” said Vincent Stamer, head of Kiel Trade Indicator, the institute’s trade index.

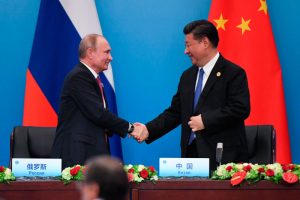

Stamer said China trade also faces “stagnation”, due largely to the Covid-related lockdown of the Shanghai metropolitan region.

While the institute’s figures for March do not yet reflect China’s lockdowns, he said “future disruptions in China’s trade are by no means off the table”.

Stamer said 12% of all goods shipped worldwide are either stuck in port or at sea.

“Of concern is the significant increase in global container ship congestion, which can also be attributed to lockdowns in China,” he said.

- George Russell

READ MORE:

Chinese Trade With Russia Feels Sting of Ukraine, Sanctions

US Trade Chief Tai Says China Must be Pushed to Change

Container shortage crisis stacking pressure on China’s export recovery