Concern is rising about China’s dominant grip on the processing of critical minerals, with carmakers around the world complaining about Beijing restricting exports of rare earth products.

Carmakers in Germany have warned that China’s export restrictions affecting rare earth alloys, mixtures and magnets could shut down production if no quick solution is found. This follows a similar complaint from Indian EV maker Bajaj Auto last week.

China’s decision in April to suspend exports of a wide range of critical minerals and magnets has upended the supply chains central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.

ALSO SEE: China Denies Trump Claim, Says It Was US That Broke Trade Deal

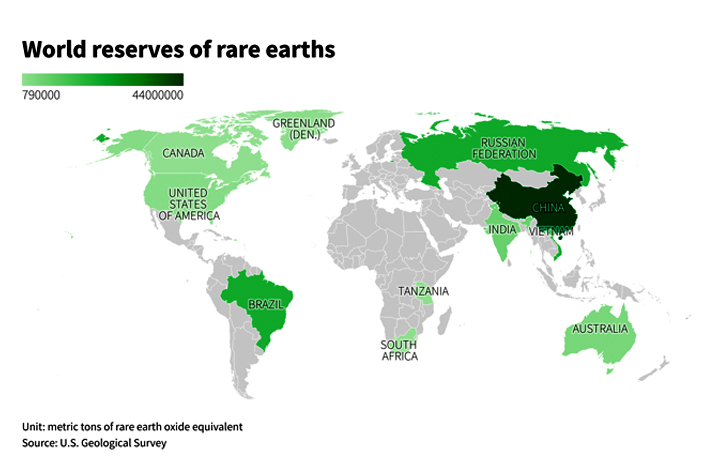

The move underscores China’s stranglehold of the critical mineral industry and is seen as a display of leverage by China in its ongoing trade war with US President Donald Trump.

Trump has sought to redefine the trading relationship with the US’ top economic rival China by imposing steep tariffs on billions of dollars of imported goods in hopes of narrowing a wide trade deficit and bringing back lost manufacturing.

Trump imposed tariffs as high as 145% against China only to scale them back after stock, bond and currency markets revolted over the sweeping nature of the levies. China has responded with its own tariffs and is leveraging its dominance in key supply chains to persuade Trump to back down.

Trump and Chinese President Xi Jinping are expected to talk this week, White House spokeswoman Karoline Leavitt told reporters on Tuesday, and the export ban is expected to be high on the agenda.

“I can assure you that the administration is actively monitoring China’s compliance with the Geneva trade agreement,” she said. “Our administration officials continue to be engaged in correspondence with their Chinese counterparts.”

Trump has previously signalled that China’s slow pace of easing the critical mineral export ban represents a violation of the Geneva agreement.

Magnet shipments halted

Shipments of the magnets, essential for assembling everything from cars and drones to robots and missiles, have been halted at many Chinese ports while licence applications make their way through the Chinese regulatory system.

The suspension has triggered anxiety in corporate boardrooms and nations’ capitals – from Tokyo to Washington – as officials scramble to identify limited alternative options amid fears that production of new automobiles and other items could grind to a halt by summer’s end.

“If the situation is not changed quickly, production delays and even production outages can no longer be ruled out,” Hildegard Mueller, head of Germany’s auto lobby, told Reuters on Tuesday.

Frank Fannon, a minerals industry consultant and former US assistant secretary of state for energy resources during Trump’s first term, said the global disruptions are not shocking to those paying attention.

“I don’t think anyone should be surprised how this is playing out. We have a production challenge (in the US) and we need to leverage our whole of government approach to secure resources and ramp up domestic capability as soon as possible. The time horizon to do this was yesterday,” Fannon said.

‘Emergency’ meetings sought

Diplomats, automakers and other executives from India, Japan and Europe were urgently seeking meetings with Beijing officials to push for faster approval of rare earth magnet exports, sources told Reuters, as shortages threatened to halt global supply chains.

A business delegation from Japan will visit Beijing in early June to meet the Ministry of Commerce over the curbs and European diplomats from countries with big auto industries have also sought “emergency” meetings with Chinese officials in recent weeks, Reuters reported.

India, where Bajaj Auto warned that any further delays in securing the supply of rare earth magnets from China could “seriously impact” electric vehicle production, is organizing a trip for auto executives in the next two to three weeks.

In May, the head of the trade group representing General Motors, Toyota, Volkswagen, Hyundai and other major automakers raised similar concerns in a letter to the Trump administration.

“Without reliable access to these elements and magnets, automotive suppliers will be unable to produce critical automotive components, including automatic transmissions, throttle bodies, alternators, various motors, sensors, seat belts, speakers, lights, motors, power steering, and cameras,” the Alliance for Automotive Innovation wrote in the letter.

US to slash legal requirements

Meanwhile, President Donald Trump is set to use emergency powers and slash legal requirements – including some congressional funding approvals – relating to a law aimed at lifting US production of critical minerals and weapons, according to a document seen by Reuters.

Trump’s action would apply to the Defence Production Act, a US law that grants the president broad emergency powers to control domestic industries and resources during national security emergencies.

The move would represent the latest attempt by the White House to reshape a critical mineral industry dominated by China. China is using its leverage in response to Trump’s trade war, recently halting critical mineral exports and rattling global supply chains.

The document is expected to be published on the Federal Register on Wednesday, the government website shows.

Trump invoked the Korean War-era law in March to help boost domestic production of critical minerals used to make consumer goods, computer chips, robots and advanced weaponry.

The law places some restrictions on the president’s authority, such as requiring the White House to seek congressional approval for projects over $50 million and forcing project delivery dates within a one-year time frame.

The president can waive those requirements in the event of an emergency and Trump is expected to invoke those powers, according to the document seen by Reuters on Tuesday, ahead of its expected publication.

The White House did not immediately respond to a request for comment. Former President Joe Biden signed similar waivers to speed up production of vaccines and medical equipment during the Covid pandemic.

John Paul Helveston, a professor at George Washington University, said US investments in critical minerals represent a long-term solution to the problem, leaving the nation vulnerable to China’s trade policy in the short run.

“This all means that if the US wants to have access to these minerals over the next 5-10 years, the US will have to maintain a trade relationship with China,” Helveston said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China ‘Totally Violated’ Tariffs Agreement With US, Trump Says

Trump’s Tariffs Reinstated as Appeals Court Pauses Trade Ruling

Shipments of US Ethane to China Face Export Licence Uncertainty

US Blocks Chip Design Software, Chemical Shipments to China

Beijing Says Latest US Chip Warning Puts Trade Truce at Risk

Mass Layoffs Avoided in China, But Export Sector Badly Shaken

Asian Markets Rise After US, China Agree to Cut Majority of Tariffs

US Firms Seen Getting Chinese Rare Earth Permits After Truce

China Follows US Playbook in Rare Earth Crackdown; Tesla Hit

China Halts Rare Earth Exports, Warns US on Deep-Sea Metals ‘Plan’

China Plunders Rare Earth Minerals as Myanmar’s Civil War Rages