(ATF) Alibaba saw strong demand for a $5 billion international bond issue and priced all four tranches well inside the indicated spreads over US Treasury yields. The success of the deal could help to revive interest in an IPO for its fintech arm Ant Group.

Alibaba priced its $5 billion four-part return to the international debt markets at spreads that were substantially below initial price guidance, after seeing demand for close to $40 billion of paper from investors who were keen to take on exposure to the company, despite concerns in recent months about its regulation in China and the state’s attitude towards its founder Jack Ma.

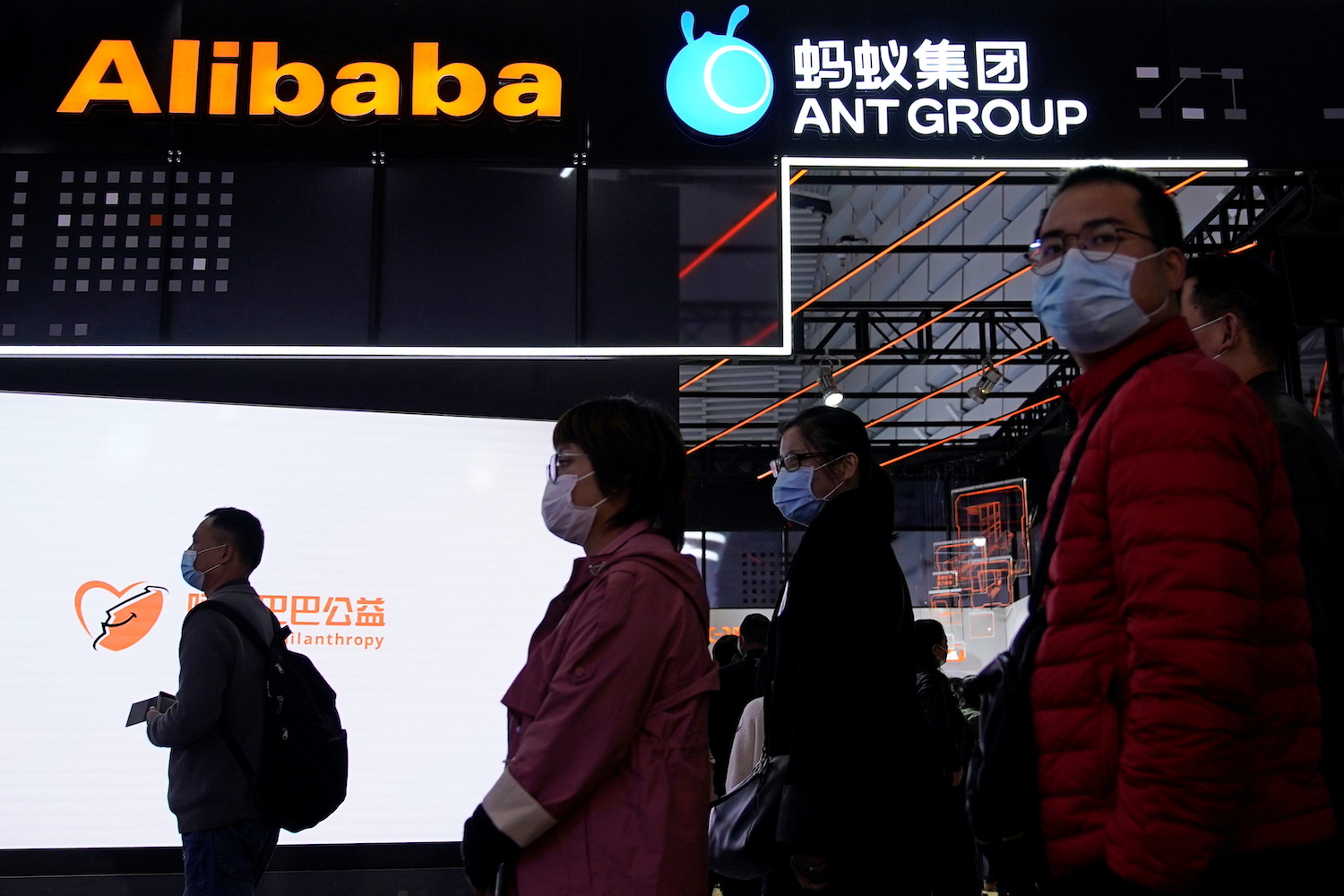

Solid quarterly results announced by Alibaba on Tuesday February 2 and signs that the company and its fintech subsidiary Ant Group have reached an accommodation with Chinese regulators helped the bond deal to sell easily.

A $1.5-billion 10-year tranche of the bond was initially marketed at a spread of around 130 basis points (bp) over the comparable US Treasury but eventually priced at 100bp over the government bond benchmark; a $1-billion 20-year deal was marketed at 140bp over the Treasury curve but also priced at 100bp over; a $1.5-billion 30-year tranche had initial guidance at 150bp over the Treasury curve but priced at 120bp over; and a $1-billion 40-year tranche was marketed at a yield around 160bp over Treasuries before pricing at 130bp over the government curve.

China International Capital Corporation, Citigroup, Credit Suisse, JPMorgan and Morgan Stanley were lead managers of the bond deal.

The $5-billion offering was the biggest US dollar bond from an Asian borrower since a $6-billion issue from Tencent last May, and comes after heavy volumes of dollar debt deals from Asian firms in January.

The strong demand for the Alibaba bond could help to revive interest in an IPO for Ant Group, Alibaba’s related fintech company, after a deal that was expected to raise around $37 billion was pulled due to intervention by Chinese regulators in November.

Ant has reportedly agreed to put its main business lines into a financial holding company in an apparent accommodation with Chinese regulators, and if this is confirmed then banks may be able to revive plans for an IPO.