Asia’s markets took a step back on Thursday as investor hopes of a cooling in US interest rate hikes took a hit and the flare-up in Sino-US tensions dampened sentiment too.

China’s markets were the outlier where the mood was upbeat on the country’s economic recovery, after a poll showed that new yuan loans extended by Chinese banks likely surged to a record high in January.

But elsewhere across the region, the prospect of an extended battle with inflation cast a long shadow.

Also on AF: US ‘Not The Only Target’ Of Chinese Spy Balloons: Blinken

Japan’s Nikkei index ended lower, marking a retreat from near two-month highs, as the benchmark index tracked downbeat performances on Wall Street after investors there braced themselves for a protracted period of high US interest rates.

The Nikkei share average ended 0.08% lower at 27,584.35, but hovered above the 27,500 level it had scaled late-January. At the start of the week, the index hit its highest since mid-December at 27,821.22 amid strong earnings results. The broader Topix inched up 0.05% to 1,985.00.

All three big US stock indexes dropped overnight, led by the tech-heavy Nasdaq, as a chorus of Fed speakers backed the idea of more hikes and high rates for longer.

The Philadelphia SE Semiconductor Index dropped 2.2% and the drop hurt Japanese chip-related stocks as well. Chip-making equipment manufacturer Tokyo Electron slumped 2.14% and shaved off 34 points off the Nikkei, making it the biggest drag.

“The market is shifting to the view that there won’t be any monetary loosening by the Fed this year, and some people who had been thinking the peak in rates would come in March now think there’s probably going to be another hike after that,” Kazuo Kamitani, a strategist at Nomura in Tokyo, said.

US consumer price data on Tuesday will provide a crucial clue to Fed policy direction, he said, and until then both US and Japanese stock markets are likely to be broadly directionless.

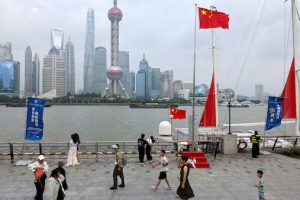

However, shares in China and Hong Kong added to their gains with investors optimistic over China’s economic recovery.

China’s blue-chip CSI 300 Index rose 1.34%, while the Shanghai Composite Index climbed 1.18%, or 38.28 points, to 3,270.38,

The Hang Seng Index rose 1.60% or 340.84 points, to 21,624.36 while the Hang Seng China Enterprises Index added 1.73%.The Shenzhen Composite Index on China’s second exchange gained 1.54%, or 32.89 points, to 2,174.20.

Adani Shares Tank Again

Elsewhere across the region, Sydney, Seoul, Singapore, Wellington, Taipei, Bangkok, Manila and Jakarta were all in the red.

Indian stocks advanced, though, with Mumbai’s signature Nifty 50 index edging ahead 0.12%, or 21.75 points, at 17,893.45.

Mumbai-listed shares of the troubled Adani conglomerate tanked again after global stock index compiler MSCI said it was reviewing the status of equities in the group. Adani Enterprises fell more than 11%.

Globally, the prospect of US interest rates going higher, and for longer, as officials try to cool the economy and bring decades-high inflation under control darkened the mood too.

Months of slowing price rises had fuelled hopes the Federal Reserve could soon pause its tightening drive or even cut rates this year, but that optimism was dealt a blow last Friday by data showing the jobs market remains strong.

And key members of the central bank have lined up this week to acknowledge that while there had been progress in the inflation battle, there would be more pain to come before things got easier.

With the world’s top economy still showing resilience despite almost a year of rate hikes and surging prices, observers said traders’ hopes for a rate cut this year were fading.

Some are now predicting they could go as high as 6%, almost one percentage point above what is currently being priced in.

Key figures

Tokyo – Nikkei 225 < DOWN 0.08% at 27,584.35 (close)

Hong Kong – Hang Seng Index > UP 1.60% at 21,624.36 (close)

Shanghai – Composite > UP 1.18% at 3,270.38 (close)

London – FTSE 100 > UP 0.64% at 7,935.45 (0938 GMT)

New York – Dow < DOWN 0.61% at 33,949.01 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

New System Needed to Regulate Big Tech in Finance, BIS Says

Japan Admits Spending $48 Billion Rescuing Plumeting Yen