Bond markets in Asia are likely to stay resilient even as the US Federal Reserve begins to unwind stimulus and hike interest rates this year, economists said.

More measured inflation will keep financial conditions relatively easier in Asia, where bond supply is also more adequately matched to demand, said Robert Tipp, chief investment strategist and head of global bonds at PGIM Fixed Income.

Asian bond markets are likely to be more resilient in terms of risk appetite, and there is less upside risk for rates, “despite the situation in China,” Tipp said, at the Reuters Global Markets Forum (GMF).

Meanwhile, analysts at Morgan Stanley wrote China’s shifting policy stance from “over-tightening” to easing would drive recovery there.

Staying “more constructive than the consensus” on Asia’s growth outlook, Morgan Stanley also cited exports and capex driving a strong and productive cycle in the region.

“US real rates have not risen by a significant extent and Asia’s starting point of macro stability means that Asia will be able to manage the Fed tightening cycle,” they wrote.

Japan is widely expected to maintain its ultra-loose policy, China’s further easing is likely to take yields lower, while South Korean yields, which have already fallen sharply, will see the Bank of Korea tightening beyond Friday’s expected hike.

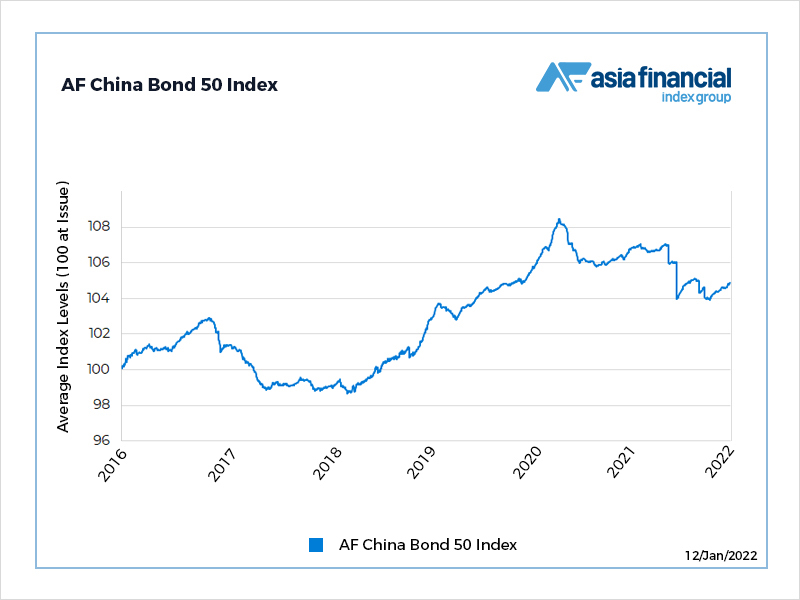

AF China Bond 50 Index. Graphic: Nitin Bhagat

Rate Hike Impact Downplayed

“Asia isn’t going to go crazy on rates locally, so may not be too affected by US rates,” said Robert Carnell, chief economist and head of research at ING Asia.

“In contrast, Australian bonds [are] likely to more closely track those of the US, and we may see the Reserve Bank of Australia hinting about their own end of taper and eventual roll-off,” Carnell said.

The US yield curve has flattened following the Fed minutes last week, as investors brace for rate hikes as soon as March that will push short-term rates higher.

US two-year Treasury yields rose to their highest level in nearly two years of 0.945%, but fell to 0.9089% after Fed Chair Jerome Powell’s Tuesday Congressional hearing.

Brian Coulton, chief economist at Fitch Ratings, wrote in a note that a full normalisation could see US nominal interest rates rise to about 3% over the medium-to-long term, potentially pushing up global rates.

• Reuters with additional editing by Jim Pollard

ALSO SEE:

Eastspring Survey Shows Bullish Appetite for China Bonds

China Economy is Heading for an Upswing, Says Morgan Stanley