Asia’s major stock indexes began the week on the back foot with traders downbeat over impending US interest rate hikes and escalating Sino-US tensions.

The risk-takers stayed on the sidelines with strong economic data out of the United States set to force the US Fed to stretch out its tightening policy even further.

Investors are braced for more challenging US figures including the closely watched ISM measures of manufacturing and services, the latter being especially important following January’s startling spike in activity.

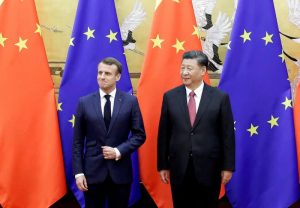

Also on AF: US Warns China Will Face ‘Real Costs’ for Lethal Aid to Russia

There are also at least six Federal Reserve policy makers on the speaking diary this week to offer a running commentary on the likelihood of further rate hikes.

Japan’s Nikkei dropped, taking its cues from Wall Street and the index sank as much as 0.59% before regaining some ground to close 0.11% lower at 27,423.96. The broader Topix was up 0.22%, or 4.38 points, to 1,992.78.

Technology was among the biggest hit sectors, given its sensitivity to higher interest rates. Chipmaking equipment maker Tokyo Electron and startup investor SoftBank Group were the Nikkei’s biggest drag, shaving off more than 20 index points each. Tokyo Electron and SoftBank Group fell 1.88% and 2.25%, respectively.

The yen was marginally higher at 136.35 per dollar, after earlier reaching its weakest level in more than two months at 136.58.

China and Hong Kong stocks finished lower amid rising China-US friction, while investors also awaited policy signals from the upcoming National People’s Congress.

The United States warned China of serious consequences if it provided arms to support Russia’s invasion of Ukraine, heightening tensions between the world’s top two economies.

US-China relations are the dominant uncertainty weighing on investors’ minds, Goldman Sachs said, citing feedback from investors.

And last week, foreign inflows via the China-Hong Kong Stock Connect recorded net weekly outflows for the first time this year, implying investors are holding back and its post-Covid re-opening momentum is likely slowing.

China’s blue-chip CSI300 Index closed down 0.4%, while the Shanghai Composite Index fell 0.28%, or 9.13 points, to 3,258.03

Hong Kong’s Hang Seng benchmark slid 0.33%, or 66.53 points, to 19,943.51, and the China Enterprises Index fell 0.6%. The Shenzhen Composite Index on China’s second exchange retreated 0.74%, or 15.77 points, to 2,124.88.

Rates Fears Boost Dollar

Elsewhere across the region, Sydney, Seoul, Singapore, Manila, Jakarta, Mumbai, Bangkok and Wellington were all in the red.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.0%, having shed 2.6% last week.

Globally, EUROSTOXX 50 futures added 0.1% and FTSE futures 0.4%. S&P 500 futures firmed 0.1%, while Nasdaq futures edged up 0.2%.

Fed futures now have US interest rates peaking around 5.42%, implying at least three more hikes from the current 4.50% to 4.75% band, and some chance of 50 basis points in March.

Markets have also nudged up the likely rate tops for a bevy of other central banks, including the European Central Bank and the Bank of England.

The Atlanta Fed’s influential GDP Now tracker has the US economy growing an annualised 2.7% in the first quarter, showing no slowdown from the December quarter.

The upward shift in Fed expectations has been a boon for the US dollar, which climbed 1.3% on a basket of currencies last week to last stand at 105.220.

Oil prices dipped as the prospect of lower Russian exports was balanced by rising inventories in the United States and concerns over global economic activity. Brent eased 33 cents to $82.83 a barrel, while US crude fell 25 cents to $76.07 per barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 0.11% at 27,423.96 (close)

Hong Kong – Hang Seng Index < DOWN 0.33% at 19,943.51 (close)

Shanghai – Composite < DOWN 0.28% at 3,258.03 (close)

London – FTSE 100 > UP 0.85% at 7,945.42 (0935 GMT)

New York – Dow < DOWN 1.02% at 32,816.92 (Friday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Ukraine, Sino-US Fears Leave Funds Cautious of Chinese Assets

BOJ Governor Kuroda Stands Firm on Ultra-Loose Policy