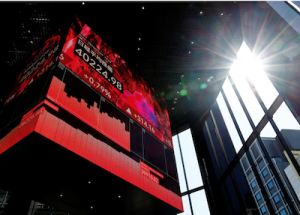

Asia’s major stock indexes were feeling the pressure on Wednesday with investors fretting over the global outlook and the threat of recession as the US labour market showed signs of slowing.

Stocks struggled to make headway, the dollar nursed losses and bonds clung to gains, as the news from the US made investors nervous about the economic outlook.

Trading across the region was also thinned by holidays in Hong Kong and China, leaving MSCI’s Asia-Pacific index excluding Japan faring little better than flat.

Also on AF: China Calls on WTO to Review Chip Export Curbs Led by US

Japan’s Nikkei share average tumbled, though, to its first loss in four days as a stronger yen and fears of a US recession hit its auto and energy stocks.

The Nikkei extended declines in the afternoon session to end down 1.68% at 27,813.26, plunging below the psychological 28,000 mark for the first time this month.

The broader Topix slid 1.92% to 1,983.84, following a three-day gain of 1.99%.

Shares that had rallied in recent days were sold by investors looking to lock in profits, with energy stocks among the worst-hit.

The yen extended its rally to as strong as 131.315 per dollar, weighing on sentiment broadly, and slapping down automakers in particular, as it cut the value of overseas sales. Toyota Motor Corp dropped 2.45%, Honda Motor Co Ltd sank 2.23% and Mazda Motor tumbled 3.33%.

Elsewhere across the region, Sydney, Bangkok and Jakarta also fell while Singapore, Mumbai, Seoul, Manila and Wellington rose.

Fed Reserve Tightening Fears

Overnight, all three major US stock indexes declined, as evidence of a cooling economy exacerbated worries that the Federal Reserve’s rate tightening campaign may trigger a deep downturn.

New data showed job openings dropped to the lowest in two years, and factory orders fell for a second month.

Two-year treasury yields, which closely track short-term rate expectations, dived almost 15 basis points and the dollar tracked the move to hit two-month troughs.

“The market’s odds of a recession have increased,” said Jamie Dimon, chief executive of the United States’ biggest bank, JPMorgan Chase & Co, in a letter to shareholders, warning the confidence fears that have rattled banks have not dissipated.

“The current crisis is not yet over,” he said. “And even when it is behind us, there will be repercussions from it for years to come.”

US interest rate futures have rallied strongly over the last few weeks, as traders figure that under-pressure banks will tighten up on lending anyway and save the need for monetary policymakers to do the job.

The latest futures pricing implies a better-than-even chance that the Federal Reserve has finished raising rates, and more than 60 bps in cuts this year.

Two-year yields are at 3.8459% and 10-year yields at 3.3517%, with the whole U.S. yield curve below top of the Fed funds rate window, which is at 5%.

Gold, which pays no yield, hit a one-year high above $2,000 an ounce overnight.

New Zealand Rate Hike

Outside the United States, markets see other central banks staying the course on hikes to tame inflation. A Reuters poll of FX strategists found most expect that to keep pressure on the dollar this year.

The Reserve Bank of New Zealand surprised traders with a 50 basis point hike on Wednesday that sent the kiwi up 1% at one stage to hit a two-month high – a contrast with Australia’s central bank, which paused its hikes on Tuesday.

Elsewhere investors see a few more rate hikes in store in Europe, where German exports have turned surprisingly strong. The euro stood by a two-month high hit overnight on the dollar at $1.0973. The kiwi was last up 0.7% at $0.6355.

China and Asia more broadly are the great hopes for growth. Japanese data on Wednesday showed services activity grew at its fastest pace in more than nine years in March, though factory output remains weak.

China’s sprawling manufacturing sector lost momentum in March, data showed earlier in the week, though investment inflows hit a record for the first quarter on foreigners’ optimism that policy support for business lies ahead.

Key figures

Tokyo – Nikkei 225 < DOWN 1.68% at 27,813.26 (close)

Hong Kong – Hang Seng Index <> CLOSED

Shanghai – Composite <> CLOSED

London – FTSE 100 > UP 0.27% at 7,655.18 (0936 GMT)

New York – Dow < DOWN 0.59% at 33,402.38 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Foreign Money Flowing Back Into China on Alibaba, Ma Boosts

China’s Yuan is Now the Most Traded Currency in Russia