The valuations of Asian equities dropped to a 17-month low at the end of October on concerns over China‘s weakening economy while analyst upgrades in earnings estimates failed to boost equities this year.

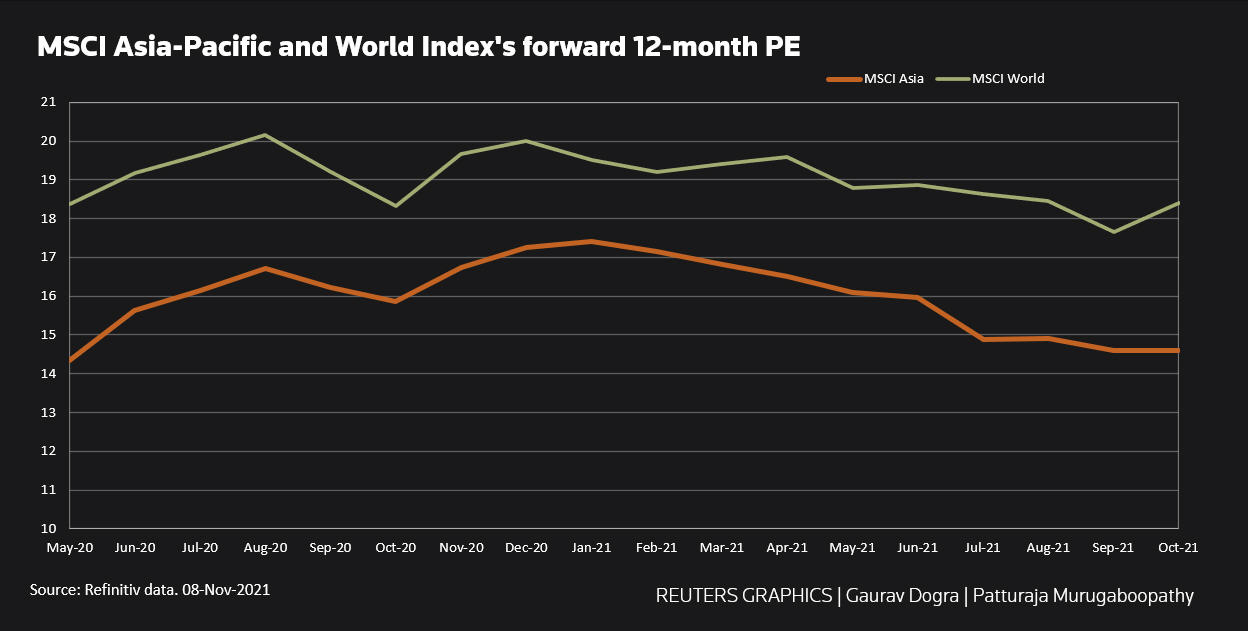

The forward 12-month price-to earnings ratio (P/E) for the MSCI Asia-Pacific index dropped to 14.59 at the end of October, the lowest since May 2020, Refinitiv Eikon showed.

The MSCI Asia Pacific index has shed 0.6% this year, compared with the MSCI United States index’s gain of 24.5% and MSCI World index‘s 17.4%.

“Asia underperformed US equities yet again as local factors weighed despite major central banks reinforcing the message that policy normalisation will be slow and gradual,” said Nomura in a report this week.

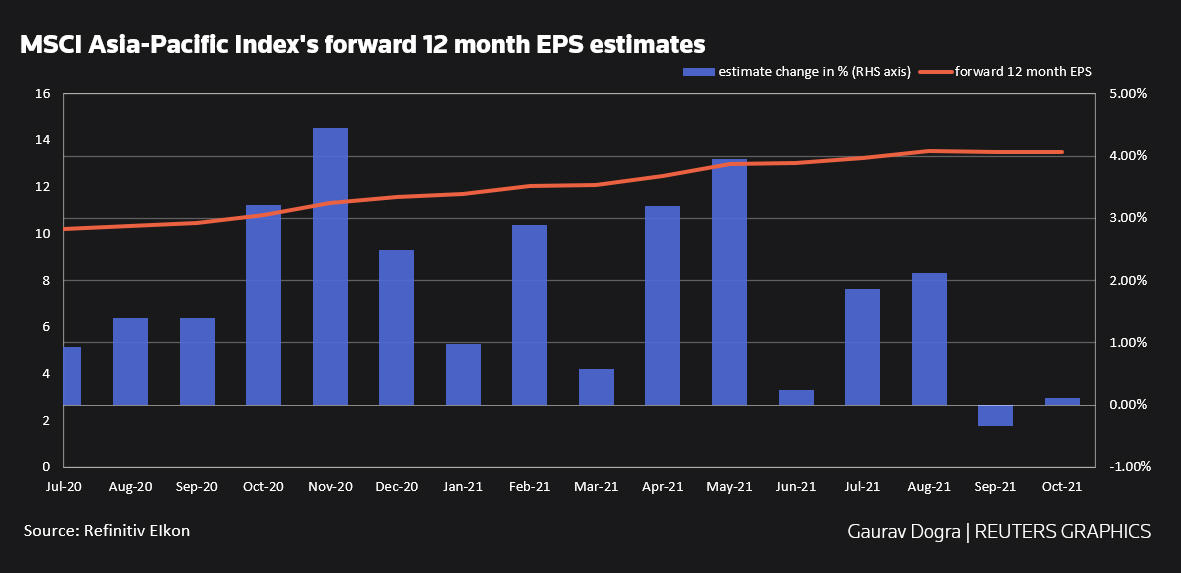

Last year, Asian stocks were bolstered by continuous earnings upgrades by analysts, as they expected a strong turnaround after corporate profits were hit by lockdowns.

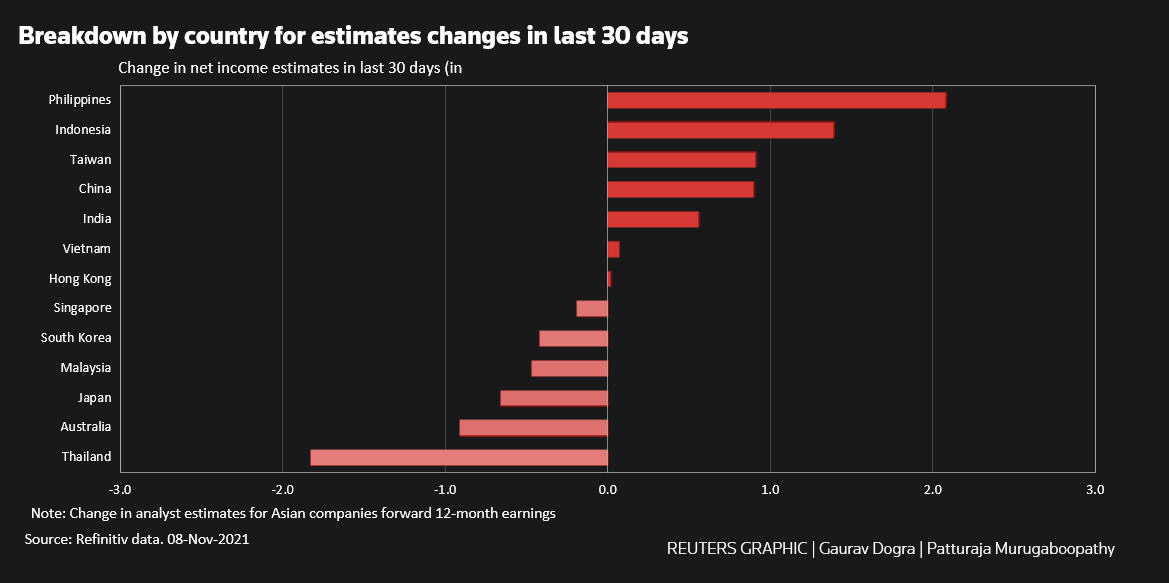

However, this year the analyst upgrades have failed to boost the region’s stocks.

“Strong earnings over the past two quarters have failed to enthuse markets as forward EPS estimates have stagnated after a V-shaped recovery over the past year,” SocGen said in a report last month.

Earnings for Asian firms that have reported so far show that 51% of companies have missed their analyst forecasts for the third quarter, compared with a global average of 40%.

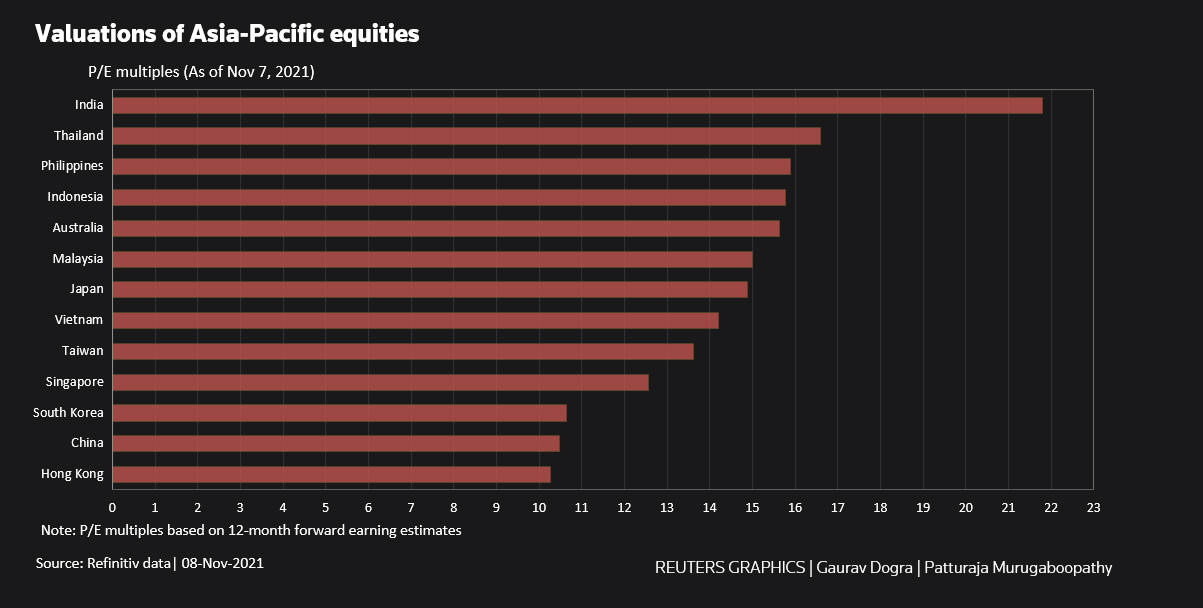

Hong Kong, Chinese and South Korean shares were the cheapest among Asian stocks, with P/E ratios of 10.3, 10.5 and 10.6 respectively, the data showed.

However, the MSCI Asia-Pacific’s forward P/E was still higher than the 10-year median of 13.03, the data showed.

“We don’t think the low valuations of emerging market (EM) equity indices relative to those of developed markets (DMs) is reason to expect EM equities to outperform over the next couple of years,” Capital Economics said in a report.

“While economic growth in developed markets remains fairly strong as they continue to open up, we think China‘s economic slowdown has a long way to run yet.”

• Reuters with additional editing by Jim Pollard

ALSO SEE:

US Fed Flags Potential Threat From China’s Evergrande

China State Council Officials Met Property Developers, Banks

Loan Crackdown Pain Spreads Beyond China Property Sector