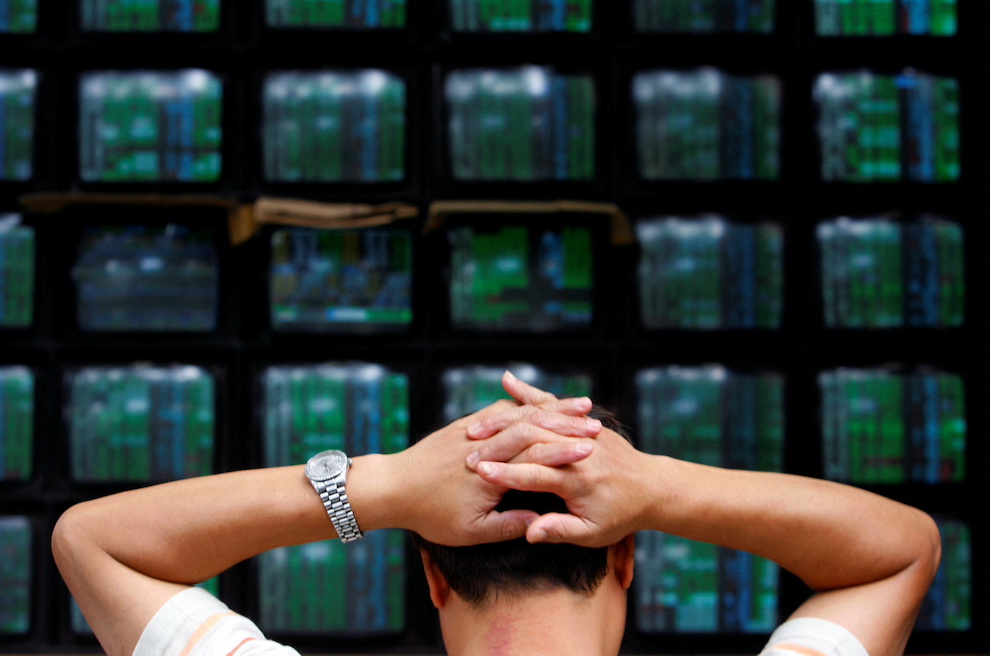

Asian equities tumbled, oil prices soared past $100 and safe havens rallied on Thursday after Russian President Vladimir Putin sent his forces into Ukraine, accelerating fears of a major war in eastern Europe.

After weeks of warnings from the United States and other powers, the Kremlin – which is said to have around 200,000 troops lined up – ordered a wide-ranging invasion of its neighbour, days after saying it would provide “peacekeepers” to two breakaway regions.

The Russian president said in a surprise statement on television: “I have made the decision of a military operation.” He also vowed retaliation against anyone who interfered and called on Ukraine military to lay down its arms.

The news sparked a furious reaction from world leaders and pledges to ramp up sanctions on Moscow.

Also on AF: Stocks Dive, Oil Soars as Russia Launches Invasion of Ukraine

Oil prices rocketed more than 6% with Brent cruising past $100, for the first time since September 2014, while other commodities including wheat rallied on fears about supplies from the resource-rich region. Aluminium hit a record high.

Safe haven assets also surged, with gold hitting a more than one-year high, the Japanese yen piling higher against the dollar and the Swiss franc hitting a five-year high on the euro.

The dollar was up 9% against the ruble, which has been battered in recent weeks on worries about the impact of sanctions on the Russian economy, while the Moscow Stock Exchange plunged almost 14% after suspending trading earlier in the day.

The country’s central bank said it was intervening to “stabilise the situation.”

Asian equities plunged, with Hong Kong, Sydney, Mumbai, Singapore and Wellington down at least 3%, while Seoul, Taipei, Bangkok and Manila fell more than 2%. There were also steep losses in Tokyo, Shanghai and Jakarta.

China Calls For Restraint

The Hang Seng Index dived 3.21%, or 758.72 points, to 22,901.56. The Shanghai Composite Index fell 1.7%, or 59.19 points to 3,429.96, while the Shenzhen Composite Index on China’s second exchange shed 2.36%, or 55.14 points, to 2,282.44.

The benchmark Nikkei 225 index fell 1.81% or 478.79 points to 25,970.82, while the broader Topix index lost 1.25% or 23.50 points to 1,857.58.

London lost more than 2% at the open while Paris and Frankfurt lost more than 4%.

“It is hard to find any reasons for the selloff to reverse now that it appears the tanks are rolling,” OANDA’s Jeffrey Halley said. “Stronger sanctions are to come on Russia and energy prices will inevitably head higher in the short term.”

China called for “restraint” on all sides.

Inflation Fears Remain

National Australia Bank’s Tapas Strickland added: ”Russia/Ukraine tensions bring both a possible demand shock [for Europe], and more importantly a much larger supply shock for the rest of the world given the importance of Russia and Ukraine to energy, hard commodities and soft commodities.”

The crisis comes as governments struggle to contain runaway inflation fuelled by demand as life returns after recent Covid-19 lockdowns, with many fearing the fragile global economic recovery from the pandemic could be knocked off course.

The stand-off in Europe has provided central banks with a further headache as they move to lift pandemic-era financial support and tighten monetary policy.

Attention is on every utterance from Federal Reserve officials as they prepare to hike interest rates next month, with speculation over how fast and hard it will move.

Commentators said bets are on six increases this year, down from previous forecasts for up to seven, adding the stakes are rising further.

Key figures around 0710 GMT

Tokyo > Nikkei 225: DOWN 1.8% at 25,970.82 (close)

Hong Kong > Hang Seng Index: DOWN 3.2% at 22,901.56 (close)

London > FTSE 100: DOWN 2.7% at 7,298.98

Shanghai > Composite: DOWN 1.7% at 3,429.96 (close)

New York > Dow: DOWN 1.4% at 33,131.76 (Wednesday close)

Brent North Sea Crude > UP 6.8% at $103.38 per barrel

West Texas Intermediate > UP 6.4% at $97.97 per barrel

- AFP with additional editing by Sean O’Meara