(ATF) Chinese investors will be able to buy into foreign bonds and bond funds with the opening on the so-called “southbound link” of the cross-border Bond Connect programme later this year.

The latest development in the internationalisation of China’s capital markets is due to go live at the beginning of the second half of 2021, sina.com reported.

It “will be implemented as soon as possible”, sina.com reported.

Also on ATF

- SOE bond gauge slides on coupon payment

- China cracks down on dodgy apps to protect citizens’ data

- WuXi Biologics to buy Pfizer drugmaking facilities in China

- Honda warns of production halts as Japan car exports slump

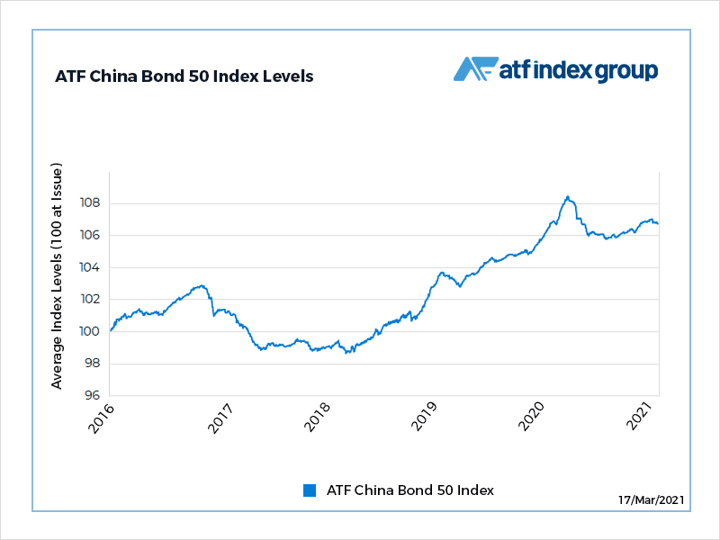

Bond Connect, focused largely on Hong Kong, facilitates trade in bonds between international and Chinese investors. The “northbound link” allowing foreign traders to invest in Chinese debt was launched in July 2017. It has grown, with daily trade volumes reaching 20.5 billion yuan last month.

Julien Martin, general manager of Bond Connect Co, told an online briefing to watch this space.

“Southbound trading will happen when northbound trading is extremely successful, insofar as we see so much ‘capital in’ that there will be need for ‘capital out’,” he was reported to have said.

“I think we are getting close to this time, and I think this is a place that should be watched. for this year.”

Risk management

The news comes after China Foreign Exchange Trading Center announced that it has officially launched Bond Connect’s foreign exchange risk management information service.

Bond Connect has been instrumental in setting up China Development Bank’s first “Carbon Neutral” special financial bond to international investors tomorrow.

Bond Connect is working closely with China Development Bank to simultaneously release issuance information and documents to overseas markets through the “New Bond Information Link” platform, and actively introduce global investors to participate in the bond primary market subscription.

Treasury bonds and policy financial bonds were the most actively traded bonds in February, accounting for 43% and 37% of monthly trading volumes, respectively. In addition Bond Connect added 24 foreign investors to the market.

Since the opening of the Northbound Link, global investors have become increasingly interested in China’s inter-bank bond market. At present, the scheme has attracted more than 2,400 global institutional investors and has facilitated the inclusion of Chinese bonds in a series of major global bond indexes.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, recently said that Hong Kong – as the world’s largest offshore yuan market – can open a wider variety of mainland-originated financial services on a larger scale, attract customers from all over the world, and accept larger amounts of yuan funds.

- Additional reporting by Reuters