Two big Chinese brokerages listed in the US saw their shares plummet on Thursday after authorities warned unlicensed dealers they were operating illegally, the Securities Times reported on Friday.

Sun Tianqi, director of the Financial Stability Bureau at the People’s Bank of China, stated that some overseas securities institutions have not obtained domestic licences and only hold overseas permits.

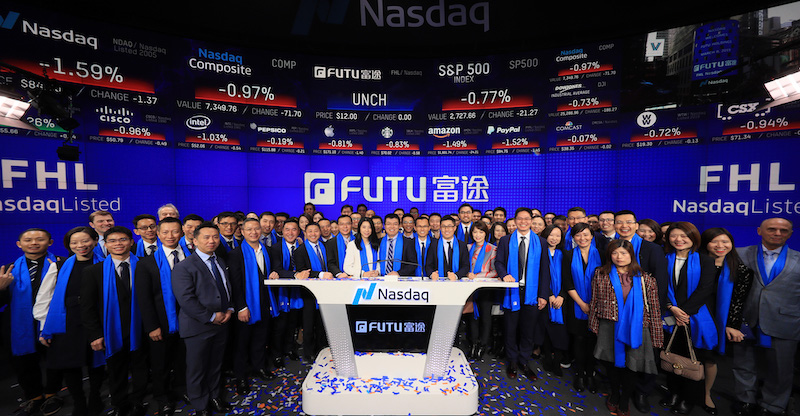

Nasdaq-listed Futu Holdings fell as much as 30% before recovering to 12% down at the close. Tiger Brokers dropped more than 22% on the Nasdaq before closing down 17%.

Read the full report: Securities Times

READ MORE:

Fees Boost Sees China Brokerage CITIC Q3 Profits Leap 46%

China’s Brokerage Revenues up 47% Amid Deregulation, Stock Rally